Debt Help in Canada: Effective Solutions for Your Financial Challenges

Navigating financial challenges can be overwhelming, especially when debts start to accumulate and become difficult to manage. Whether you are dealing with credit card debt, personal loans, or other financial obligations, seeking debt help in Canada can provide you with the support and guidance needed to regain control of your finances. In Canada, a range of options is available to help individuals find solutions to their debt issues and pave the way for financial recovery.

https://flywiththought.com...

Navigating financial challenges can be overwhelming, especially when debts start to accumulate and become difficult to manage. Whether you are dealing with credit card debt, personal loans, or other financial obligations, seeking debt help in Canada can provide you with the support and guidance needed to regain control of your finances. In Canada, a range of options is available to help individuals find solutions to their debt issues and pave the way for financial recovery.

https://flywiththought.com...

04:46 AM - Feb 21, 2025 (UTC)

How Debt Settlement Affects Your Credit Score: What You Need to Know

Debt settlement can be an effective way to manage overwhelming financial obligations, but it also comes with significant consequences, particularly for your credit score.

https://www.bondhuplus.com...

Debt settlement can be an effective way to manage overwhelming financial obligations, but it also comes with significant consequences, particularly for your credit score.

https://www.bondhuplus.com...

09:18 AM - Feb 18, 2025 (UTC)

Navigate Financial Challenges with Expert Guidance from Bankruptcy Canada

If you're struggling with overwhelming debt, Bankruptcy Canada provides trusted solutions to help you regain financial stability. Bankruptcy can feel daunting, but it offers a fresh start by eliminating unmanageable debt and stopping creditor harassment. At Bankruptcy Canada, our licensed insolvency trustees guide you through every step, ensuring you understand your options. Whether you’re considering bankruptcy, a consumer proposal, or alternative debt relief solutions, we provide tailored advice to help you make informed decisions.

https://bankruptcycanada.c...

If you're struggling with overwhelming debt, Bankruptcy Canada provides trusted solutions to help you regain financial stability. Bankruptcy can feel daunting, but it offers a fresh start by eliminating unmanageable debt and stopping creditor harassment. At Bankruptcy Canada, our licensed insolvency trustees guide you through every step, ensuring you understand your options. Whether you’re considering bankruptcy, a consumer proposal, or alternative debt relief solutions, we provide tailored advice to help you make informed decisions.

https://bankruptcycanada.c...

05:39 AM - Feb 18, 2025 (UTC)

Debt Consolidation in Canada: Get Back on Track with Your Finances

Managing multiple debts can be overwhelming, especially when it feels like payments are piling up, interest rates are high, and staying organized becomes increasingly difficult. For many Canadians, the idea of consolidating their debts into one manageable payment is an attractive solution. Debt consolidation in Canada offers a way to simplify your financial situation, reduce stress, and take control of your finances again. In this article, we will explore what debt consolidation is, how it works, and why it may be the right step for your financial recovery.

https://bankruptcy.hashnod...

Managing multiple debts can be overwhelming, especially when it feels like payments are piling up, interest rates are high, and staying organized becomes increasingly difficult. For many Canadians, the idea of consolidating their debts into one manageable payment is an attractive solution. Debt consolidation in Canada offers a way to simplify your financial situation, reduce stress, and take control of your finances again. In this article, we will explore what debt consolidation is, how it works, and why it may be the right step for your financial recovery.

https://bankruptcy.hashnod...

09:06 AM - Feb 07, 2025 (UTC)

Canada Debt Help Programs vs. DIY Budgeting: Which Works Best for Your Financial Recovery?

Managing debt can feel overwhelming, especially when it starts to affect your daily life and future plans. Whether you’re dealing with credit card balances, loans, or unexpected expenses, finding a way to regain control is essential. In Canada, there are two primary approaches to tackling debt: enrolling in Canada debt help programs or creating a DIY budgeting plan. Each method has its strengths and challenges, so let’s explore which option might be best for your financial recovery.

https://guard1analert.com/...

Managing debt can feel overwhelming, especially when it starts to affect your daily life and future plans. Whether you’re dealing with credit card balances, loans, or unexpected expenses, finding a way to regain control is essential. In Canada, there are two primary approaches to tackling debt: enrolling in Canada debt help programs or creating a DIY budgeting plan. Each method has its strengths and challenges, so let’s explore which option might be best for your financial recovery.

https://guard1analert.com/...

