Crypto pinned this post

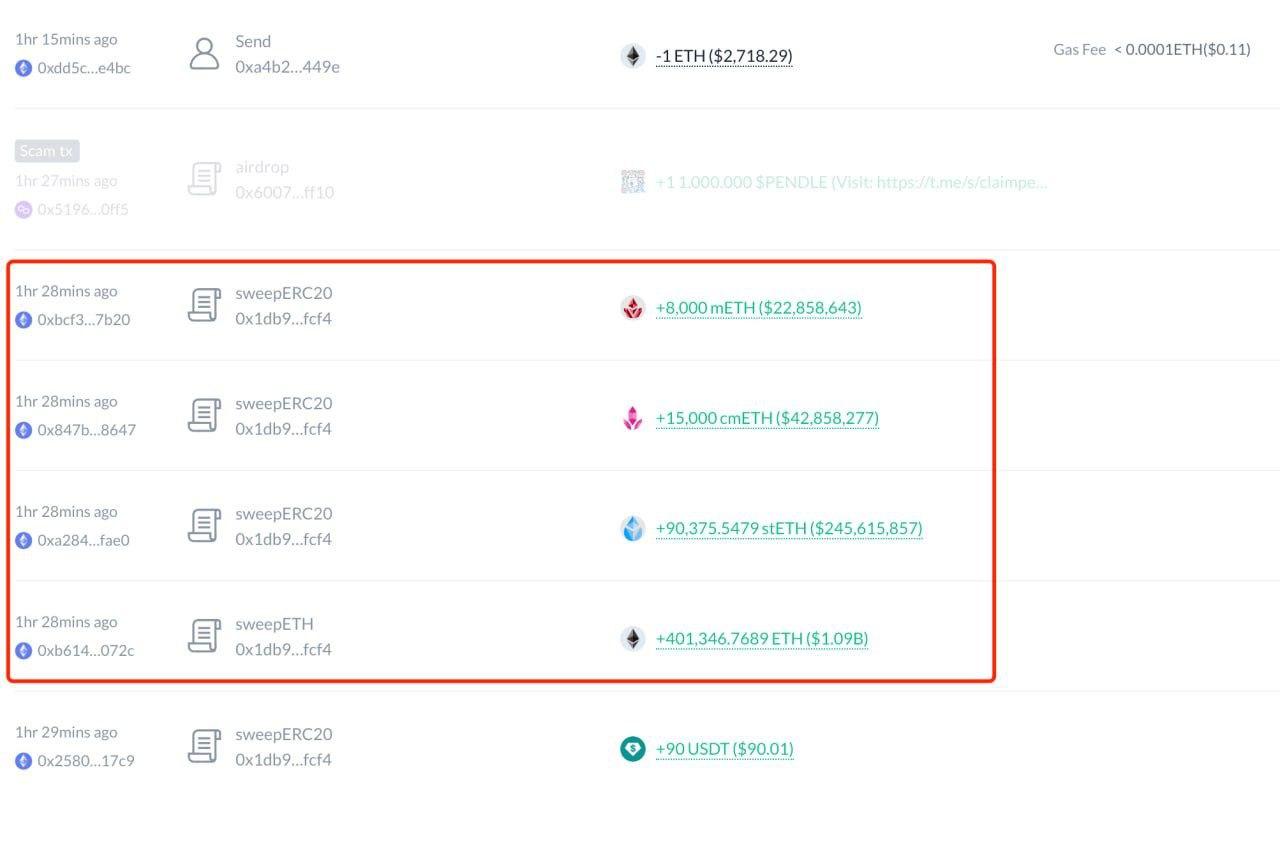

📈 According to zachxbt, Bybit was hacked with $1.4B worth of $ETH, $stETH, $cmETH and $mETH outflow from #bybit .

The hacker is exchanging $stETH, $cmETH and $mETH for $ETH. 😬

Address:

0x47666fab8bd0ac7003bce3f5c3585383f09486e2

0xa4b2fd68593b6f34e51cb9edb66e71c1b4ab449e

0xdd90071d52f20e85c89802e5dc1ec0a7b6475f92

The hacker is exchanging $stETH, $cmETH and $mETH for $ETH. 😬

Address:

0x47666fab8bd0ac7003bce3f5c3585383f09486e2

0xa4b2fd68593b6f34e51cb9edb66e71c1b4ab449e

0xdd90071d52f20e85c89802e5dc1ec0a7b6475f92

04:13 AM - Feb 22, 2025 (UTC)

Look at this face. It doesn't seek glory, doesn't expect praise.

