Crypto pinned this post

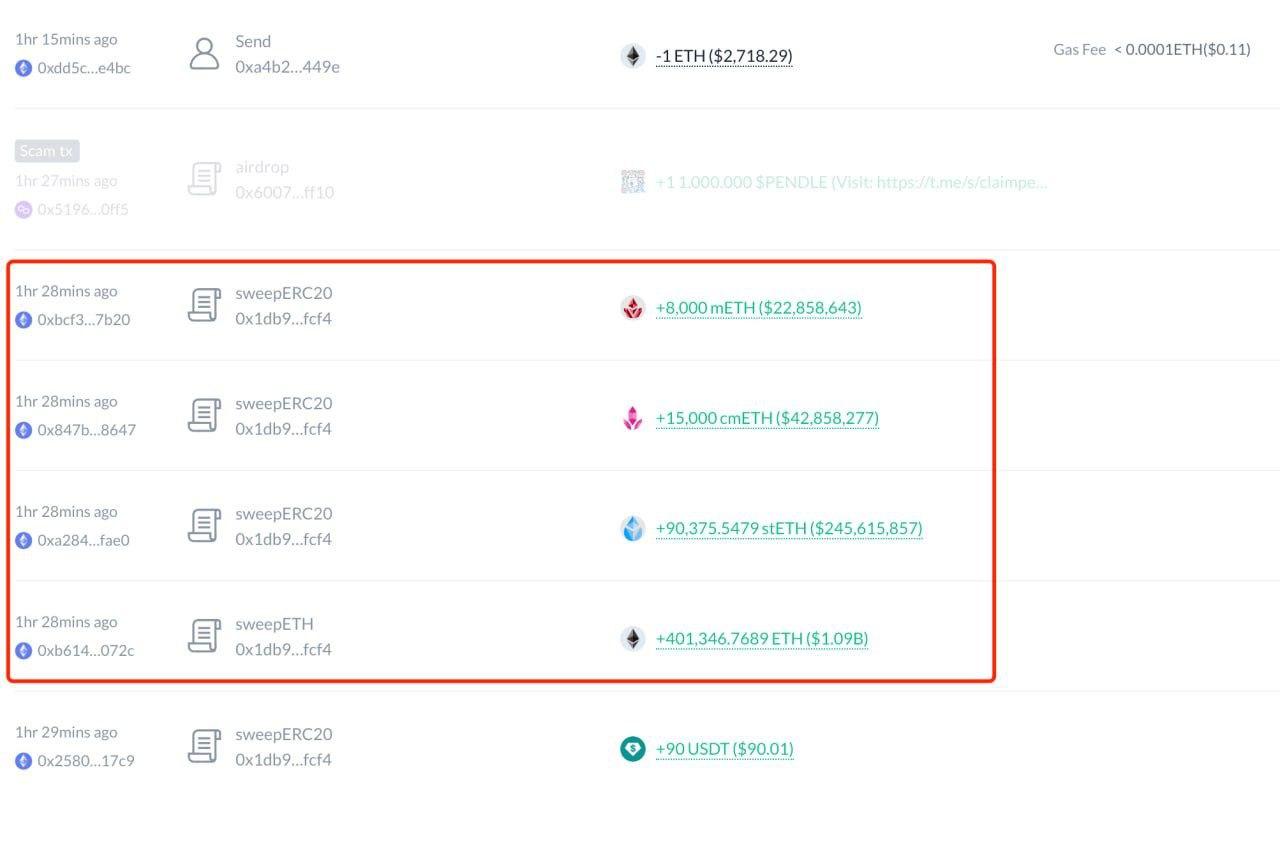

📈 According to zachxbt, Bybit was hacked with $1.4B worth of $ETH, $stETH, $cmETH and $mETH outflow from #bybit .

