Online Notary Services: Secure, Fast & Convenient Notarization

Discover the convenience of online notary services for fast, secure document notarization. Whether for personal or business use, you can have your documents notarized remotely with ease. Using secure video conferencing, our expert notaries ensure your documents meet legal standards, all from the comfort of your home. Skip the travel and enjoy the benefits of 24/7 availability, accessibility, and digital recordkeeping. Choose our online notary service for reliable and efficient notarization.

https://bluenotary.us/onli...

Discover the convenience of online notary services for fast, secure document notarization. Whether for personal or business use, you can have your documents notarized remotely with ease. Using secure video conferencing, our expert notaries ensure your documents meet legal standards, all from the comfort of your home. Skip the travel and enjoy the benefits of 24/7 availability, accessibility, and digital recordkeeping. Choose our online notary service for reliable and efficient notarization.

https://bluenotary.us/onli...

Online Notarization on the Blockchain (RON) - BlueNotary

Notarize your documents online in less than 5 minutes for only $25. Quick, Legal, and Highly Secure Online Public Notary Service. Find Notary Near Me. Notarizations available anytime from anywhere in the USA.

https://bluenotary.us/online-notary

02:23 PM - Apr 03, 2025 (UTC)

Effortlessly generate detailed checkstubs for accurate recordkeeping. Our user-friendly tool makes it simple to create professional documentation to track your earnings and deductions.

https://paystubsplanet.com...

https://paystubsplanet.com...

06:25 AM - Oct 29, 2024 (UTC)

Your Weekly Tax Tip - Those Pesky Records! What do I need to keep?

Know when to keep or throw out your tax records. Here is what you need to know. Read More https://shorturl.at/YQWAN

#TaxRecords #RecordKeeping #OrganizedTaxes #TaxDocuments #TaxTimeTips #FinancialOrganization #KeepOrToss #SmartFiling #DocumentManagement #TaxSeasonReady #TaxEducation #KnowYourTaxes #TaxPreparationTips #TaxPlanning #StayOrganized #WhatToKeep #DeclutterYourFiles #TaxTips2024 #TaxTimeHelp #FileSmart

Know when to keep or throw out your tax records. Here is what you need to know. Read More https://shorturl.at/YQWAN

#TaxRecords #RecordKeeping #OrganizedTaxes #TaxDocuments #TaxTimeTips #FinancialOrganization #KeepOrToss #SmartFiling #DocumentManagement #TaxSeasonReady #TaxEducation #KnowYourTaxes #TaxPreparationTips #TaxPlanning #StayOrganized #WhatToKeep #DeclutterYourFiles #TaxTips2024 #TaxTimeHelp #FileSmart

05:01 AM - Dec 11, 2024 (UTC)

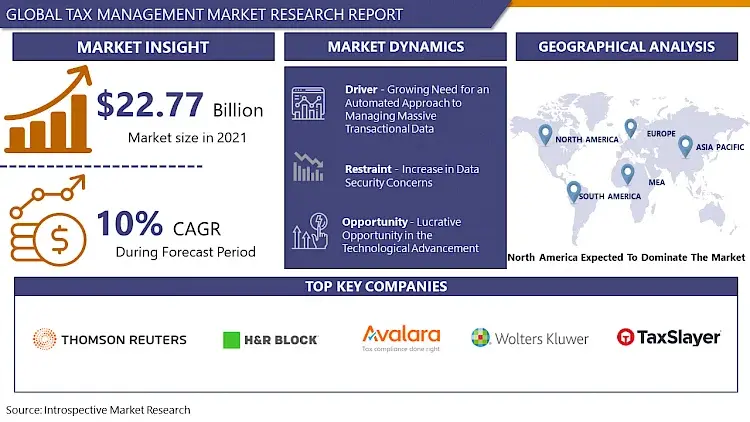

Global Tax Management Market: An Escalating Sector with Projected Growth to Reach USD 53.70 Billion By 2030 | 10% CAGR

Global Tax Management Market Size Was Valued at USD 25.05 Billion In 2022 And Is Projected to Reach USD 53.70 Billion By 2030, Growing at A CAGR of 10% From 2023 To 2030.

