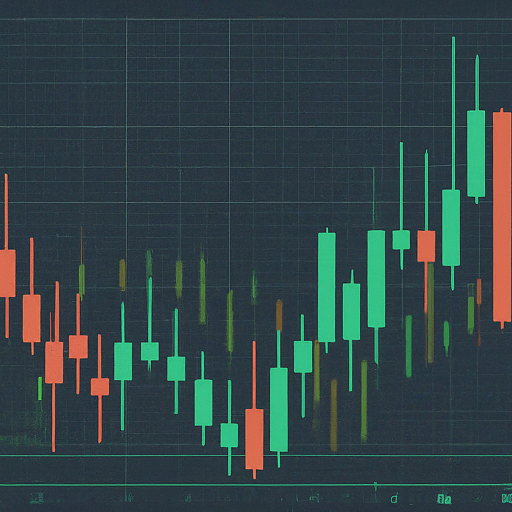

In crypto, Pump-and-dump is a fraudulent process where the price of a specific #Cryptocurrency is artificially inflated ("pump"), and once the price has risen, large quantities of that cryptocurrency are sold off ("dump"), resulting in losses for regular investors. This is a form of market manipulation that typically occurs with smaller or less popular cryptocurrencies.

Steps in the Pump-and-dump process:

1. Pump (Price Inflation): A group or individual selects a low-value or less liquid cryptocurrency and starts purchasing large amounts of it. This buying activity quickly increases the price of the cryptocurrency. Additionally, they spread rumors through social media, forums, or chat groups that the cryptocurrency’s price will rise further. This leads regular investors to start buying as well, which pushes the price even higher.

2. Dump (Price Drop): Once the price has risen significantly, the original manipulators sell off their entire holdings. This large sell-off causes the price to drop sharply. Regular investors, when they realize they’ve been part of a manipulation scheme, experience further losses as the price plummets.

Effects of Pump-and-dump:

- Harmed Investors: Those who bought the cryptocurrency late suffer major losses as the price rapidly falls.

- Market Distrust: Such activities erode investor confidence and destabilize the market.

- Legal Action: In many countries, Pump-and-dump schemes are illegal, and regulatory bodies take action to prevent them. However, detecting them in the crypto market can be difficult due to the relatively lower level of regulation.

To protect themselves from Pump-and-dump schemes, investors should conduct thorough research on the actual value and projects behind cryptocurrencies and be cautious of sudden price surges.

Steps in the Pump-and-dump process:

1. Pump (Price Inflation): A group or individual selects a low-value or less liquid cryptocurrency and starts purchasing large amounts of it. This buying activity quickly increases the price of the cryptocurrency. Additionally, they spread rumors through social media, forums, or chat groups that the cryptocurrency’s price will rise further. This leads regular investors to start buying as well, which pushes the price even higher.

2. Dump (Price Drop): Once the price has risen significantly, the original manipulators sell off their entire holdings. This large sell-off causes the price to drop sharply. Regular investors, when they realize they’ve been part of a manipulation scheme, experience further losses as the price plummets.

Effects of Pump-and-dump:

- Harmed Investors: Those who bought the cryptocurrency late suffer major losses as the price rapidly falls.

- Market Distrust: Such activities erode investor confidence and destabilize the market.

- Legal Action: In many countries, Pump-and-dump schemes are illegal, and regulatory bodies take action to prevent them. However, detecting them in the crypto market can be difficult due to the relatively lower level of regulation.

To protect themselves from Pump-and-dump schemes, investors should conduct thorough research on the actual value and projects behind cryptocurrencies and be cautious of sudden price surges.

05:26 AM - Oct 07, 2024 (UTC)