The hacker is exchanging $stETH, $cmETH and $mETH for $ETH. 😬

Address:

0x47666fab8bd0ac7003bce3f5c3585383f09486e2

0xa4b2fd68593b6f34e51cb9edb66e71c1b4ab449e

0xdd90071d52f20e85c89802e5dc1ec0a7b6475f92

The hacker is exchanging $stETH, $cmETH and $mETH for $ETH. 😬

Address:

0x47666fab8bd0ac7003bce3f5c3585383f09486e2

0xa4b2fd68593b6f34e51cb9edb66e71c1b4ab449e

0xdd90071d52f20e85c89802e5dc1ec0a7b6475f92

04:13 AM - Feb 22, 2025 (UTC)

Look at this face. It doesn't seek glory, doesn't expect praise.

His name is Donald.

Every day, for a month now, he gets up early in the morning to support the workers. He feeds everyone: Solana Flippers, SNG Abusers and even NFT Holders! His hands never get tired, his heart is full of care for ordinary people. He doesn't dream of awards, he just does his job - with love, dedication and incredible persistence.

So let's just say thank you to him!

Thank you, Donald, for your work and for not letting us go hungry. You are a real hero. 🍔❤️

His name is Donald.

Every day, for a month now, he gets up early in the morning to support the workers. He feeds everyone: Solana Flippers, SNG Abusers and even NFT Holders! His hands never get tired, his heart is full of care for ordinary people. He doesn't dream of awards, he just does his job - with love, dedication and incredible persistence.

So let's just say thank you to him!

Thank you, Donald, for your work and for not letting us go hungry. You are a real hero. 🍔❤️

06:21 AM - Dec 12, 2024 (UTC)

Capo now provides proper analysis. Now with proper analysis, you will make a little profit and win followers and trust. Then give bamboo again. This is how they manipulate.

In fact, they are very good traders. Jim Cramer also knows very good analysis. But why do they do this? The answer is simple, if everyone buys, then who will sell? Who will they buy and sell to? Capo's total followers are 1 lakh 90 thousand.

So these accounts are very harmful for newbies. They themselves are profiting in secret, but they will never let you profit. So I don't share these channels either.

In fact, they are very good traders. Jim Cramer also knows very good analysis. But why do they do this? The answer is simple, if everyone buys, then who will sell? Who will they buy and sell to? Capo's total followers are 1 lakh 90 thousand.

So these accounts are very harmful for newbies. They themselves are profiting in secret, but they will never let you profit. So I don't share these channels either.

05:14 AM - Dec 12, 2024 (UTC)

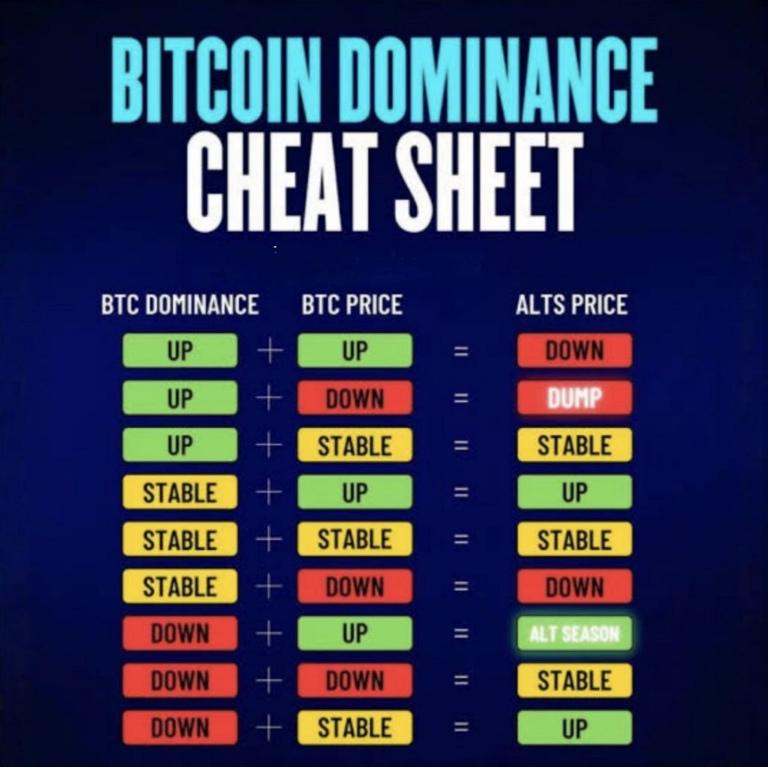

"Bitcoin Dominance Cheat Sheet" that visually explains how Bitcoin's dominance and price changes impact altcoin prices. Here’s a breakdown of the combinations:

BTC Dominance Up + BTC Price Up = Altcoin Price Down

BTC Dominance Up + BTC Price Down = Altcoin Price Dump

BTC Dominance Up + BTC Price Stable = Altcoin Price Stable

BTC Dominance Stable + BTC Price Up = Altcoin Price Up

BTC Dominance Stable + BTC Price Stable = Altcoin Price Stable

BTC Dominance Stable + BTC Price Down = Altcoin Price Down

BTC Dominance Down + BTC Price Up = Altseason (Altcoins rise significantly)

BTC Dominance Down + BTC Price Down = Altcoin Price Stable

BTC Dominance Down + BTC Price Stable = Altcoin Price Up

This chart helps traders predict the behavior of altcoins (alternative cryptocurrencies) based on Bitcoin's market trends.

BTC Dominance Up + BTC Price Up = Altcoin Price Down

BTC Dominance Up + BTC Price Down = Altcoin Price Dump

BTC Dominance Up + BTC Price Stable = Altcoin Price Stable

BTC Dominance Stable + BTC Price Up = Altcoin Price Up

BTC Dominance Stable + BTC Price Stable = Altcoin Price Stable

BTC Dominance Stable + BTC Price Down = Altcoin Price Down

BTC Dominance Down + BTC Price Up = Altseason (Altcoins rise significantly)

BTC Dominance Down + BTC Price Down = Altcoin Price Stable

BTC Dominance Down + BTC Price Stable = Altcoin Price Up

This chart helps traders predict the behavior of altcoins (alternative cryptocurrencies) based on Bitcoin's market trends.

03:02 PM - Oct 16, 2024 (UTC)

(E)

⚡️ To succeed in crypto trading, it's essential to have knowledge of some key concepts and strategies. Here are some important points:

✔️1. Gaining Basic Knowledge:

Understanding Blockchain and Cryptocurrency: It's crucial to grasp the fundamental idea of blockchain technology and how it works. Similarly, understanding the nature of different cryptocurrencies (like Bitcoin, Ethereum) and their differences is important.

Market Operations: The crypto market is not like the traditional markets. Prices can fluctuate suddenly. Knowing the market's movement and the characteristics of cryptocurrencies is necessary.

✔️2. Technical Analysis:

Reading Charts and Graphs: You need to be familiar with tools like candlesticks, trendlines, support and resistance levels, and moving averages.

Using Indicators: Applying indicators like RSI, MACD, Bollinger Bands, and Fibonacci Retracement correctly can help make better trading decisions.

✔️3. Fundamental Analysis:

Understanding the Project: You need to have a clear understanding of the project you are investing in. It's important to know the project's team, goals, roadmap, and technical capabilities.

Supply and Demand in the Market: The value of a cryptocurrency also depends on its supply and demand. This data needs to be analyzed properly.

✔️4. Risk Management:

Stop Loss and Profit Targets: When starting a trade, it's important to set your stop loss and profit target. This helps limit potential losses.

Portfolio Diversification: Instead of putting all your capital in one place, it's wise to invest in various projects.

✔️5. Following Market Sentiment and News:

The movement of the cryptocurrency market is often influenced by market sentiment. Various international news and events (like major regulatory updates or technological advancements) can affect the market. Therefore, staying updated with news is essential.

✔️6. Using Trading Platforms and Tools:

Knowledge of various trading platforms (like Binance, Coinbase, Kraken) and their tools is necessary. You should also understand the features, fees, and security aspects of these platforms.

✔️7. Mental Preparation and Patience:

Crypto trading can often be emotional. If you can't control your emotions, the chances of losses are higher. It's important to be patient and avoid indecision.

✔️8. Developing a Trading Strategy:

Decide whether you want to invest long-term or trade short-term, and create your strategy accordingly. Day trading, swing trading, or position trading—each has its own tactics and timeframes.

‼️ Mastering these aspects can significantly increase your chances of success in #crypto trading.