Tax management refers to the administration of funds and assets for tax payment. The primary objective of tax administration is to comply with income tax rules and regulations. Similarly, it includes the deduction of taxes at the source, the auditing of accounts, the timely filing of tax returns, etc. Increasing demand for tax recordkeeping solutions is expected to be a key factor driving revenue growth in the global tax management market over the forecast period. Record keeping is a crucial strategy for most businesses when it comes to storing essential tax documents, and tax software can facilitate this process.

Using cloud-based tax software, businesses can store tax information from prior years in a secure manner on cloud storage. Using such a solution, businesses can gain immediate access to the essential tax information for any fiscal year.

Top Key Players Covered in The Tax Management Market

Thomson Reuters (Canada), Intuit (US),H&R Block (US), Avalara (US), Wolters Kluwer NV (Netherlands), Automatic Data Processing (US), TaxSlayer (US), Taxback International (Ireland), TaxCloud (US), Drake Enterprises (US), Canopy Tax (US), TaxJar (US), Webgility (US), LOVAT Software (UK), SafeSend (US), EXEMPTAX (US), Sales Tax DataLINK (US), Shoeboxed (US), SAXTAX (US), and Other Major Players.

To Understand Business Strategies, Request For a Sample Report @

https://introspectivemarke...

Global Tax Management Market Size Was Valued at USD 25.05 Billion In 2022 And Is Projected to Reach USD 53.70 Billion By 2030, Growing at A CAGR of 10% From 2023 To 2030.

Tax management refers to the administration of funds and assets for tax payment. The primary objective of tax administration is to comply with income tax rules and regulations. Similarly, it includes the deduction of taxes at the source, the auditing of accounts, the timely filing of tax returns, etc. Increasing demand for tax recordkeeping solutions is expected to be a key factor driving revenue growth in the global tax management market over the forecast period. Record keeping is a crucial strategy for most businesses when it comes to storing essential tax documents, and tax software can facilitate this process.

Using cloud-based tax software, businesses can store tax information from prior years in a secure manner on cloud storage. Using such a solution, businesses can gain immediate access to the essential tax information for any fiscal year.

Top Key Players Covered in The Tax Management Market

Thomson Reuters (Canada), Intuit (US),H&R Block (US), Avalara (US), Wolters Kluwer NV (Netherlands), Automatic Data Processing (US), TaxSlayer (US), Taxback International (Ireland), TaxCloud (US), Drake Enterprises (US), Canopy Tax (US), TaxJar (US), Webgility (US), LOVAT Software (UK), SafeSend (US), EXEMPTAX (US), Sales Tax DataLINK (US), Shoeboxed (US), SAXTAX (US), and Other Major Players.

To Understand Business Strategies, Request For a Sample Report @

https://introspectivemarke...

Request Sample| IMR

We Introspective Market Research holds expertise in providing latest, authentic and reliable research reports across all the business verticals.

https://introspectivemarketresearch.com/request/16590

12:32 PM - Jan 02, 2024 (UTC)

Global Tax Management Market: An Escalating Sector with Projected Growth to Reach USD 53.70 Billion By 2030 | 10% CAGR

Global Tax Management Market Size Was Valued at USD 25.05 Billion In 2022 And Is Projected to Reach USD 53.70 Billion By 2030, Growing at A CAGR of 10% From 2023 To 2030.

Tax management refers to the administration of funds and assets for tax payment. The primary objective of tax administration is to comply with income tax rules and regulations. Similarly, it includes the deduction of taxes at the source, the auditing of accounts, the timely filing of tax returns, etc. Increasing demand for tax recordkeeping solutions is expected to be a key factor driving revenue growth in the global tax management market over the forecast period. Record keeping is a crucial strategy for most businesses when it comes to storing essential tax documents, and tax software can facilitate this process.

