Dwngo social network website

Dwngo – The Social Media Platform! * Share your thoughts & ideas * Publish blogs & trending stories * Connect, engage & grow your networkJoin now & be part of the future of social networking! #SocialMedia #Blogging #Dwngo --https://dwngo.com/

At Everden Rust, we understand the importance of community. Our charitable giving efforts are focused on supporting local initiatives and organizations, ensuring that we contribute positively to the communities we serve.

Visit Now:https://www.everdenrust.co...

Immerse yourself in the unparalleled amalgamation of disco aesthetics and the metaverse at Discocat.com. Explore an amalgamation of enjoyment, style, and charitable endeavours, all within a singular venue. Shop now!

https://discocat.com/

According to astrology, if you feel stuck in life for years, it indicates imbalances in your planetary influences and karmic patterns. Here's what you can do:

1. Analyze Your Birth Chart: Malefic placements of Saturn, Rahu, Ketu, or afflicted lords of important houses (like the 1st, 10th, 9th, or 4th) could be the culprits.

2. Strengthen Beneficial Planets: This could involve wearing specific gemstones, chanting relevant mantras, performing pujas or making charitable donations.

3. Pacify Malefic Planets: Specific remedies are often prescribed to reduce planet negative impact. For eg, chanting specific mantras (like the Shani Mantra or Hanuman Chalisa), or performing rituals.

4. Address Karmic Issues: Sometimes past karma involved. Selfless service, making amends where needed or engaging in spiritual practices to purify your energy.

5. Balance Your Energies: Certain practices like yoga, meditation, and mindfulness can harmonize positive cosmic flows.

6. Follow Vastu Principles: Ensure your living and working spaces are in harmony with Vastu Shastra, the Vedic science of architecture. Correcting imbalances in your environment can positively impact your life's flow.

Important Note: Astrological remedies work best when combined with your sincere efforts and positive intentions. They are meant to guide and support you, not replace your own actions in navigating life's challenges.

visit https://astroera.in

Section 8 companies are non-profit organizations formed to promote charitable objectives and create valuable change in society but mandated in today's regulatory environment to comply with the dematerialization of shares as per norms formulated by the Ministry of Corporate Affairs (MCA) and Securities and Exchange Board of India From ISIN generation to e-voting event management and NextGen share solutions, a trusted RTA makes the demat process easy, secure, and efficient read more ...

link:-https://www.nextgenregistr...

