5G Chipset Market Forecasting 2030: Market Trends and Growth Status

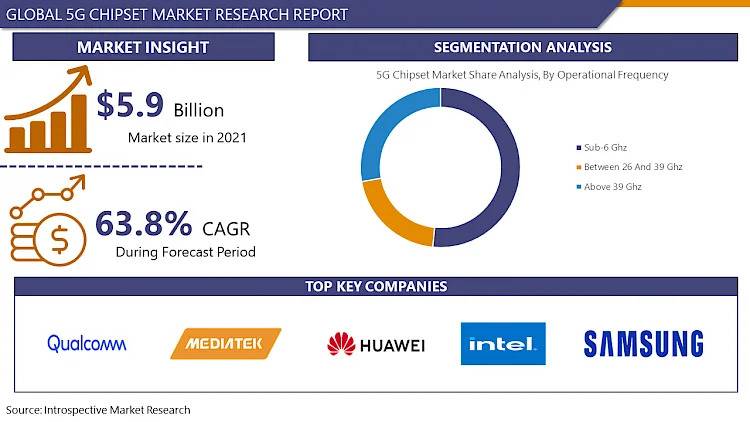

Global 5G Chipset market was estimated at USD 5.9 billion in 2021, and is anticipated to reach USD 186.66 billion by 2028, growing at a CAGR of 63.8%.

5G chipsets enable 5G packet communication on notebook PCs with mobile network capability, smartphones, IoT devices, and portable hotspots. It is expected that 5G mobile devices would integrate high-frequency millimeter-wave (mm Wave) bands with highly-focused beam-steering with well-known sub-6 GHz channels and innovative MIMO antenna systems. Globally, major telecom service providers are updating to 5G, which mainly uses denser arrays of tiny antennas to provide extremely fast network and communication speeds. It is projected that 5G technology would unleash a massive Internet of Things ecosystem, enabling networks to support billions of linked devices. For example, more than 10 million 5G mobile subscribers were predicted, per Ericsson's Mobility Report from June 2019.

Players Covered in 5G Chipset market are:

Analog Devices Inc., Anokiwave Inc., Renesas Electronics Corporation, Cavium Inc., MediaTek Inc., Intel Corporation, Samsung Electronics Co. Ltd, Xilinx Inc., Nokia Corporation, Broadcom Inc., Infineon Technologies AG, Huawei Technologies Co. Ltd, Qorvo Inc., NXP Semiconductors NV, Texas Instruments Inc., Qualcomm Technologies Inc and Majore Key Players.

Start with a Free Sample Report Today!

Introspective Market Research specializes in delivering comprehensive market research studies that offer valuable insights and strategic guidance to businesses worldwide. With a focus on reliability and accuracy, our reports empower informed decision-making.

An in-depth examination of the overall 5G Chipset industry is done to provide this market report encompassing all essential market fundamentals. Our findings are built upon a solid foundation, drawing from a wide range of primary and secondary sources. To further enhance the comprehensiveness of our evaluation, we employ industry-standard tools such as Porter's Five Forces Analysis, SWOT Analysis, and Price Trend Analysis.

Discount on the Research Report@

Segmentation Analysis of the 5G Chipset Market:

By Chipset Type, the Application-specific Integrated Circuits (ASIC) segment was expected to dominate the market, with 27.3% of the market share in 2019, followed by FPGA and mm Wave chipsets segments, with 27.08% and 24.88% shares, respectively

The sub-6 GHz segment was estimated to account for the largest share of 80.19% in 2027, while the above 39 GHz segment is expected to witness the highest CAGR of 122.9%.

By End-User industry, the consumer electronics industry was expected to account for the largest market share of 78.30%. The Industrial Automation is anticipated to indicate the highest CAGR of 89.2% during the forecast period.

By Type

Application-Specific Integrated Circuits (ASIC)

Radio Frequency Integrated Circuit (RFIC)

Millimeter Wave Technology Chips

Field-Programmable Gate Array (FPGA)

By Operational Frequency

Sub-6 Ghz

Between 26 And 39 Ghz

Above 39 Ghz

By End Users

Consumer Electronics

Industrial Automation

Automotive & Transportation

Energy & Utilities

Healthcare

Retail

We're Flexible - Inquire About Customization!

5G Chipset Market Regional Analysis

With 42.05% of the market share in 2025, Asia-Pacific was predicted to lead all other regions, followed by North America and Europe with 30.70% and 23.04% of the share, respectively.

Because of the large number of pure-play foundries that are now functioning in China and South Korea, the Asia-Pacific region is anticipated to occupy a significant part of the market. With 30 new facilities currently under construction, China is home to the largest fab projects globally, according to SEMI. The nation's foundry business can be split into two categories: local and multinational, the latter of which includes foundries run by foreign suppliers like Intel. International players are allowed to enter the country due to the significant presence of OSAT producers around the nation.