#cryptotrading

✔️1. Gaining Basic Knowledge:

Understanding Blockchain and Cryptocurrency: It's crucial to grasp the fundamental idea of blockchain technology and how it works. Similarly, understanding the nature of different cryptocurrencies (like Bitcoin, Ethereum) and their differences is important.

Market Operations: The crypto market is not like the traditional markets. Prices can fluctuate suddenly. Knowing the market's movement and the characteristics of cryptocurrencies is necessary.

✔️2. Technical Analysis:

Reading Charts and Graphs: You need to be familiar with tools like candlesticks, trendlines, support and resistance levels, and moving averages.

Using Indicators: Applying indicators like RSI, MACD, Bollinger Bands, and Fibonacci Retracement correctly can help make better trading decisions.

✔️3. Fundamental Analysis:

Understanding the Project: You need to have a clear understanding of the project you are investing in. It's important to know the project's team, goals, roadmap, and technical capabilities.

Supply and Demand in the Market: The value of a cryptocurrency also depends on its supply and demand. This data needs to be analyzed properly.

✔️4. Risk Management:

Stop Loss and Profit Targets: When starting a trade, it's important to set your stop loss and profit target. This helps limit potential losses.

Portfolio Diversification: Instead of putting all your capital in one place, it's wise to invest in various projects.

✔️5. Following Market Sentiment and News:

The movement of the cryptocurrency market is often influenced by market sentiment. Various international news and events (like major regulatory updates or technological advancements) can affect the market. Therefore, staying updated with news is essential.

✔️6. Using Trading Platforms and Tools:

Knowledge of various trading platforms (like Binance, Coinbase, Kraken) and their tools is necessary. You should also understand the features, fees, and security aspects of these platforms.

✔️7. Mental Preparation and Patience:

Crypto trading can often be emotional. If you can't control your emotions, the chances of losses are higher. It's important to be patient and avoid indecision.

✔️8. Developing a Trading Strategy:

Decide whether you want to invest long-term or trade short-term, and create your strategy accordingly. Day trading, swing trading, or position trading—each has its own tactics and timeframes.

‼️ Mastering these aspects can significantly increase your chances of success in #crypto trading.

#cryptotrading

11:48 AM - Oct 09, 2024 (UTC)

Spot trade is a trading method where an asset (such as cryptocurrency, stocks, or forex) is bought or sold immediately, and the delivery of the asset happens right after the transaction is completed. In this type of trading, the asset is traded at the current market price, and the transaction is usually settled within two business days.

Characteristics of Spot Trade:

- Immediate Transaction: The buying or selling is completed instantly, meaning it doesn't occur on a specified future date but rather immediately.

- Market Price: In spot trading, there is no pre-determined price; the transaction occurs at the current market price.

- Quick Delivery: After the trade, the asset is directly transferred to the buyer, like in cryptocurrency trading, where the coins are sent to the buyer’s wallet.

Through spot trading, traders have the advantage of quickly buying and selling their assets without getting involved in the complexities of long-term contracts or futures contracts.

Characteristics of Spot Trade:

- Immediate Transaction: The buying or selling is completed instantly, meaning it doesn't occur on a specified future date but rather immediately.

- Market Price: In spot trading, there is no pre-determined price; the transaction occurs at the current market price.

- Quick Delivery: After the trade, the asset is directly transferred to the buyer, like in cryptocurrency trading, where the coins are sent to the buyer’s wallet.

Through spot trading, traders have the advantage of quickly buying and selling their assets without getting involved in the complexities of long-term contracts or futures contracts.

06:18 AM - Oct 08, 2024 (UTC)

The crypto market community is important because it serves as a driving force for the success of a cryptocurrency project. Here are a few reasons why the crypto market community is so crucial:

- Trust and Credibility: A community helps build investors' trust in a project. If there is an active and supportive community behind a project, it enhances the project's credibility, which attracts new users and investors.

- Investor Engagement: The community helps keep investors regularly informed about the project's updates, decisions, and developments. This creates a direct connection between investors and the project’s progress.

- Marketing and Promotion: Active community members spread positive messages about the project's success and future, often creating a strong marketing push for free.

- Contribution to Development: Community members can provide valuable feedback and suggestions for improving the project, opening new opportunities and helping solve problems for developers.