Using cloud-based tax software, businesses can store tax information from prior years in a secure manner on cloud storage. Using such a solution, businesses can gain immediate access to the essential tax information for any fiscal year.

Top Key Players Covered in The Tax Management Market

Thomson Reuters (Canada), Intuit (US),H&R Block (US), Avalara (US), Wolters Kluwer NV (Netherlands), Automatic Data Processing (US), TaxSlayer (US), Taxback International (Ireland), TaxCloud (US), Drake Enterprises (US), Canopy Tax (US), TaxJar (US), Webgility (US), LOVAT Software (UK), SafeSend (US), EXEMPTAX (US), Sales Tax DataLINK (US), Shoeboxed (US), SAXTAX (US), and Other Major Players.

To Understand Business Strategies, Request For a Sample Report @

https://introspectivemarke...

Global Tax Management Market Size Was Valued at USD 25.05 Billion In 2022 And Is Projected to Reach USD 53.70 Billion By 2030, Growing at A CAGR of 10% From 2023 To 2030.

Tax management refers to the administration of funds and assets for tax payment. The primary objective of tax administration is to comply with income tax rules and regulations. Similarly, it includes the deduction of taxes at the source, the auditing of accounts, the timely filing of tax returns, etc. Increasing demand for tax recordkeeping solutions is expected to be a key factor driving revenue growth in the global tax management market over the forecast period. Record keeping is a crucial strategy for most businesses when it comes to storing essential tax documents, and tax software can facilitate this process.

Using cloud-based tax software, businesses can store tax information from prior years in a secure manner on cloud storage. Using such a solution, businesses can gain immediate access to the essential tax information for any fiscal year.

Top Key Players Covered in The Tax Management Market

Thomson Reuters (Canada), Intuit (US),H&R Block (US), Avalara (US), Wolters Kluwer NV (Netherlands), Automatic Data Processing (US), TaxSlayer (US), Taxback International (Ireland), TaxCloud (US), Drake Enterprises (US), Canopy Tax (US), TaxJar (US), Webgility (US), LOVAT Software (UK), SafeSend (US), EXEMPTAX (US), Sales Tax DataLINK (US), Shoeboxed (US), SAXTAX (US), and Other Major Players.

To Understand Business Strategies, Request For a Sample Report @

https://introspectivemarke...

12:22 PM - Feb 29, 2024 (UTC)

Invoice and purchase books online at betteroffice.store.

In today’s competitive business world, keeping track of transactions is crucial. That’s where invoice books come into play. Whether you run a small business, a retail shop, or a large enterprise, having professional invoice books can help maintain accurate financial records. If you’re looking for premium-quality invoice books, betteroffice.store is the perfect place to find a variety of options tailored to your business needs

For more info: https://betteroffice.store...

Tags: #InvoiceBooks #PurchaseBooks #BusinessStationery #BetterOfficeStore #BillingBooks #CarbonlessInvoiceBooks #OfficeSupplies #ReceiptBooks #FinancialRecords #SmallBusinessTools #AccountingEssentials #ProfessionalInvoices #RecordKeeping #businessgrowth

In today’s competitive business world, keeping track of transactions is crucial. That’s where invoice books come into play. Whether you run a small business, a retail shop, or a large enterprise, having professional invoice books can help maintain accurate financial records. If you’re looking for premium-quality invoice books, betteroffice.store is the perfect place to find a variety of options tailored to your business needs

For more info: https://betteroffice.store...

Tags: #InvoiceBooks #PurchaseBooks #BusinessStationery #BetterOfficeStore #BillingBooks #CarbonlessInvoiceBooks #OfficeSupplies #ReceiptBooks #FinancialRecords #SmallBusinessTools #AccountingEssentials #ProfessionalInvoices #RecordKeeping #businessgrowth

04:40 AM - Feb 20, 2025 (UTC)

Sponsored by

OWT

6 months ago

Global Tax Management Market: An Escalating Sector with Projected Growth to Reach USD 53.70 Billion By 2030 | 10% CAGR

Global Tax Management Market Size Was Valued at USD 25.05 Billion In 2022 And Is Projected to Reach USD 53.70 Billion By 2030, Growing at A CAGR of 10% From 2023 To 2030.

