Read this - https://thegeneralpost.com...

Read this blog to learn more - https://blogrism.com/nbfc-...

Why NBFC Loan Software is Essential for NBFCs? - blogrism.com

Automating this aspect of workflow helps save time and the precious energies of your workforce. With the right NBFC loan software.

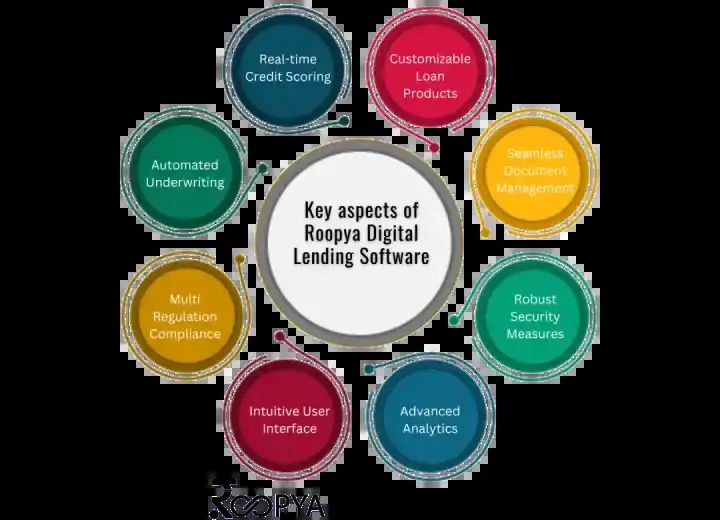

https://blogrism.com/nbfc-loan-software/Roopya provides the best digital lending platform for NBFC in India. Our complete platform automates the lending process and includes features such as real-time credit score, customisable loan packages, and high security. Roopya maintains compliance with Indian regulations and offers a user-friendly interface for its smooth operation. Increase your lending services with advanced analytics as well as effective document management. Choose Roopya for secure safe and effective digital financing in India. Start today!

Visit - https://roopya.money/best-...

The non-banking financial sector today needs the best software solutions to achieve operational excellence and efficiency, and deliver improved customer experiences. Additionally, technological adoption is a topmost priority today for NBFCs. That’s because the landscape is so evolving so competitively that manual processes and semi-automated solutions can no longer help NBFCs survive or sustain anymore. Choosing the best digital lending platform for NBFC is crucial and here are the things to consider when selecting the right one for your operations.

Read - https://pencraftednews.com...

6 Top Features of the Best digital lending platform for NBFC - PenCraftedNews

Choosing the best digital lending platform for NBFC is crucial and here are the things to consider when selecting the right one for your operations.

https://pencraftednews.com/best-digital-lending-platform-for-nbfc/Go through this link to learn more details. - @roopya .money/understanding-the-gamut-of-nbfc-lending-solutions-028a24052fe5" target="_blank" class="inline-link">https://medium.com/ @roopya ...

Understanding the Gamut of NBFC Lending Solutions | by Roopya | May, 2024 | Medium

As per ResearchAndMarkets.com, between 2021 and 2026, the sector for non-banking financial corporation (NBFCs) is expected to grow at a CAGR of 18.5%. The Reserve Bank of India (RBI) registered…

https://medium.com/@roopya.money/understanding-the-gamut-of-nbfc-lending-solutions-028a24052fe5NBFCs in the country now have access to equip themselves with the latest technologies and software solutions to improve their services and products. NBFC loan software is one such solution that can improve the workflows in NBFCs, improve their productivities, and respond better to loan requests. Not just this, the right software solution can help reduce costs and overheads, overcome operational loopholes, reduce human biases and redtapism, along with improving customer experiences. Go through this link to learn more details.

Read this blog - https://factofit.com/nbfc-...

The Urgent Need For NBFC Loan Software | FACTOFIT

NBFC loan software is one such solution that can improve the workflows in NBFCs, improve their productivities, and respond better to loan requests.

https://factofit.com/nbfc-loan-software/If you are searching NBFC loan software in India, then you are at the right place. Now you can search Roopya. Roopya's NBFC loan software and experience frictionless loan management. Automate workflows, enhance customer experience, and achieve operational excellence. Don't wait! Schedule a free demo of Roopya's NBFC loan software today and experience the future of loan management.

Visit - https://roopya.money/digit...