His name is Donald.

Every day, for a month now, he gets up early in the morning to support the workers. He feeds everyone: Solana Flippers, SNG Abusers and even NFT Holders! His hands never get tired, his heart is full of care for ordinary people. He doesn't dream of awards, he just does his job - with love, dedication and incredible persistence.

So let's just say thank you to him!

Thank you, Donald, for your work and for not letting us go hungry. You are a real hero. 🍔❤️

His name is Donald.

Every day, for a month now, he gets up early in the morning to support the workers. He feeds everyone: Solana Flippers, SNG Abusers and even NFT Holders! His hands never get tired, his heart is full of care for ordinary people. He doesn't dream of awards, he just does his job - with love, dedication and incredible persistence.

So let's just say thank you to him!

Thank you, Donald, for your work and for not letting us go hungry. You are a real hero. 🍔❤️

06:21 AM - Dec 12, 2024 (UTC)

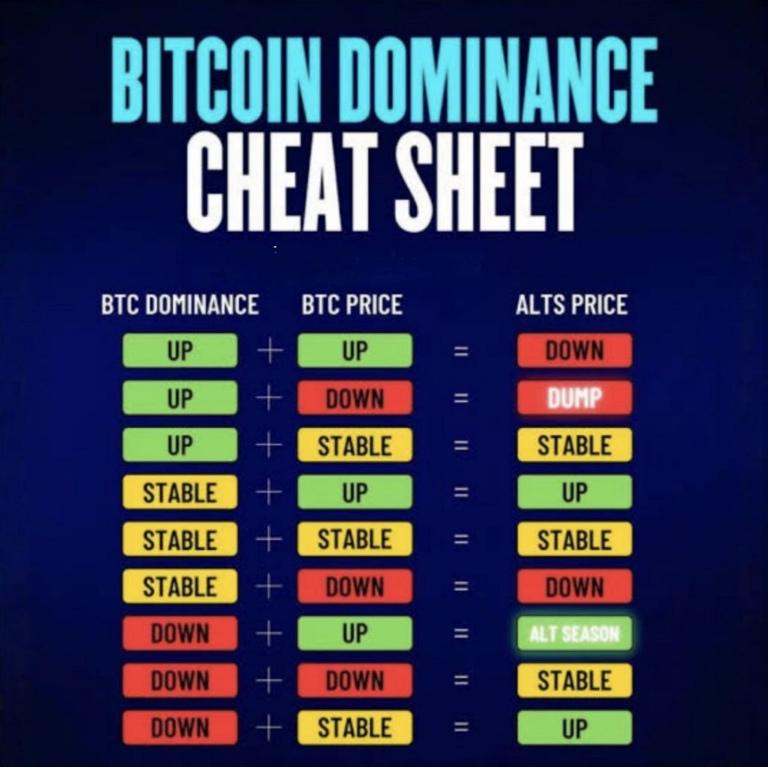

"Bitcoin Dominance Cheat Sheet" that visually explains how Bitcoin's dominance and price changes impact altcoin prices. Here’s a breakdown of the combinations:

BTC Dominance Up + BTC Price Up = Altcoin Price Down

BTC Dominance Up + BTC Price Down = Altcoin Price Dump

BTC Dominance Up + BTC Price Stable = Altcoin Price Stable

BTC Dominance Stable + BTC Price Up = Altcoin Price Up

BTC Dominance Stable + BTC Price Stable = Altcoin Price Stable

BTC Dominance Stable + BTC Price Down = Altcoin Price Down

BTC Dominance Down + BTC Price Up = Altseason (Altcoins rise significantly)

BTC Dominance Down + BTC Price Down = Altcoin Price Stable

BTC Dominance Down + BTC Price Stable = Altcoin Price Up

This chart helps traders predict the behavior of altcoins (alternative cryptocurrencies) based on Bitcoin's market trends.