06:47 AM - Jan 27, 2025 (UTC)

Creating a Custom Debt Management Plan: Tips for Tailoring It to Your Lifestyle

Managing debt can feel overwhelming, but with the right approach, you can regain control of your finances. A debt management plan (DMP) is a powerful tool that helps you pay off your debts in a structured way, often with lower interest rates and more manageable monthly payments. However, for a debt management plan to work effectively, it needs to be tailored to your lifestyle and financial situation. https://sites.google.com/v...

Managing debt can feel overwhelming, but with the right approach, you can regain control of your finances. A debt management plan (DMP) is a powerful tool that helps you pay off your debts in a structured way, often with lower interest rates and more manageable monthly payments. However, for a debt management plan to work effectively, it needs to be tailored to your lifestyle and financial situation. https://sites.google.com/v...

08:42 AM - Jan 24, 2025 (UTC)

How Debt Consolidation Can Help Canadians Rebuild Financial Stability

We all strive for financial stability, but sometimes, it can feel like an elusive goal, especially when debt piles up. Managing multiple debts can overwhelm many Canadians, increasing stress and financial uncertainty. If you’re stuck in a cycle of high-interest loans and multiple monthly payments, debt consolidation in Canada could be a viable solution to help you regain control of your financial future.

https://forbespromagazine....

We all strive for financial stability, but sometimes, it can feel like an elusive goal, especially when debt piles up. Managing multiple debts can overwhelm many Canadians, increasing stress and financial uncertainty. If you’re stuck in a cycle of high-interest loans and multiple monthly payments, debt consolidation in Canada could be a viable solution to help you regain control of your financial future.

https://forbespromagazine....

01:17 PM - Jan 09, 2025 (UTC)

Licensed Insolvency Trustee: Expert Guidance for Financial Relief

A licensed insolvency trustee is a government-appointed expert who can provide invaluable help when dealing with severe financial troubles. If you're facing bankruptcy or looking for alternatives like debt consolidation, an insolvency trustee will guide you through the entire process. By offering professional advice and managing your case, they ensure you're making informed decisions. Whether you're struggling with overwhelming debt or need help navigating the complexities of insolvency, a licensed insolvency trustee can offer the support and expertise necessary to get your financial situation back on track.

https://bankruptcycanada.c...

A licensed insolvency trustee is a government-appointed expert who can provide invaluable help when dealing with severe financial troubles. If you're facing bankruptcy or looking for alternatives like debt consolidation, an insolvency trustee will guide you through the entire process. By offering professional advice and managing your case, they ensure you're making informed decisions. Whether you're struggling with overwhelming debt or need help navigating the complexities of insolvency, a licensed insolvency trustee can offer the support and expertise necessary to get your financial situation back on track.

https://bankruptcycanada.c...

09:08 AM - Jan 08, 2025 (UTC)

What is Bankruptcy and How Can It Help You Start Fresh?

Bankruptcy is a legal process that provides individuals and businesses with a structured way to eliminate or repay overwhelming debt. It’s often misunderstood, but for those struggling financially, bankruptcy can offer a much-needed fresh start. Understanding what is bankruptcy and how it works is essential to determine if it’s the right option for your financial situation.

https://www.diveboard.com/...

Bankruptcy is a legal process that provides individuals and businesses with a structured way to eliminate or repay overwhelming debt. It’s often misunderstood, but for those struggling financially, bankruptcy can offer a much-needed fresh start. Understanding what is bankruptcy and how it works is essential to determine if it’s the right option for your financial situation.

https://www.diveboard.com/...

09:49 AM - Dec 27, 2024 (UTC)

Understanding Consumer Proposals in Calgary: A Comprehensive Guide to Debt Relief

Financial struggles can be overwhelming, and many individuals in Calgary find themselves dealing with the stress of mounting debt. When debt becomes unmanageable, it’s crucial to explore options that can offer relief. One such option is a consumer proposal in Calgary. This legal process allows individuals to address their debts in a manageable way, avoiding bankruptcy while still finding a solution to their financial problems. In this comprehensive guide, we’ll dive into what a consumer proposal is, how it works, and how it can help you regain control of your financial future.

https://beforeitbusiness.c...

