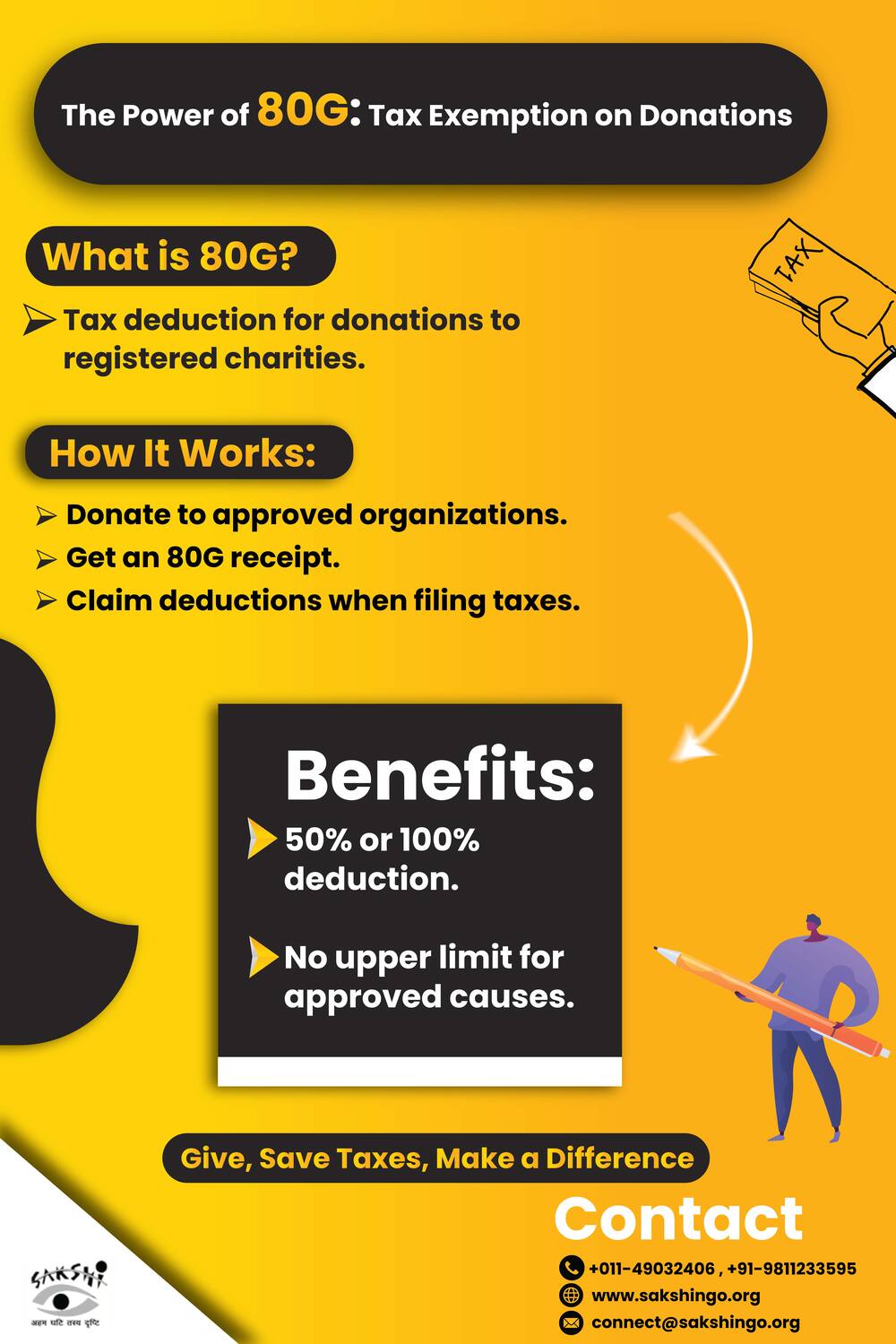

The Power of 80 G- Tax Exemption on Donation

Donating to a registered charity is not just a way to support a charitable cause; it also has financial benefits under Section 80G of the Income Tax Act. When you make a contribution to qualifying or registered NGOs and trusts, you can claim a tax exemption on donation, which reduces your taxable income. Simply you are receiving part of the donation as savings by filing your taxes.

To get the benefits of tax savings, always collect the donation receipt and make sure the nonprofit organization is 80G registered. Denoting is a smart way to help facilitate social change while obtaining social change savings. Give back while spending less with 80G benefits.

https://sakshingo.org/80g-...

#taxexemption #80G #savetax #donatingtongo #taxexemptionondonation #taxexemptionthrough80G

Donating to a registered charity is not just a way to support a charitable cause; it also has financial benefits under Section 80G of the Income Tax Act. When you make a contribution to qualifying or registered NGOs and trusts, you can claim a tax exemption on donation, which reduces your taxable income. Simply you are receiving part of the donation as savings by filing your taxes.