BTC Dominance Up + BTC Price Up = Altcoin Price Down

BTC Dominance Up + BTC Price Down = Altcoin Price Dump

BTC Dominance Up + BTC Price Stable = Altcoin Price Stable

BTC Dominance Stable + BTC Price Up = Altcoin Price Up

BTC Dominance Stable + BTC Price Stable = Altcoin Price Stable

BTC Dominance Stable + BTC Price Down = Altcoin Price Down

BTC Dominance Down + BTC Price Up = Altseason (Altcoins rise significantly)

BTC Dominance Down + BTC Price Down = Altcoin Price Stable

BTC Dominance Down + BTC Price Stable = Altcoin Price Up

This chart helps traders predict the behavior of altcoins (alternative cryptocurrencies) based on Bitcoin's market trends.

03:02 PM - Oct 16, 2024 (UTC)

(E)

Crypto Volume refers to the number of times a particular #Cryptocurrency has been traded within a specific period. It is typically represented as the trading data over 24hours. Volume is a crucial indicator as it helps to understand the market's activity and the level of investor interest.

Detailed Analysis of Crypto Volume:

1. Market Activity: If the volume of a cryptocurrency is high, it indicates that there is a large amount of trading, and investors are showing interest in that currency. On the contrary, if the volume is low, it suggests that trading activity is decreasing and market interest is waning.

2. Liquidity: #Volume indicates the liquidity of a cryptocurrency. High volume means there are enough buyers and sellers in the market, facilitating faster trades and bringing stability to price fluctuations. In a low-volume market, #prices can experience larger fluctuations due to fewer investors.

3. Price Trends: Volume is often linked with price trends. If the price of a cryptocurrency starts increasing along with its volume, it suggests that the price rise could be sustainable. Conversely, if the price rises without a corresponding increase in volume, it may indicate an impending decline.

4. Market Sentiment: Volume is a critical indicator of #market sentiment. When a large institution or a whale invests in a currency, the volume can rise rapidly, which can have a positive or negative impact on the market.

Why is Crypto Volume Important?

- Market Dynamics: When volume increases, it shows that there is significant market activity, which boosts investor confidence.

- Price Prediction: #Volume increases or decreases can often signal future trends in the market.

- Making Informed Decisions: In a high-volume market, investors can trade more easily, and prices are less likely to be impacted by individual trades.

Therefore, understanding #crypto #market volume is essential for making informed investment decisions and gaining a clearer insight into the market dynamics.

Detailed Analysis of Crypto Volume:

1. Market Activity: If the volume of a cryptocurrency is high, it indicates that there is a large amount of trading, and investors are showing interest in that currency. On the contrary, if the volume is low, it suggests that trading activity is decreasing and market interest is waning.

2. Liquidity: #Volume indicates the liquidity of a cryptocurrency. High volume means there are enough buyers and sellers in the market, facilitating faster trades and bringing stability to price fluctuations. In a low-volume market, #prices can experience larger fluctuations due to fewer investors.

3. Price Trends: Volume is often linked with price trends. If the price of a cryptocurrency starts increasing along with its volume, it suggests that the price rise could be sustainable. Conversely, if the price rises without a corresponding increase in volume, it may indicate an impending decline.

4. Market Sentiment: Volume is a critical indicator of #market sentiment. When a large institution or a whale invests in a currency, the volume can rise rapidly, which can have a positive or negative impact on the market.

Why is Crypto Volume Important?

- Market Dynamics: When volume increases, it shows that there is significant market activity, which boosts investor confidence.

- Price Prediction: #Volume increases or decreases can often signal future trends in the market.

- Making Informed Decisions: In a high-volume market, investors can trade more easily, and prices are less likely to be impacted by individual trades.

Therefore, understanding #crypto #market volume is essential for making informed investment decisions and gaining a clearer insight into the market dynamics.

06:10 AM - Oct 07, 2024 (UTC)

In crypto, Pump-and-dump is a fraudulent process where the price of a specific #Cryptocurrency is artificially inflated ("pump"), and once the price has risen, large quantities of that cryptocurrency are sold off ("dump"), resulting in losses for regular investors. This is a form of market manipulation that typically occurs with smaller or less popular cryptocurrencies.