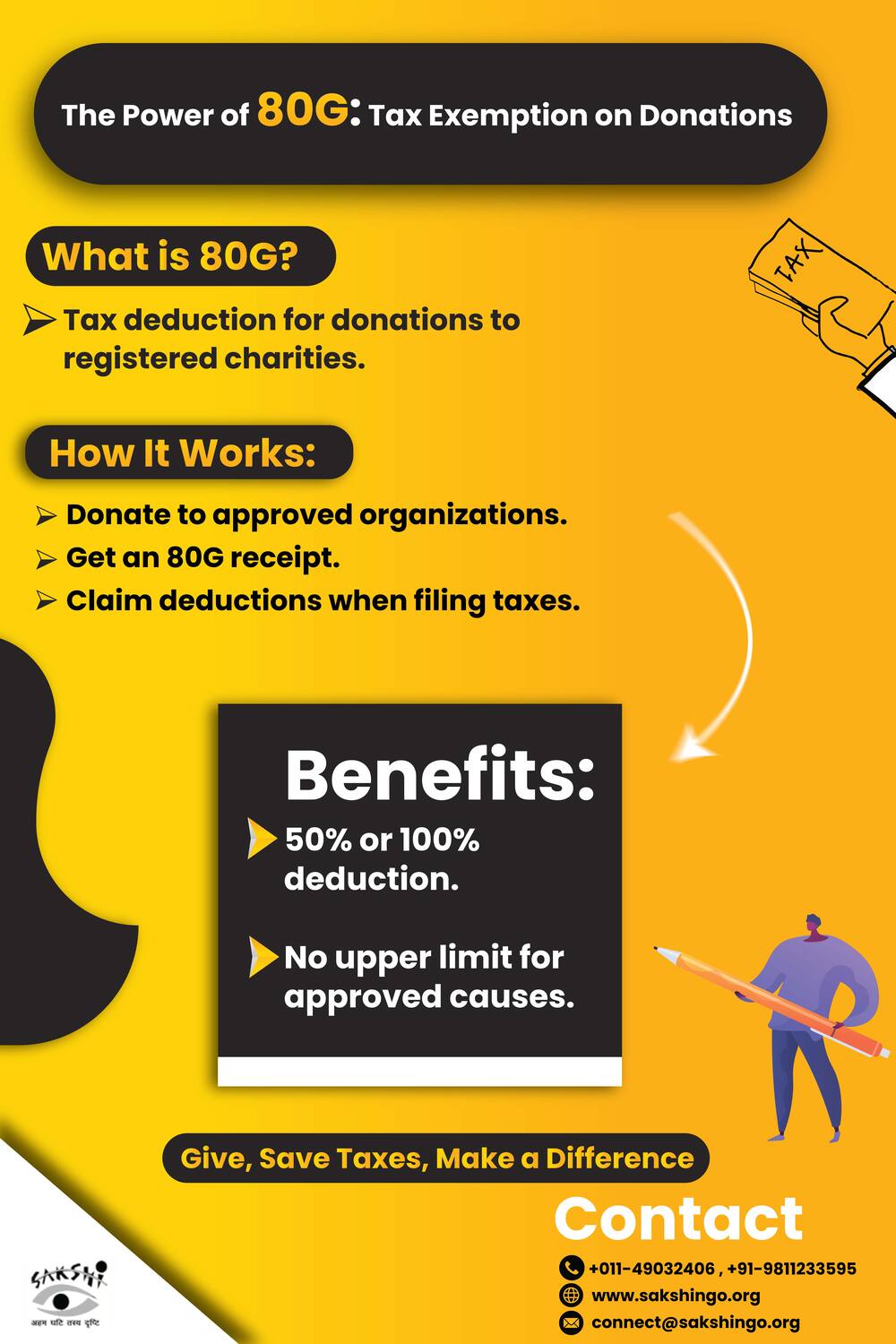

When you donate to specified charitable institutions that fulfill the conditions in Section 80G of the Income Tax Act of 1961 you can obtain 100% tax benefit. If you donate to certain NGOs and other charitable trusts that qualify for full or part tax relief (80G Exempt NGO)

For receiving 100% tax relief under 80G, you should donate to specifically listed NGOs eligible for a complete deduction, including the Prime Minister's National Relief Fund or any other prescribed institutions. They have to be substantiated through an authentic 80G receipt from the NGO proving your donation.

Check if the NGO is registered as an 80G Exempt NGO confirm if the certificate is active and validate it through the Income Tax website. When filing your ITR, include the donation you made in the 80G section and retain the proof that was provided for your records.

https://sakshingo.org/80g-...

#taxexemption #taxexemptionondonation #donatetongo #80gngoinindia #donation

Readmore: https://maxhr.io/ramadan-2...

#ReddyBook #Ramadan2025 #Flexiblehours #StayandRelax

#NatureRetreat

Ramadan 2025 in UAE: 5 Essential Tips for HR Professionals

Discover five essential HR tips for Ramadan 2025 in UAE to ensure compliance with labor laws, support employee well-being, and maintain workplace productivity. Learn how to create an inclusive and flexible work environment during the holy month.

https://maxhr.io/ramadan-2025-in-uae/Beyond his professional endeavors, Kurtis Patel is also recognized for his commitment to corporate social responsibility. He has been instrumental in organizing charitable campaigns, reflecting SK Laboratories' dedication to making a positive impact in the community.Kurtis Patel serves as the Chief Operating Officer (COO) at SK Laboratories Inc., a dietary supplement manufacturer based in Anaheim, California. With over 30 years of expertise, SK Laboratories specializes in the development and manufacturing of powders, capsules, and tablets, providing turnkey solutions for clients.

https://social1776.com/kur...

Kurtis Patel

Kurtis Patel, the Chief Executive Officer at SK Labs, leads with over 30 years of expertise in dietary supplement development.

https://social1776.com/kurtispatelMark your calendars for May 27, 2025, as we celebrate Shani Jayanti, the auspicious birth anniversary of Lord Shani—the celestial deity symbolizing justice, discipline, and karmic balance.

✨ Why Observe Shani Jayanti?

This sacred day offers a unique opportunity to align with Saturn's energies, seeking relief from challenges like Sade Sati, Shani Dosha, and other karmic hurdles.

🛐 Simple Rituals to Honor Lord Shani:

Tailabhishekam: Perform an oil offering to Lord Shani, symbolizing the cleansing of past karmas.

Peepal Tree Worship: Light a mustard oil lamp beneath a Peepal tree, invoking blessings and ancestral grace.

Charitable Acts: Donate black sesame seeds, mustard oil, or iron items to the needy, mitigating Saturn's adverse effects.

🕉️ Mantra for the Day:

Chant “Om Sham Shanicharaya Namah” 108 times to appease Lord Shani and invite positivity into your life.

🌟 Astrological Significance:

Engaging in these rituals can help balance your karmic debts, ushering in discipline, resilience, and spiritual growth.

📿 Embrace the Path of Righteousness:

Let this Shani Jayanti be a turning point towards a life of integrity and inner strength.