To get the benefits of tax savings, always collect the donation receipt and make sure the nonprofit organization is 80G registered. Denoting is a smart way to help facilitate social change while obtaining social change savings. Give back while spending less with 80G benefits.

https://sakshingo.org/80g-...

#taxexemption #80G #savetax #donatingtongo #taxexemptionondonation #taxexemptionthrough80G

06:21 AM - May 26, 2025 (UTC)

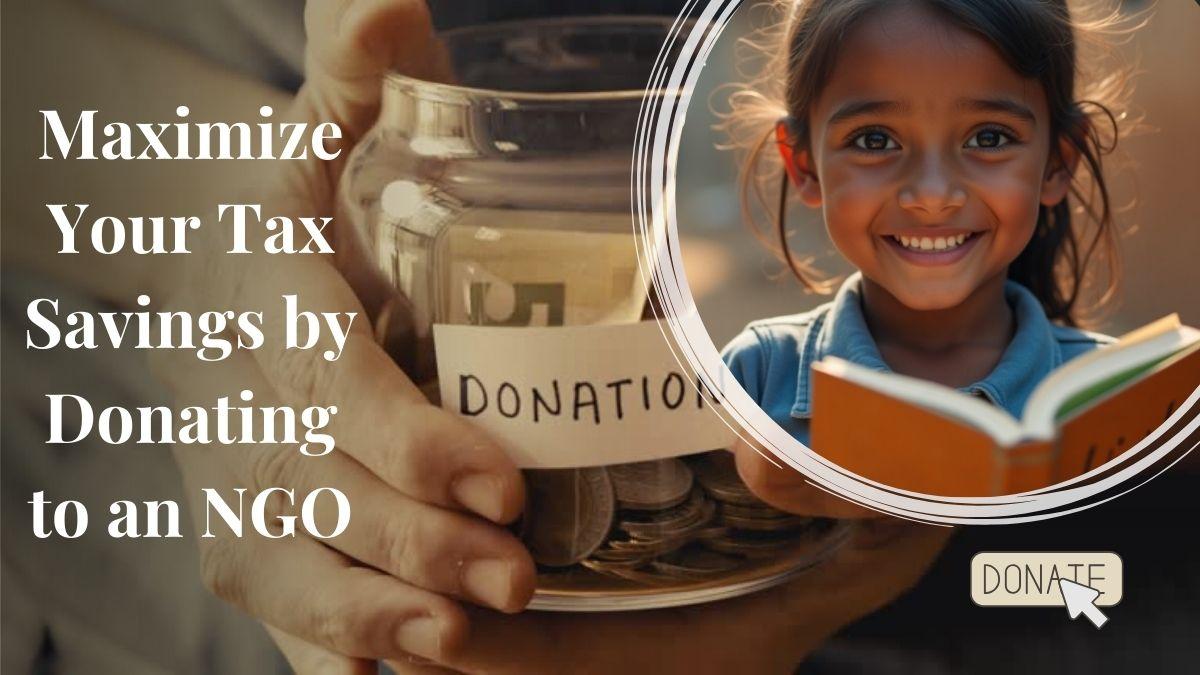

How to Maximize Your Tax Savings by Donating to an NGO?

Contributing to an NGO not only does good to the cause but also allows you to Maximize Your Tax Savings by Donating to an NGO under Section 80G of the Income Tax Act. A contribution to certified NGOs can lead to a deduction of 50% to 100% from taxable income depending on certification. To be eligible, ensure the NGO is registered and has a valid 80G certificate.

Always retain donation receipts and claim tax deductions while submitting your Income Tax Return (ITR). Using bank transfers or online payments rather than cash ensures transparency and tax compliance. Strategic giving helps you save the most on taxes by donating to an NGO while supporting social welfare, thus it is a win-win situation for both donors and recipients.

https://sakshingo.org/how-...

#taxexemption #taxexemptionondonation #donatetongo #ngoinindia #donation

Contributing to an NGO not only does good to the cause but also allows you to Maximize Your Tax Savings by Donating to an NGO under Section 80G of the Income Tax Act. A contribution to certified NGOs can lead to a deduction of 50% to 100% from taxable income depending on certification. To be eligible, ensure the NGO is registered and has a valid 80G certificate.

Always retain donation receipts and claim tax deductions while submitting your Income Tax Return (ITR). Using bank transfers or online payments rather than cash ensures transparency and tax compliance. Strategic giving helps you save the most on taxes by donating to an NGO while supporting social welfare, thus it is a win-win situation for both donors and recipients.

https://sakshingo.org/how-...