Financial struggles can be overwhelming, and many individuals in Calgary find themselves dealing with the stress of mounting debt. When debt becomes unmanageable, it’s crucial to explore options that can offer relief. One such option is a consumer proposal in Calgary. This legal process allows individuals to address their debts in a manageable way, avoiding bankruptcy while still finding a solution to their financial problems. In this comprehensive guide, we’ll dive into what a consumer proposal is, how it works, and how it can help you regain control of your financial future.

https://beforeitbusiness.c...

09:22 AM - Dec 27, 2024 (UTC)

Sponsored by

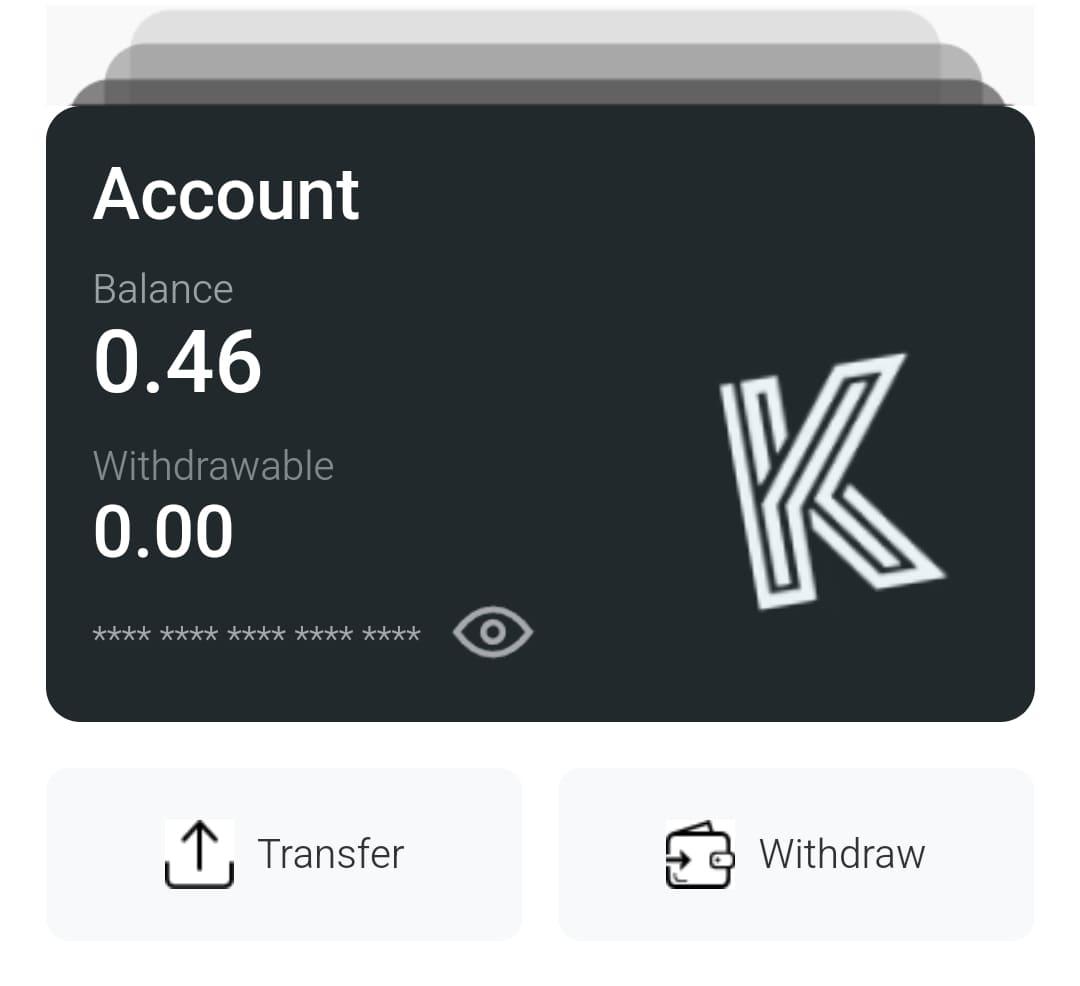

KIVA Network

9 days ago

Kiva Network Mining Project & Get Rewards $KIVA

#Sing-Up Link: https://kivanet.com/regist...

*Register With Email

*Submit Code: YXDNO3

*Send To Email: Verify me to [email protected]

--Login Here: https://app.kivanet.com

|---Click K logo to Start Mining

|---Click Notification Icon

|---Complete Task to Increase Mining Reward

|---Done

⚠️Note: 20% of total supply for mining Kiva has its own blockchain