Steps in the Pump-and-dump process:

1. Pump (Price Inflation): A group or individual selects a low-value or less liquid cryptocurrency and starts purchasing large amounts of it. This buying activity quickly increases the price of the cryptocurrency. Additionally, they spread rumors through social media, forums, or chat groups that the cryptocurrency’s price will rise further. This leads regular investors to start buying as well, which pushes the price even higher.

2. Dump (Price Drop): Once the price has risen significantly, the original manipulators sell off their entire holdings. This large sell-off causes the price to drop sharply. Regular investors, when they realize they’ve been part of a manipulation scheme, experience further losses as the price plummets.

Effects of Pump-and-dump:

- Harmed Investors: Those who bought the cryptocurrency late suffer major losses as the price rapidly falls.

- Market Distrust: Such activities erode investor confidence and destabilize the market.

- Legal Action: In many countries, Pump-and-dump schemes are illegal, and regulatory bodies take action to prevent them. However, detecting them in the crypto market can be difficult due to the relatively lower level of regulation.

To protect themselves from Pump-and-dump schemes, investors should conduct thorough research on the actual value and projects behind cryptocurrencies and be cautious of sudden price surges.

Steps in the Pump-and-dump process:

1. Pump (Price Inflation): A group or individual selects a low-value or less liquid cryptocurrency and starts purchasing large amounts of it. This buying activity quickly increases the price of the cryptocurrency. Additionally, they spread rumors through social media, forums, or chat groups that the cryptocurrency’s price will rise further. This leads regular investors to start buying as well, which pushes the price even higher.

2. Dump (Price Drop): Once the price has risen significantly, the original manipulators sell off their entire holdings. This large sell-off causes the price to drop sharply. Regular investors, when they realize they’ve been part of a manipulation scheme, experience further losses as the price plummets.

Effects of Pump-and-dump:

- Harmed Investors: Those who bought the cryptocurrency late suffer major losses as the price rapidly falls.

- Market Distrust: Such activities erode investor confidence and destabilize the market.

- Legal Action: In many countries, Pump-and-dump schemes are illegal, and regulatory bodies take action to prevent them. However, detecting them in the crypto market can be difficult due to the relatively lower level of regulation.

To protect themselves from Pump-and-dump schemes, investors should conduct thorough research on the actual value and projects behind cryptocurrencies and be cautious of sudden price surges.

05:26 AM - Oct 07, 2024 (UTC)

#Whale : The Crypto Market's Big Fish

A whale in the crypto market is a person or entity that holds a massive amount of cryptocurrency. Their significant holdings can influence market prices, often leading to significant fluctuations.

Key Characteristics of a Whale:

Large Holdings: Whales possess a substantial quantity of a specific cryptocurrency, often enough to manipulate the market.

Market Influence: Their buying and selling activities can significantly impact the price of a cryptocurrency.

Potential for Manipulation: Whales can engage in activities like market manipulation or pump-and-dump schemes, which can harm smaller investors.

Why are Whales Important?

Price Volatility: Whales can cause sudden price swings, making it difficult for smaller investors to predict market trends.

Market Manipulation: Whales can manipulate the market for personal gain, leading to unfair practices and losses for smaller investors.

Market Sentiment: Whale activity can influence market sentiment, affecting the overall perception of a cryptocurrency.

It's essential to be aware of whale activity in the #crypto market. While they can contribute to market growth, they can also pose risks to smaller investors. Understanding the role of whales can help you make more informed investment decisions.

Would you like to know more about how whales can influence the crypto market?

0/1

A whale in the crypto market is a person or entity that holds a massive amount of cryptocurrency. Their significant holdings can influence market prices, often leading to significant fluctuations.

Key Characteristics of a Whale:

Large Holdings: Whales possess a substantial quantity of a specific cryptocurrency, often enough to manipulate the market.

Market Influence: Their buying and selling activities can significantly impact the price of a cryptocurrency.

Potential for Manipulation: Whales can engage in activities like market manipulation or pump-and-dump schemes, which can harm smaller investors.

Why are Whales Important?

Price Volatility: Whales can cause sudden price swings, making it difficult for smaller investors to predict market trends.

Market Manipulation: Whales can manipulate the market for personal gain, leading to unfair practices and losses for smaller investors.

Market Sentiment: Whale activity can influence market sentiment, affecting the overall perception of a cryptocurrency.