#taxexemption #taxexemptionondonation #donatetongo #ngoinindia #donation

10:23 AM - Mar 27, 2025 (UTC)

How to Save Taxes with 80G Donations in India

Donating to a registered 80G Exempt NGO benefits not only the cause but you as well through tax savings. Tax Exemption under 80G allows individuals and companies to claim deductions in donations made to qualifying charitable causes. The deductible amount can either be 50% or 100% of the donated money, depending on the certification of the NGO.

To take advantage of this benefit, make sure that the NGO is registered under 80G and obtain the donation receipt, and it should reflect the NGO's name, PAN, and registration number. Enter the donation value while submitting your income tax return in the appropriate section to obtain the deduction.

By making a thoughtful donation to an 80G Exempt NGO, you can support social welfare without increasing your taxable income. Always check the status of the NGO's 80G for maximum benefit.

https://sakshingo.org/80g-...

#80gtaxexemption #80gexemptngo #taxexemption #ngoinindia #donatetongo #socialwelfare

Donating to a registered 80G Exempt NGO benefits not only the cause but you as well through tax savings. Tax Exemption under 80G allows individuals and companies to claim deductions in donations made to qualifying charitable causes. The deductible amount can either be 50% or 100% of the donated money, depending on the certification of the NGO.

To take advantage of this benefit, make sure that the NGO is registered under 80G and obtain the donation receipt, and it should reflect the NGO's name, PAN, and registration number. Enter the donation value while submitting your income tax return in the appropriate section to obtain the deduction.

By making a thoughtful donation to an 80G Exempt NGO, you can support social welfare without increasing your taxable income. Always check the status of the NGO's 80G for maximum benefit.

https://sakshingo.org/80g-...

#80gtaxexemption #80gexemptngo #taxexemption #ngoinindia #donatetongo #socialwelfare

12:08 PM - Mar 06, 2025 (UTC)

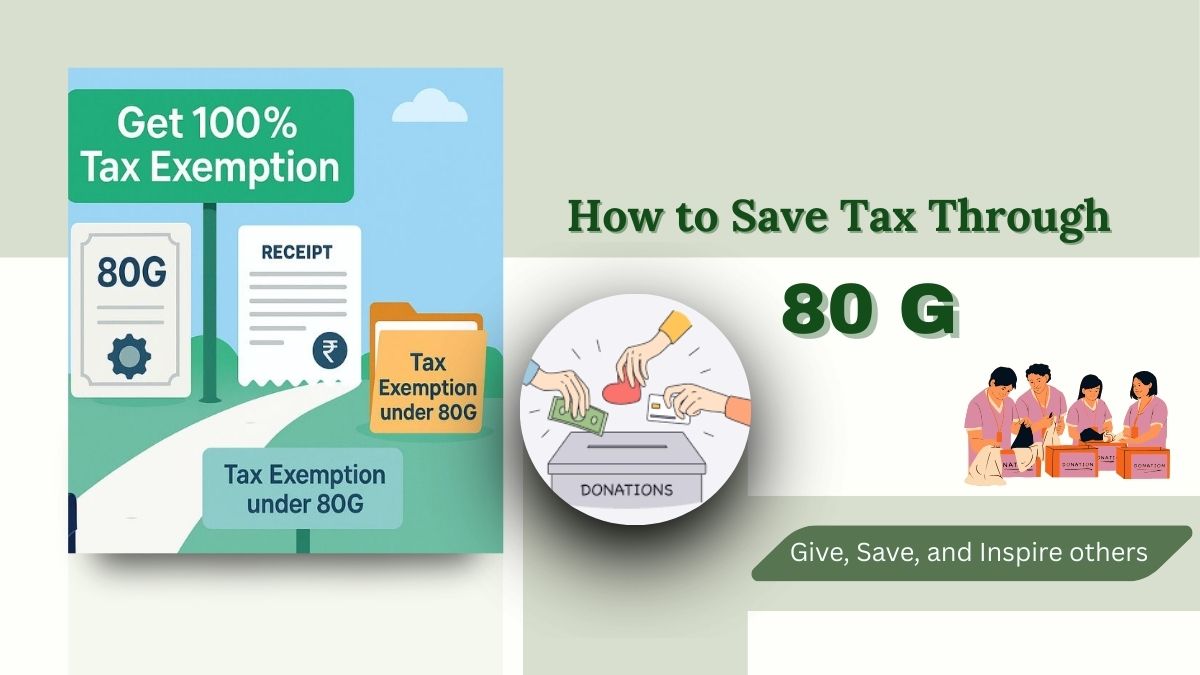

How to Save Tax Through 80 G

Want to cut your tax bill while benefiting others? As per Section 80G of the Income Tax Act, you can claim deductions for donations to eligible charities and relief funds. It is a smart way to combine kindness with financial planning.