- Liquidity and Trading: An active community helps maintain regular trading activity, increasing liquidity in the market and keeping trading volumes stable.

- Support and Education: Crypto communities provide support and education for new investors. In community forums or on social media, new users can ask questions, find solutions to issues, and learn from experienced members.

Altogether, a strong crypto community is essential for ensuring the sustainability and growth of a project.

- Trust and Credibility: A community helps build investors' trust in a project. If there is an active and supportive community behind a project, it enhances the project's credibility, which attracts new users and investors.

- Investor Engagement: The community helps keep investors regularly informed about the project's updates, decisions, and developments. This creates a direct connection between investors and the project’s progress.

- Marketing and Promotion: Active community members spread positive messages about the project's success and future, often creating a strong marketing push for free.

- Contribution to Development: Community members can provide valuable feedback and suggestions for improving the project, opening new opportunities and helping solve problems for developers.

- Liquidity and Trading: An active community helps maintain regular trading activity, increasing liquidity in the market and keeping trading volumes stable.

- Support and Education: Crypto communities provide support and education for new investors. In community forums or on social media, new users can ask questions, find solutions to issues, and learn from experienced members.

Altogether, a strong crypto community is essential for ensuring the sustainability and growth of a project.

06:06 AM - Oct 08, 2024 (UTC)

The primary difference between market cap and fully diluted market cap lies in the method of determining the total value of a cryptocurrency or stock.

Market Cap (Market Capitalization):

This represents the total value of the currently circulating coins or shares in the market. Market capitalization is calculated by multiplying the number of circulating coins or shares by the current market price. Calculation method: Market Cap = Number of circulating coins/shares × Current price.

Fully Diluted Market Cap:

This refers to the total value of a cryptocurrency or stock when all possible coins or shares are in circulation. It includes not only the currently circulating coins but also the future maximum supply of all coins/shares. Calculation method: Fully Diluted Market Cap = Total maximum supply (future max supply) × Current price.

Example: If a #Cryptocurrency has 1 million coins currently in circulation and the price is $5, the market cap would be $5,000,000. However, if the maximum supply is 2 million coins, the fully diluted market cap would be $10,000,000.

Market Cap (Market Capitalization):

This represents the total value of the currently circulating coins or shares in the market. Market capitalization is calculated by multiplying the number of circulating coins or shares by the current market price. Calculation method: Market Cap = Number of circulating coins/shares × Current price.

Fully Diluted Market Cap:

This refers to the total value of a cryptocurrency or stock when all possible coins or shares are in circulation. It includes not only the currently circulating coins but also the future maximum supply of all coins/shares. Calculation method: Fully Diluted Market Cap = Total maximum supply (future max supply) × Current price.

Example: If a #Cryptocurrency has 1 million coins currently in circulation and the price is $5, the market cap would be $5,000,000. However, if the maximum supply is 2 million coins, the fully diluted market cap would be $10,000,000.

05:56 AM - Oct 08, 2024 (UTC)

Chain explorers (or blockchain explorers) are specialized tools or websites used to view all the information related to a blockchain. Using them, users can search for specific blocks, transactions, wallet addresses, and other blockchain-related data. Blockchain explorers make the transaction records of a blockchain more accessible and transparent.

How chain explorers work:

- Transaction search: You can use a specific transaction ID (TxID) to find a transaction and view its detailed information, such as the number of coins sent, the recipient and sender's addresses, transaction fees, and block confirmations.

- Wallet address search: By entering a particular wallet address, you can view the transaction history from that address, the total balance, and the current amount of coins held in that address.

- Block details: You can see what information is contained within a specific block in the blockchain, such as the block number, block hash, the time it was mined, the number of transactions in the block, and details about the miner.

- Token or coin search: Information about a specific token or coin can be found, such as its latest transactions, total supply, and current price.

Examples:

- Etherscan: A popular explorer used for the Ethereum blockchain, providing information about Ethereum-based transactions and smart contracts.

- Blockchain Explorer: Used for the Bitcoin blockchain, allowing users to search for Bitcoin transactions, blocks, and addresses.

Using blockchain explorers, users can easily monitor blockchain activity and verify transactions, which helps maintain transparency and security within the blockchain network.

