Enhanced bonding and communication among the staff, their morale, and retention of top talent generate business outcomes when the corporate group trip itinerary indeed leaves a mark on work. Partnering with a travel agency like Majestic Millionaires Travel Agency for group travel or a travel agent from home ensures that your next corporate trip is a success which makes the team more tightly knit for the foreseeable future.

For more info. visit:https://incmajesticmillion...

Enhanced bonding and communication among the staff, their morale, and retention of top talent generate business outcomes when the corporate group trip itinerary indeed leaves a mark on work. Partnering with a travel agency like Majestic Millionaires Travel Agency for group travel or a travel agent from home ensures that your next corporate trip is a success which makes the team more tightly knit for the foreseeable future.

For more info. visit:https://incmajesticmillion...

How to Build a MetaMask Wallet Clone Script | Javarevisited

Rising crypto demand and secure digital assets are vital. for that MetaMask wallet clone offers the perfect solution for efficient wallet support. Know Here!

https://medium.com/javarevisited/metamask-clone-script-build-a-metamask-like-a-crypto-wallet-c8b45595ad9chttps://thenexturbanmillio...

Millionaires are busy. Whether you’re an entrepreneur, VP or CEO of a business, you spend a lot of time in the office trying to nurture and grow your business. A lot of personal sacrifices are involved in your success. And your personal, love life is often put on hold because you don’t have the time to spend finding that someone special to share your life with.

https://exquisiteintroduct...

Holidays are supposed to be relaxed and playful, but shoddy planning can convert them into stress. Of course, by hiring a luxury travel company like Majestic Millionaires Travel Agency, you can rest assured that every aspect of the trip will be taken care of in a memorable way.

For more info. visit: https://majesticmillionair...

5 Common Travel Planning Mistakes And How The Mistakes Can Be Avoided

Everyone anticipates an exciting and enjoyable planning process, which turns out to be so overwhelming and stressful. Be it a weekend vacati...

https://majesticmillionairesinc.blogspot.com/2025/02/5-common-travel-planning-mistakes-and.htmlChennai has more than 4,000 millionaires, ranking 5th in India. Searching for the perfect apartment in a big city can be an overwhelming experience. In this piece, we highlighted the Top 10 Luxury Apartment In Chennai.

Click for more-https://www.indiapropertyd...

#realestate #property

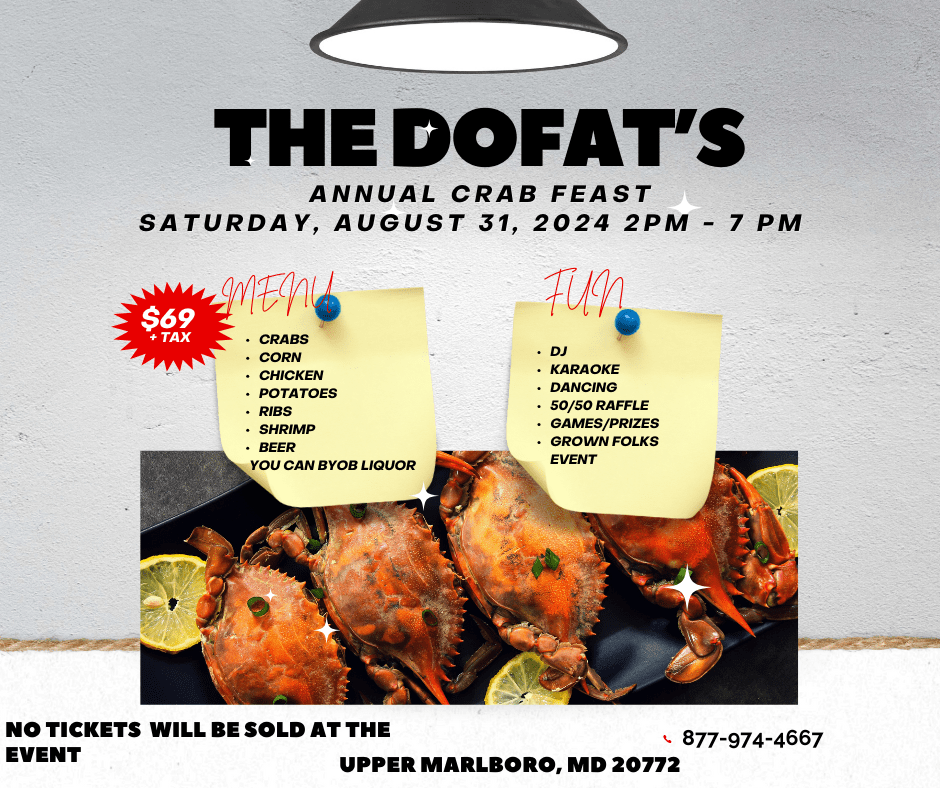

In offering paradoxes about occasional insipid offers, finding worthy group travel deals in Maryland can be a search for gold in dirt. This is where your Majestic Millionaires Travel Agency must make its mark.Let Majestic Millionaires And Travel Agency put together an itinerary that speaks to the bold aspirations of your brand. Read more: https://majesticmillionair...