It's essential to be aware of whale activity in the #crypto market. While they can contribute to market growth, they can also pose risks to smaller investors. Understanding the role of whales can help you make more informed investment decisions.

Would you like to know more about how whales can influence the crypto market?

0/1

05:04 AM - Oct 07, 2024 (UTC)

There can be many reasons for pumping a crypto #token , and these reasons can work together at different times. All the reasons are mentioned below:

1. Increased market demand: When many people suddenly start buying a token, demand for it increases, causing the price to rise rapidly.

2. Influencer or Celebrity Promotion: If a famous influencer or celebrity promotes a certain token, many followers may be interested in buying it. This has a huge impact on the market.

3. Project development and innovation: If a crypto project has a new innovation, development or important partnership, such as a deal with a large organization or a new technology launch, then investors are interested in buying that token.

4. Trading Volume Increase: When a token's trading volume suddenly increases, its value can also increase rapidly.

5. Low Supply: If the supply of a token is low, but the demand is high, the value of the token increases rapidly.

6. Pump and Dump Scheme: Some groups or big investors get together to buy the token and artificially increase its price. They later sell the token at a higher price, causing the price to fall.

7. Market Trends and Hype: When a certain trend or hype is created in the market (such as excitement about a new technology or project), the price of the token may increase. This is often caused by the media or social media.

8. Exchange Listing: If a token is newly listed on a major crypto exchange, many investors become interested in buying the new token, causing the price to rise.

9. Burn Events: If a crypto project burns some of its tokens, the supply decreases. Low supply can cause prices to rise.

10. Investor Sentiment: The crypto market is very sentimental. If investors are positive about a token's future prospects, they invest in that token, causing its price to rise.

11. Market Manipulation: Big investors (Whales) can sometimes manipulate the market by buying and selling large amounts of tokens to increase the price.

12. Macro Economic Impact: Broader economic conditions or new policy implementation may impact the crypto market, causing the price of certain tokens to rise.

13. Fundamental Analysis and Technical Analysis: Some traders or investors start buying tokens based on fundamental or technical analysis, due to which its price may rise rapidly.

These are the possible factors that can cause the price of a #crypto token to suddenly increase.

0/1

1. Increased market demand: When many people suddenly start buying a token, demand for it increases, causing the price to rise rapidly.

2. Influencer or Celebrity Promotion: If a famous influencer or celebrity promotes a certain token, many followers may be interested in buying it. This has a huge impact on the market.

3. Project development and innovation: If a crypto project has a new innovation, development or important partnership, such as a deal with a large organization or a new technology launch, then investors are interested in buying that token.

4. Trading Volume Increase: When a token's trading volume suddenly increases, its value can also increase rapidly.

5. Low Supply: If the supply of a token is low, but the demand is high, the value of the token increases rapidly.

6. Pump and Dump Scheme: Some groups or big investors get together to buy the token and artificially increase its price. They later sell the token at a higher price, causing the price to fall.

7. Market Trends and Hype: When a certain trend or hype is created in the market (such as excitement about a new technology or project), the price of the token may increase. This is often caused by the media or social media.

8. Exchange Listing: If a token is newly listed on a major crypto exchange, many investors become interested in buying the new token, causing the price to rise.

9. Burn Events: If a crypto project burns some of its tokens, the supply decreases. Low supply can cause prices to rise.

10. Investor Sentiment: The crypto market is very sentimental. If investors are positive about a token's future prospects, they invest in that token, causing its price to rise.

11. Market Manipulation: Big investors (Whales) can sometimes manipulate the market by buying and selling large amounts of tokens to increase the price.

12. Macro Economic Impact: Broader economic conditions or new policy implementation may impact the crypto market, causing the price of certain tokens to rise.

13. Fundamental Analysis and Technical Analysis: Some traders or investors start buying tokens based on fundamental or technical analysis, due to which its price may rise rapidly.

These are the possible factors that can cause the price of a #crypto token to suddenly increase.

0/1

01:57 PM - Oct 06, 2024 (UTC)

#BTC☀ founder died in 2014, his friend Adam Back remained.!

The mystery surrounding the true identity of Satoshi Nakamoto, the creator of Bitcoin, has intrigued people for years. Hal Finney and Adam Back are frequently mentioned as potential candidates due to their involvement in cryptography and Bitcoin's early development.

