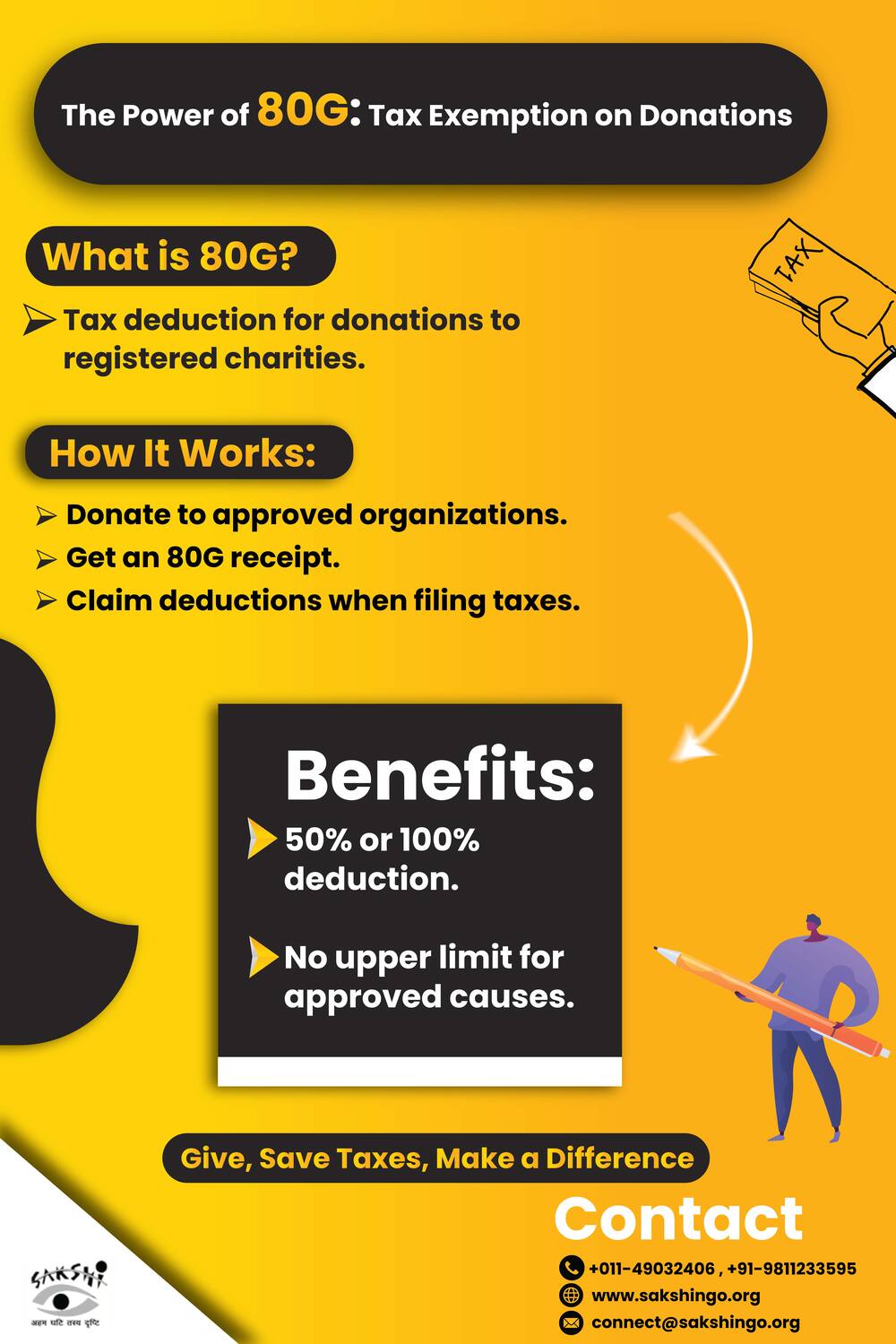

The Power of 80 G- Tax Exemption on Donation

Donating to a registered charity is not just a way to support a charitable cause; it also has financial benefits under Section 80G of the Income Tax Act. When you make a contribution to qualifying or registered NGOs and trusts, you can claim a tax exemption on donation, which reduces your taxable income. Simply you are receiving part of the donation as savings by filing your taxes.

To get the benefits of tax savings, always collect the donation receipt and make sure the nonprofit organization is 80G registered. Denoting is a smart way to help facilitate social change while obtaining social change savings. Give back while spending less with 80G benefits.

https://sakshingo.org/80g-...

#taxexemption #80G #savetax #donatingtongo #taxexemptionondonation #taxexemptionthrough80G

Donating to a registered charity is not just a way to support a charitable cause; it also has financial benefits under Section 80G of the Income Tax Act. When you make a contribution to qualifying or registered NGOs and trusts, you can claim a tax exemption on donation, which reduces your taxable income. Simply you are receiving part of the donation as savings by filing your taxes.

To get the benefits of tax savings, always collect the donation receipt and make sure the nonprofit organization is 80G registered. Denoting is a smart way to help facilitate social change while obtaining social change savings. Give back while spending less with 80G benefits.

https://sakshingo.org/80g-...

#taxexemption #80G #savetax #donatingtongo #taxexemptionondonation #taxexemptionthrough80G

06:21 AM - May 26, 2025 (UTC)

Sponsored by

OWT

5 months ago

Dwngo social network website

Dwngo – The Social Media Platform! * Share your thoughts & ideas * Publish blogs & trending stories * Connect, engage & grow your networkJoin now & be part of the future of social networking! #SocialMedia #Blogging #Dwngo --https://dwngo.com/

Bal Raksha Bharat, also known as Save the Children India, is dedicated to improving the lives of underprivileged children. When you donate to our cause, you not only contribute to child welfare but also benefit from income tax exemption under Section 80G of the Income Tax Act.

Your generous donations help provide education, healthcare, and protection to vulnerable children across India. As a donor, you can claim income tax exemption of up to 50% of your contribution, reducing your taxable income while making a meaningful impact. This means your support not only transforms lives but also offers financial advantages.

https://balrakshabharat.or...

#incometaxexemption #savetax

Your generous donations help provide education, healthcare, and protection to vulnerable children across India. As a donor, you can claim income tax exemption of up to 50% of your contribution, reducing your taxable income while making a meaningful impact. This means your support not only transforms lives but also offers financial advantages.

https://balrakshabharat.or...

#incometaxexemption #savetax

Donate Now for Income Tax Exemption | Bal Raksha Bharat - Bal Raksha Bharat

Support Bal Raksha Bharat's noble cause. Donate now for income tax exemption and make a difference in children's lives. Your contribution matters!

https://balrakshabharat.org/web-stories/donate-now-for-income-tax-exemption-bal-raksha-bharat/

07:46 AM - Feb 24, 2025 (UTC)