🔗 Dive deeper into the significance and rituals of Shani Jayanti here:

Read More. https://www.dkscore.com/fe...

#shanijayanti2025 #LordShani #KarmaAndJustice

Donating to a registered charity is not just a way to support a charitable cause; it also has financial benefits under Section 80G of the Income Tax Act. When you make a contribution to qualifying or registered NGOs and trusts, you can claim a tax exemption on donation, which reduces your taxable income. Simply you are receiving part of the donation as savings by filing your taxes.

To get the benefits of tax savings, always collect the donation receipt and make sure the nonprofit organization is 80G registered. Denoting is a smart way to help facilitate social change while obtaining social change savings. Give back while spending less with 80G benefits.

https://sakshingo.org/80g-...

#taxexemption #80G #savetax #donatingtongo #taxexemptionondonation #taxexemptionthrough80G

Without a will, UK intestacy laws decide who inherits what, which may not reflect your intentions. If you have dependants, specific assets, or charitable goals, estate planning ensures they’re honoured. It can also minimise inheritance tax and prevent family disputes by clearly setting out your wishes.

Website : https://mushlovesocial.com...

Navigating taxes in Denver can be complex, but with expert guidance, you can ensure compliance and maximize savings. Our team of certified public accountants specializes in tax planning, preparation, and advisory services for individuals and businesses.

Smart Tax Strategies

Retirement Savings: Reduce taxable income with IRAs and 401(k)s.

Tax-Advantaged Accounts: Optimize HSAs and FSAs.

Real Estate Tax Benefits: Deduct mortgage interest and property taxes.

Charitable Contributions: Gain deductions while supporting causes.

Why Choose a Denver Tax Accountant?

Personalized Service: Tailored solutions for individuals and businesses.

Compliance & Deductions: Navigate tax laws and maximize eligible deductions.

Local Expertise: In-depth knowledge of Denver’s tax regulations.

Comprehensive CPA Services

Tax Preparation & Consulting: Ensure accuracy and compliance.

Bookkeeping & Financial Reporting: Streamline accounting processes.

Strategic Tax Advisory: Optimize tax efficiency for business growth.

Your Partner in Financial Success

At GCK Accounting, we build lasting relationships, offering customized strategies and innovative financial solutions to drive business success. Contact us today for expert tax support tailored to your needs.

https://www.gckaccounting....

Invoidea is a trusted nonprofit web design agency that understands the needs of NGOs and charitable organizations. They create websites that are donation-friendly, easy to manage, and visually appealing. Invoidea helps nonprofits connect better with supporters and achieve their online goals.

https://invoidea.com/nonpr...

As our support network grew, with more volunteers joining our cause, we recognised the need for a more organised approach. Thus, Humanity Care Relief was established to channel our efforts more effectively and make a lasting impact.

An enriching experience awaits anyone who establishes a non-profit organization in India to conduct social educational or charitable activities. Organizations focused on social welfare and non-profit activities prefer to acquire Section 8 Company status as it functions as the most common organization structure. A Section 8 company stands as one of the best legal choices when starting non-profit ventures in India read more ...

link:-https://servicesplusstartu...

Best Section 8 Company Registration in India Quick & Easy

An enriching experience awaits anyone who establishes a non-profit organization in India to conduct social educational or charitable activities. Organizations focused on social welfare and non-profit activities prefer to acquire Section 8 Company status as it functions as the most common organizatio..

https://servicesplusstartu.wixsite.com/my-site-1/post/best-section-8-company-registration-in-india-quick-easyDisasters like wildfires, floods, hurricanes, and earthquakes are making headlines more than ever. When severe damage occurs, the President may issue a federal disaster declaration — unlocking IRS tax relief to help victims recover financially.

Declared disaster victims may deduct uninsured losses on their tax returns, within certain limits. The IRS also automatically extends tax deadlines by 60 days, and often up to one year.

Taxpayers affected by federally declared disasters can withdraw up to $22,000 from their IRA, 401(k), or 403(b) without penalty. Taxes owed on the withdrawal can be paid over three years.

Government disaster relief payments — including mitigation funds — are generally tax-free. Charitable organization payments are also considered tax-free gifts.

Thanks to 2024 legislation, most wildfire-related payments from 2020 to 2025 are tax-free. Taxpayers who previously paid tax on these may file amended returns — even for 2020 and 2021 — until December 12, 2025.

https://owntweet.com/uploa...

Casualty gains (when insurance exceeds property value) can be deferred if you reinvest the payout in repairs or replacements within two years — or four for a main home. Total home loss may also qualify for a gain exclusion of up to $250,000 ($500,000 for joint filers).

Questions? Contact us at helloagfintax.com.