Hal Finney was one of the first individuals to run Bitcoin and received a transaction directly from Satoshi. His connection to Bitcoin is undeniable. However, Finney passed away in 2014 due to ALS. Some believe he could have been Satoshi, but there is no conclusive evidence to support this. His personal records, including email conversations, show communication with Satoshi, but they don’t prove that he was the creator.

Adam Back, another possible candidate, invented Hashcash, a proof-of-work system that inspired Bitcoin’s mining algorithm. While Back has denied being Satoshi, rumors persist because of his technical expertise and early involvement in the Bitcoin community.

Speculation about the release of an HBO documentary that might reveal the true founder of Bitcoin has sparked interest. If Satoshi's identity were confirmed, it could have significant implications for the market. Such a revelation might affect investor confidence or generate massive media attention, depending on how the information is presented.

However, caution should be exercised when considering claims that Bitcoin’s price will either crash to zero or skyrocket due to the reveal of Satoshi's identity. While the mystery is captivating, Bitcoin’s current value is based on its decentralized nature, widespread adoption, and utility, rather than who its founder is.

BlackRock, a major financial institution, has been accumulating Bitcoin, showing its confidence in the asset. It's unlikely they would do so without thoroughly understanding the risks, including the uncertainty surrounding Satoshi’s identity.

In the end, the identity of Satoshi remains one of the greatest unsolved puzzles in the crypto world. While a potential revelation could cause short-term market fluctuations, Bitcoin’s long-term value is likely grounded in its technology, adoption, and role as a store of value.

#HBODocumentarySatoshiRevealed #WeAreAllSatoshi #SECAppealRipple

The mystery surrounding the true identity of Satoshi Nakamoto, the creator of Bitcoin, has intrigued people for years. Hal Finney and Adam Back are frequently mentioned as potential candidates due to their involvement in cryptography and Bitcoin's early development.

Hal Finney was one of the first individuals to run Bitcoin and received a transaction directly from Satoshi. His connection to Bitcoin is undeniable. However, Finney passed away in 2014 due to ALS. Some believe he could have been Satoshi, but there is no conclusive evidence to support this. His personal records, including email conversations, show communication with Satoshi, but they don’t prove that he was the creator.

Adam Back, another possible candidate, invented Hashcash, a proof-of-work system that inspired Bitcoin’s mining algorithm. While Back has denied being Satoshi, rumors persist because of his technical expertise and early involvement in the Bitcoin community.

Speculation about the release of an HBO documentary that might reveal the true founder of Bitcoin has sparked interest. If Satoshi's identity were confirmed, it could have significant implications for the market. Such a revelation might affect investor confidence or generate massive media attention, depending on how the information is presented.

However, caution should be exercised when considering claims that Bitcoin’s price will either crash to zero or skyrocket due to the reveal of Satoshi's identity. While the mystery is captivating, Bitcoin’s current value is based on its decentralized nature, widespread adoption, and utility, rather than who its founder is.

BlackRock, a major financial institution, has been accumulating Bitcoin, showing its confidence in the asset. It's unlikely they would do so without thoroughly understanding the risks, including the uncertainty surrounding Satoshi’s identity.

In the end, the identity of Satoshi remains one of the greatest unsolved puzzles in the crypto world. While a potential revelation could cause short-term market fluctuations, Bitcoin’s long-term value is likely grounded in its technology, adoption, and role as a store of value.

#HBODocumentarySatoshiRevealed #WeAreAllSatoshi #SECAppealRipple

05:38 PM - Oct 05, 2024 (UTC)

Check out #DeFiLlama for the latest insights on decentralized finance! From TVL tracking to protocol analytics, they provide the data you need to navigate the #defi landscape. Explore the future of finance today! ? #defi #crypto #Blockchain

https://defillama.com

https://defillama.com

11:28 AM - Oct 04, 2024 (UTC)

Sponsored by

OWT

6 months ago

Dwngo social network website

Dwngo – The Social Media Platform! * Share your thoughts & ideas * Publish blogs & trending stories * Connect, engage & grow your networkJoin now & be part of the future of social networking! #SocialMedia #Blogging #Dwngo --https://dwngo.com/