Tax management refers to the administration of funds and assets for tax payment. The primary objective of tax administration is to comply with income tax rules and regulations. Similarly, it includes the deduction of taxes at the source, the auditing of accounts, the timely filing of tax returns, etc. Increasing demand for tax recordkeeping solutions is expected to be a key factor driving revenue growth in the global tax management market over the forecast period. Record keeping is a crucial strategy for most businesses when it comes to storing essential tax documents, and tax software can facilitate this process.

Using cloud-based tax software, businesses can store tax information from prior years in a secure manner on cloud storage. Using such a solution, businesses can gain immediate access to the essential tax information for any fiscal year.

Top Key Players Covered in The Tax Management Market

Thomson Reuters (Canada), Intuit (US),H&R Block (US), Avalara (US), Wolters Kluwer NV (Netherlands), Automatic Data Processing (US), TaxSlayer (US), Taxback International (Ireland), TaxCloud (US), Drake Enterprises (US), Canopy Tax (US), TaxJar (US), Webgility (US), LOVAT Software (UK), SafeSend (US), EXEMPTAX (US), Sales Tax DataLINK (US), Shoeboxed (US), SAXTAX (US), and Other Major Players.

To Understand Business Strategies, Request For a Sample Report @

https://introspectivemarke...

Global Tax Management Market Size Was Valued at USD 25.05 Billion In 2022 And Is Projected to Reach USD 53.70 Billion By 2030, Growing at A CAGR of 10% From 2023 To 2030.

Tax management refers to the administration of funds and assets for tax payment. The primary objective of tax administration is to comply with income tax rules and regulations. Similarly, it includes the deduction of taxes at the source, the auditing of accounts, the timely filing of tax returns, etc. Increasing demand for tax recordkeeping solutions is expected to be a key factor driving revenue growth in the global tax management market over the forecast period. Record keeping is a crucial strategy for most businesses when it comes to storing essential tax documents, and tax software can facilitate this process.

Using cloud-based tax software, businesses can store tax information from prior years in a secure manner on cloud storage. Using such a solution, businesses can gain immediate access to the essential tax information for any fiscal year.

Top Key Players Covered in The Tax Management Market

Thomson Reuters (Canada), Intuit (US),H&R Block (US), Avalara (US), Wolters Kluwer NV (Netherlands), Automatic Data Processing (US), TaxSlayer (US), Taxback International (Ireland), TaxCloud (US), Drake Enterprises (US), Canopy Tax (US), TaxJar (US), Webgility (US), LOVAT Software (UK), SafeSend (US), EXEMPTAX (US), Sales Tax DataLINK (US), Shoeboxed (US), SAXTAX (US), and Other Major Players.

To Understand Business Strategies, Request For a Sample Report @

https://introspectivemarke...

11:54 AM - Apr 29, 2024 (UTC)

Electronic Lab Notebook Market Is Anticipated to Witness High Growth Owing to Digital Transformation

Electronic Lab Notebooks (ELNs) are advanced software solutions designed to replace traditional paper-based recordkeeping in scientific research and laboratory environments. By offering cloud-based and on-premise platforms, these digital tools enhance data capture, facilitate seamless collaboration, and ensure regulatory compliance across multiple industry segments such as pharmaceuticals, biotechnology, academia, and chemical research. Key features include real-time data sharing, customizable templates, audit trails, and integrated analytics, allowing research teams to streamline workflows, reduce errors, and accelerate time-to-market for new products.

Get More Insights - Electronic Lab Notebook Market

https://www.patreon.com/po...