How chain explorers work:

- Transaction search: You can use a specific transaction ID (TxID) to find a transaction and view its detailed information, such as the number of coins sent, the recipient and sender's addresses, transaction fees, and block confirmations.

- Wallet address search: By entering a particular wallet address, you can view the transaction history from that address, the total balance, and the current amount of coins held in that address.

- Block details: You can see what information is contained within a specific block in the blockchain, such as the block number, block hash, the time it was mined, the number of transactions in the block, and details about the miner.

- Token or coin search: Information about a specific token or coin can be found, such as its latest transactions, total supply, and current price.

Examples:

- Etherscan: A popular explorer used for the Ethereum blockchain, providing information about Ethereum-based transactions and smart contracts.

- Blockchain Explorer: Used for the Bitcoin blockchain, allowing users to search for Bitcoin transactions, blocks, and addresses.

Using blockchain explorers, users can easily monitor blockchain activity and verify transactions, which helps maintain transparency and security within the blockchain network.

10:17 AM - Oct 07, 2024 (UTC)

Crypto Volume refers to the number of times a particular #Cryptocurrency has been traded within a specific period. It is typically represented as the trading data over 24hours. Volume is a crucial indicator as it helps to understand the market's activity and the level of investor interest.

Detailed Analysis of Crypto Volume:

1. Market Activity: If the volume of a cryptocurrency is high, it indicates that there is a large amount of trading, and investors are showing interest in that currency. On the contrary, if the volume is low, it suggests that trading activity is decreasing and market interest is waning.

2. Liquidity: #Volume indicates the liquidity of a cryptocurrency. High volume means there are enough buyers and sellers in the market, facilitating faster trades and bringing stability to price fluctuations. In a low-volume market, #prices can experience larger fluctuations due to fewer investors.

3. Price Trends: Volume is often linked with price trends. If the price of a cryptocurrency starts increasing along with its volume, it suggests that the price rise could be sustainable. Conversely, if the price rises without a corresponding increase in volume, it may indicate an impending decline.

4. Market Sentiment: Volume is a critical indicator of #market sentiment. When a large institution or a whale invests in a currency, the volume can rise rapidly, which can have a positive or negative impact on the market.

Why is Crypto Volume Important?

- Market Dynamics: When volume increases, it shows that there is significant market activity, which boosts investor confidence.

- Price Prediction: #Volume increases or decreases can often signal future trends in the market.

- Making Informed Decisions: In a high-volume market, investors can trade more easily, and prices are less likely to be impacted by individual trades.

Therefore, understanding #crypto #market volume is essential for making informed investment decisions and gaining a clearer insight into the market dynamics.

Detailed Analysis of Crypto Volume:

1. Market Activity: If the volume of a cryptocurrency is high, it indicates that there is a large amount of trading, and investors are showing interest in that currency. On the contrary, if the volume is low, it suggests that trading activity is decreasing and market interest is waning.

2. Liquidity: #Volume indicates the liquidity of a cryptocurrency. High volume means there are enough buyers and sellers in the market, facilitating faster trades and bringing stability to price fluctuations. In a low-volume market, #prices can experience larger fluctuations due to fewer investors.

3. Price Trends: Volume is often linked with price trends. If the price of a cryptocurrency starts increasing along with its volume, it suggests that the price rise could be sustainable. Conversely, if the price rises without a corresponding increase in volume, it may indicate an impending decline.

4. Market Sentiment: Volume is a critical indicator of #market sentiment. When a large institution or a whale invests in a currency, the volume can rise rapidly, which can have a positive or negative impact on the market.

Why is Crypto Volume Important?

- Market Dynamics: When volume increases, it shows that there is significant market activity, which boosts investor confidence.

- Price Prediction: #Volume increases or decreases can often signal future trends in the market.

- Making Informed Decisions: In a high-volume market, investors can trade more easily, and prices are less likely to be impacted by individual trades.

Therefore, understanding #crypto #market volume is essential for making informed investment decisions and gaining a clearer insight into the market dynamics.

06:10 AM - Oct 07, 2024 (UTC)

Sponsored by

OWT

7 months ago