By Region

North America (US, Canada, Mexico)

Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

South America (Brazil, Argentina, Rest of SA)

Owning our reports (For More, Buy Our Report) will help you solve the following issues:

Uncertainty about the future?

Our research and insights help our clients to foresee upcoming revenue pockets and growth areas. This helps our clients to invest or divest their resources.

Understanding market sentiments?

It is im

Global 5G Chipset market was estimated at USD 5.9 billion in 2021, and is anticipated to reach USD 186.66 billion by 2028, growing at a CAGR of 63.8%.

5G chipsets enable 5G packet communication on notebook PCs with mobile network capability, smartphones, IoT devices, and portable hotspots. It is expected that 5G mobile devices would integrate high-frequency millimeter-wave (mm Wave) bands with highly-focused beam-steering with well-known sub-6 GHz channels and innovative MIMO antenna systems. Globally, major telecom service providers are updating to 5G, which mainly uses denser arrays of tiny antennas to provide extremely fast network and communication speeds. It is projected that 5G technology would unleash a massive Internet of Things ecosystem, enabling networks to support billions of linked devices. For example, more than 10 million 5G mobile subscribers were predicted, per Ericsson's Mobility Report from June 2019.

Players Covered in 5G Chipset market are:

Analog Devices Inc., Anokiwave Inc., Renesas Electronics Corporation, Cavium Inc., MediaTek Inc., Intel Corporation, Samsung Electronics Co. Ltd, Xilinx Inc., Nokia Corporation, Broadcom Inc., Infineon Technologies AG, Huawei Technologies Co. Ltd, Qorvo Inc., NXP Semiconductors NV, Texas Instruments Inc., Qualcomm Technologies Inc and Majore Key Players.

Start with a Free Sample Report Today!

Introspective Market Research specializes in delivering comprehensive market research studies that offer valuable insights and strategic guidance to businesses worldwide. With a focus on reliability and accuracy, our reports empower informed decision-making.

An in-depth examination of the overall 5G Chipset industry is done to provide this market report encompassing all essential market fundamentals. Our findings are built upon a solid foundation, drawing from a wide range of primary and secondary sources. To further enhance the comprehensiveness of our evaluation, we employ industry-standard tools such as Porter's Five Forces Analysis, SWOT Analysis, and Price Trend Analysis.

Discount on the Research Report@

Segmentation Analysis of the 5G Chipset Market:

By Chipset Type, the Application-specific Integrated Circuits (ASIC) segment was expected to dominate the market, with 27.3% of the market share in 2019, followed by FPGA and mm Wave chipsets segments, with 27.08% and 24.88% shares, respectively

The sub-6 GHz segment was estimated to account for the largest share of 80.19% in 2027, while the above 39 GHz segment is expected to witness the highest CAGR of 122.9%.

By End-User industry, the consumer electronics industry was expected to account for the largest market share of 78.30%. The Industrial Automation is anticipated to indicate the highest CAGR of 89.2% during the forecast period.

By Type

Application-Specific Integrated Circuits (ASIC)

Radio Frequency Integrated Circuit (RFIC)

Millimeter Wave Technology Chips

Field-Programmable Gate Array (FPGA)

By Operational Frequency

Sub-6 Ghz

Between 26 And 39 Ghz

Above 39 Ghz

By End Users

Consumer Electronics

Industrial Automation

Automotive & Transportation

Energy & Utilities

Healthcare

Retail

We're Flexible - Inquire About Customization!

5G Chipset Market Regional Analysis

With 42.05% of the market share in 2025, Asia-Pacific was predicted to lead all other regions, followed by North America and Europe with 30.70% and 23.04% of the share, respectively.

Because of the large number of pure-play foundries that are now functioning in China and South Korea, the Asia-Pacific region is anticipated to occupy a significant part of the market. With 30 new facilities currently under construction, China is home to the largest fab projects globally, according to SEMI. The nation's foundry business can be split into two categories: local and multinational, the latter of which includes foundries run by foreign suppliers like Intel. International players are allowed to enter the country due to the significant presence of OSAT producers around the nation.

By Region

North America (US, Canada, Mexico)

Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

South America (Brazil, Argentina, Rest of SA)

Owning our reports (For More, Buy Our Report) will help you solve the following issues:

Uncertainty about the future?

Our research and insights help our clients to foresee upcoming revenue pockets and growth areas. This helps our clients to invest or divest their resources.

Understanding market sentiments?

It is im

08:02 AM - Jan 22, 2024 (UTC)