#ElectronicLabNotebook #ELNMarketTrends #CloudBasedLabSoftware #PharmaceuticalRnDTools #CoherentMarketInsights

Electronic Lab Notebooks (ELNs) are advanced software solutions designed to replace traditional paper-based recordkeeping in scientific research and laboratory environments. By offering cloud-based and on-premise platforms, these digital tools enhance data capture, facilitate seamless collaboration, and ensure regulatory compliance across multiple industry segments such as pharmaceuticals, biotechnology, academia, and chemical research. Key features include real-time data sharing, customizable templates, audit trails, and integrated analytics, allowing research teams to streamline workflows, reduce errors, and accelerate time-to-market for new products.

Get More Insights - Electronic Lab Notebook Market

https://www.patreon.com/po...

#ElectronicLabNotebook #ELNMarketTrends #CloudBasedLabSoftware #PharmaceuticalRnDTools #CoherentMarketInsights

11:44 AM - May 12, 2025 (UTC)

Global Tax Management Market: An Escalating Sector with Projected Growth to Reach USD 53.70 Billion By 2030 | 10% CAGR

Global Tax Management Market Size Was Valued at USD 25.05 Billion In 2022 And Is Projected to Reach USD 53.70 Billion By 2030, Growing at A CAGR of 10% From 2023 To 2030.

Tax management refers to the administration of funds and assets for tax payment. The primary objective of tax administration is to comply with income tax rules and regulations. Similarly, it includes the deduction of taxes at the source, the auditing of accounts, the timely filing of tax returns, etc. Increasing demand for tax recordkeeping solutions is expected to be a key factor driving revenue growth in the global tax management market over the forecast period. Record keeping is a crucial strategy for most businesses when it comes to storing essential tax documents, and tax software can facilitate this process.

Using cloud-based tax software, businesses can store tax information from prior years in a secure manner on cloud storage. Using such a solution, businesses can gain immediate access to the essential tax information for any fiscal year.

Top Key Players Covered in The Tax Management Market

Thomson Reuters (Canada), Intuit (US),H&R Block (US), Avalara (US), Wolters Kluwer NV (Netherlands), Automatic Data Processing (US), TaxSlayer (US), Taxback International (Ireland), TaxCloud (US), Drake Enterprises (US), Canopy Tax (US), TaxJar (US), Webgility (US), LOVAT Software (UK), SafeSend (US), EXEMPTAX (US), Sales Tax DataLINK (US), Shoeboxed (US), SAXTAX (US), and Other Major Players.

To Understand Business Strategies, Request For a Sample Report @

https://introspectivemarke...

Global Tax Management Market Size Was Valued at USD 25.05 Billion In 2022 And Is Projected to Reach USD 53.70 Billion By 2030, Growing at A CAGR of 10% From 2023 To 2030.

Tax management refers to the administration of funds and assets for tax payment. The primary objective of tax administration is to comply with income tax rules and regulations. Similarly, it includes the deduction of taxes at the source, the auditing of accounts, the timely filing of tax returns, etc. Increasing demand for tax recordkeeping solutions is expected to be a key factor driving revenue growth in the global tax management market over the forecast period. Record keeping is a crucial strategy for most businesses when it comes to storing essential tax documents, and tax software can facilitate this process.

Using cloud-based tax software, businesses can store tax information from prior years in a secure manner on cloud storage. Using such a solution, businesses can gain immediate access to the essential tax information for any fiscal year.

Top Key Players Covered in The Tax Management Market

Thomson Reuters (Canada), Intuit (US),H&R Block (US), Avalara (US), Wolters Kluwer NV (Netherlands), Automatic Data Processing (US), TaxSlayer (US), Taxback International (Ireland), TaxCloud (US), Drake Enterprises (US), Canopy Tax (US), TaxJar (US), Webgility (US), LOVAT Software (UK), SafeSend (US), EXEMPTAX (US), Sales Tax DataLINK (US), Shoeboxed (US), SAXTAX (US), and Other Major Players.

To Understand Business Strategies, Request For a Sample Report @

https://introspectivemarke...

Request Sample| IMR

We Introspective Market Research holds expertise in providing latest, authentic and reliable research reports across all the business verticals.

https://introspectivemarketresearch.com/request/16590

11:55 AM - Feb 05, 2024 (UTC)