When you donate to a registered NGO or fund, you may receive 50% or 100% deduction depending on the organization’s approval. Always request a receipt with the organization’s PAN number, as you'll surely need it when filing your returns. Some donations also have a maximum limit, so check the details.

Then when you are filing your income tax returns, simply attach the proof and enjoy the benefits! You help a good cause while cutting down your tax - it’s a win-win.

So if you plan to make donations this year, remember to save tax through 80G.

https://www.linkedin.com/p...

#taxexemption #TaxDeduction #80gtaxexemption #80gtaxdeduction #80exemptngo

Want to cut your tax bill while benefiting others? As per Section 80G of the Income Tax Act, you can claim deductions for donations to eligible charities and relief funds. It is a smart way to combine kindness with financial planning.

When you donate to a registered NGO or fund, you may receive 50% or 100% deduction depending on the organization’s approval. Always request a receipt with the organization’s PAN number, as you'll surely need it when filing your returns. Some donations also have a maximum limit, so check the details.

Then when you are filing your income tax returns, simply attach the proof and enjoy the benefits! You help a good cause while cutting down your tax - it’s a win-win.

So if you plan to make donations this year, remember to save tax through 80G.

https://www.linkedin.com/p...

#taxexemption #TaxDeduction #80gtaxexemption #80gtaxdeduction #80exemptngo

09:23 AM - May 28, 2025 (UTC)

How Do I Get 100% Tax Exemption?

When you donate to specified charitable institutions that fulfill the conditions in Section 80G of the Income Tax Act of 1961 you can obtain 100% tax benefit. If you donate to certain NGOs and other charitable trusts that qualify for full or part tax relief (80G Exempt NGO)

For receiving 100% tax relief under 80G, you should donate to specifically listed NGOs eligible for a complete deduction, including the Prime Minister's National Relief Fund or any other prescribed institutions. They have to be substantiated through an authentic 80G receipt from the NGO proving your donation.

Check if the NGO is registered as an 80G Exempt NGO confirm if the certificate is active and validate it through the Income Tax website. When filing your ITR, include the donation you made in the 80G section and retain the proof that was provided for your records.

https://sakshingo.org/80g-...

#taxexemption #taxexemptionondonation #donatetongo #80gngoinindia #donation

When you donate to specified charitable institutions that fulfill the conditions in Section 80G of the Income Tax Act of 1961 you can obtain 100% tax benefit. If you donate to certain NGOs and other charitable trusts that qualify for full or part tax relief (80G Exempt NGO)

For receiving 100% tax relief under 80G, you should donate to specifically listed NGOs eligible for a complete deduction, including the Prime Minister's National Relief Fund or any other prescribed institutions. They have to be substantiated through an authentic 80G receipt from the NGO proving your donation.

Check if the NGO is registered as an 80G Exempt NGO confirm if the certificate is active and validate it through the Income Tax website. When filing your ITR, include the donation you made in the 80G section and retain the proof that was provided for your records.

https://sakshingo.org/80g-...

#taxexemption #taxexemptionondonation #donatetongo #80gngoinindia #donation

09:07 AM - Apr 04, 2025 (UTC)

Sponsored by

OWT

6 months ago

How Much Tax is Exempt from 80G?

Under Section 80G of the Income Tax Act, donations made to eligible charitable institutions and relief funds qualify for tax exemption. The exemption percentage depends on the organization’s approval status. Some donations qualify for a 100% deduction, while others offer a 50% deduction with or without an upper limit.

To claim Tax Exemption under 80G, the donor must obtain a receipt from the 80G Exempt NGO, mentioning the PAN and registration number of the organization. Additionally, the donation should be made through bank transfers, cheques, or digital payments to be valid for exemption.

Donors can claim Tax Exemption on Donation while filing their Income Tax Return (ITR) by mentioning the donation details under Section 80G. Always verify the organization’s 80G certification before contributing.

https://sakshingo.org/80g-...

#80gtaxexemption #80gexemptngo #taxexemption #ngoinindia #donatetongo #socialwelfare

Under Section 80G of the Income Tax Act, donations made to eligible charitable institutions and relief funds qualify for tax exemption. The exemption percentage depends on the organization’s approval status. Some donations qualify for a 100% deduction, while others offer a 50% deduction with or without an upper limit.

To claim Tax Exemption under 80G, the donor must obtain a receipt from the 80G Exempt NGO, mentioning the PAN and registration number of the organization. Additionally, the donation should be made through bank transfers, cheques, or digital payments to be valid for exemption.

Donors can claim Tax Exemption on Donation while filing their Income Tax Return (ITR) by mentioning the donation details under Section 80G. Always verify the organization’s 80G certification before contributing.

https://sakshingo.org/80g-...

#80gtaxexemption #80gexemptngo #taxexemption #ngoinindia #donatetongo #socialwelfare

11:58 AM - Feb 28, 2025 (UTC)