Why Corporate Group Trips In Maryland Deserve A Makeover

Corporate group trips in Maryland are often seen as dull, ordinary, checklist-style meetings with generic hotels and uninspired venues. But...

https://majesticmillionairesinc.blogspot.com/2025/05/why-corporate-group-trips-in-maryland.htmlExperience the best of premium travel with a leading luxury travel agency USA. Majestic Millionaires Travel Agency specializes in luxurious domestic and international escapes, crafted for travelers who demand excellence and sophistication.

For more information visit: https://www.majesticmillio...

All-Inclusive Travel Agency Upper Marlboro | Luxury travel Company Maryland, USA

Majestic Millionaires Travel Agency in Upper Marlboro,Maryland offers all-inclusive trips and global and local tours. Discover unmatched travel services for a seamless experience. Your dream getaway awaits.

https://www.majesticmillionaires.com/Some go abroad for higher studies, some go there to settle down through jobs. Every year, there are many people who go to other countries from India for some reasons. But the words rich or super rich in this regard are surprising. That is, in India, those who have assets of more than Rs. 25 crores are called super rich or wealthy, millionaires. However, in this regard, one in every five super rich people said that they want to leave India.

https://vaartha.com/i-woul...

Vaartha: Telugu News | Latest News Telugu | Breaking News Telugu

అత్యంత సంపద ఉన్న ప్రతి ఐదుగురు కోరీశ్వరుల్లో ఒకరు ఇండియా విడిచి వెళ్లాలనుకుంటున్నట్లు చెప్పారు..ఇటీవల, కోటక్ మహీంద్రా బ్యాంక్

https://vaartha.com/i-would-rather-settle-abroad-than-in-india/international-news/465968/#Popcat , #MUMU the Bull, and #Billy are soaring with explosive gains!

Don't miss your chance to ride the wave—these coins are on fire and could make you rich! ??

https://coinpedia.org/news...

These Three Meme Coins Can Bring Waves of New Millionaires!

Lookout for these three meme coins as they might be the makers of next waves of crypto millionaires ! Are you watching them?

https://coinpedia.org/news/these-three-meme-coins-can-bring-waves-of-new-millionaires/Enjoy customized, high-end travel plans from Majestic Millionaires Travel Agency, the trusted luxury travel agency in Virginia. We design every itinerary with attention to comfort, class, and unforgettable experiences.

For more information visit: https://www.majesticmillio...

Finding a travel agency that caters to group tours is relatively simple if you know where to look and what to consider.One standout option is Majestic Millionaires Travel Agency, a trusted name in group travel. With the right tours travel agency, you can ensure that your group trip is expertly managed, allowing you to focus on enjoying the journey and making lasting memories.

For more info. visit:https://qr.ae/pYxfdi

Majestic Millionaires Travel Agency's answer to How can I find a travel agency that caters to group tours? - Quora

Majestic Millionaires Travel Agency's answer: Finding a travel agency that caters to group tours is relatively simple if you know where to look and what to consider. A tours travel agency specializing in group tours can offer tailored experiences, taking care of logistics, accommodations, and t..

https://qr.ae/pYxfdiBe it a tucked-away hideaway or a lively family excursion, the door to high-tier travel options into Virginia is now wide open for you. We have the best exclusive travel offers in Virginia that can be perfect for your next getaway. the Majestic Millionaires Travel Agency is top of the list when one plans to venture into Virginia on their terms. Read more: https://ext-6770351.livejo...

How To Unlock Exclusive Travel Offers In Virginia: ext_6770351 — LiveJournal

Dreams of a lifetime escape filled with lavish adventures? Looking for a way to blindly enjoy the beauties of Virginia while retaining the classy excitement? Well, here's the deal. Majestic Millionaires Travel Agency is re-centering your travel experience by offering hand-curated,…

https://ext-6770351.livejournal.com/498.htmlPlanning a group getaway? Majestic Millionaires Travel Agency is the perfect group travel agency Maryland. We offer tailored services for large groups, making every trip enjoyable, stress-free, and perfectly organized from start to finish.

For more info. visit:https://www.majesticmillio...

Become A Travel Agent - Majestic Millionaires

Start Your Dream Career as a Travel Agent Today What You Get Pricing Apply FAQs Join the Majestic Millionaires Travel Agency Team! Are you ready to embark on an exciting journey in the travel industry? Becoming a travel agent with Majestic Millionaires Travel Agency is as simple as 1-2-3. Complete t..

https://www.majesticmillionaires.com/become-a-travel-agent/Dwngo social network website

Dwngo – The Social Media Platform! * Share your thoughts & ideas * Publish blogs & trending stories * Connect, engage & grow your networkJoin now & be part of the future of social networking! #SocialMedia #Blogging #Dwngo --https://dwngo.com/