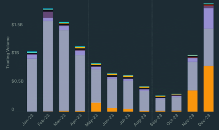

Crypto Volume refers to the number of times a particular #Cryptocurrency has been traded within a specific period. It is typically represented as the trading data over 24hours. Volume is a crucial indicator as it helps to understand the market's activity and the level of investor interest.

Detailed Analysis of Crypto Volume:

1. Market Activity: If the volume of a cryptocurrency is high, it indicates that there is a large amount of trading, and investors are showing interest in that currency. On the contrary, if the volume is low, it suggests that trading activity is decreasing and market interest is waning.

2. Liquidity: #Volume indicates the liquidity of a cryptocurrency. High volume means there are enough buyers and sellers in the market, facilitating faster trades and bringing stability to price fluctuations. In a low-volume market, #prices can experience larger fluctuations due to fewer investors.

3. Price Trends: Volume is often linked with price trends. If the price of a cryptocurrency starts increasing along with its volume, it suggests that the price rise could be sustainable. Conversely, if the price rises without a corresponding increase in volume, it may indicate an impending decline.

4. Market Sentiment: Volume is a critical indicator of #market sentiment. When a large institution or a whale invests in a currency, the volume can rise rapidly, which can have a positive or negative impact on the market.

Why is Crypto Volume Important?

- Market Dynamics: When volume increases, it shows that there is significant market activity, which boosts investor confidence.

- Price Prediction: #Volume increases or decreases can often signal future trends in the market.

- Making Informed Decisions: In a high-volume market, investors can trade more easily, and prices are less likely to be impacted by individual trades.

Therefore, understanding #crypto #market volume is essential for making informed investment decisions and gaining a clearer insight into the market dynamics.

Detailed Analysis of Crypto Volume:

1. Market Activity: If the volume of a cryptocurrency is high, it indicates that there is a large amount of trading, and investors are showing interest in that currency. On the contrary, if the volume is low, it suggests that trading activity is decreasing and market interest is waning.

2. Liquidity: #Volume indicates the liquidity of a cryptocurrency. High volume means there are enough buyers and sellers in the market, facilitating faster trades and bringing stability to price fluctuations. In a low-volume market, #prices can experience larger fluctuations due to fewer investors.

3. Price Trends: Volume is often linked with price trends. If the price of a cryptocurrency starts increasing along with its volume, it suggests that the price rise could be sustainable. Conversely, if the price rises without a corresponding increase in volume, it may indicate an impending decline.

4. Market Sentiment: Volume is a critical indicator of #market sentiment. When a large institution or a whale invests in a currency, the volume can rise rapidly, which can have a positive or negative impact on the market.

Why is Crypto Volume Important?

- Market Dynamics: When volume increases, it shows that there is significant market activity, which boosts investor confidence.

- Price Prediction: #Volume increases or decreases can often signal future trends in the market.

- Making Informed Decisions: In a high-volume market, investors can trade more easily, and prices are less likely to be impacted by individual trades.

Therefore, understanding #crypto #market volume is essential for making informed investment decisions and gaining a clearer insight into the market dynamics.

06:10 AM - Oct 07, 2024 (UTC)