@marialitinetsky " target="_blank" class="inline-link">https://www.dearbloggers.c...

Get expert insights on real estate with Maria Litinetsky. As a professional property manager, she provides effective solutions for property investments and rentals. Trust her to manage your real estate efficiently!

Subscribe to Unlock

For 1$ / Monthly

Why Migsun Lucknow Central Is Best For Commercial Investments In Lucknow? | Property in Lucknow

Lucknow appears at the top when it comes to Indian real estate investment hotspots. Known for its rich cultural legacy, this City of Nawabs is now making waves for its commercial real estate. Among the developments that catch the eye here, Migsun Lucknow Central stands out for investors who want to ..

https://propertiesinlucknow.in/why-migsun-lucknow-central-is-best-for-commercial-investments-in-lucknow/https://www.reportprime.co...

The Healthcare Security Systems market is witnessing robust growth driven by the increasing incidence of data breaches, rising investments in healthcare infrastructure, and stricter regulatory requirements for patient data protection. The integration of advanced technologies like AI and IoT in surveillance, and the growing need for physical and cybersecurity convergence in hospitals and clinics are shaping the industry.

The ever-changing healthcare system in the UAE, security, access, and operational control are not negotiable. It doesn't matter if it's installing an Full Height Turnstile Gate in Dubai, deploying a Tripod Turnstile Gate in Abu Dhabi, integrating a flap barrier turnstile in Sharjah, or implementing a swing barrier gate turnstile in Ajman , these systems are vital for the safety of hospitals and their performance.

Turnstile speed gates are much more than just physical barriers. They are intelligent infrastructure investments that improve security for staff and patients while helping to ensure compliance. They also improve the efficiency of hospital activities.

Tektronix Technology Systems

📧 Email: connecttektronixllc.ae

📱 Phone/WhatsApp: +971 50 814 4086 | +971 55 232 2390

📍 Office Address:

Office No.1E1, Hamarain Center 132,

Abu Baker Al Siddique Rd, Deira, Dubai – P.O. Box 85955

🌐 https://tektronixllc.ae/tu...

Step into a world where grandeur meets financial wisdom at Experion The Trillion. Nestled in a prime locale, this premium development offers a fusion of opulent living spaces and unmatched investment potential. From sophisticated architecture to cutting-edge amenities, every detail caters to refined tastes and modern lifestyles. Investors eye impressive returns thanks to the project’s strategic location and rising market demand. Whether you seek a dream home or a profitable asset, this is an address that promises both. Make a move towards an elevated lifestyle and secure your future with an investment destined to shine in the urban skyline.

https://realtyassistant.in...

Track the new IPO launch date of upcoming stock market listings in India with Finnpick. Get real-time updates on fresh IPOs, issue dates, and subscription timelines. Whether you're a seasoned investor or a beginner, Finnpick brings you the latest IPO calendar to help you plan your investments smartly. Visit finnpick for in-depth IPO insights and stay ahead in the market!

https://finnpick.com/

https://www.greencardfund....

Explore Green Card Fund's EB5 Regional Center Project offerings, which meet USCIS regulations and offer investors a secure path to permanent residency through structured investments and targeted employment area benefits.

#Eb5regionalcenterproject

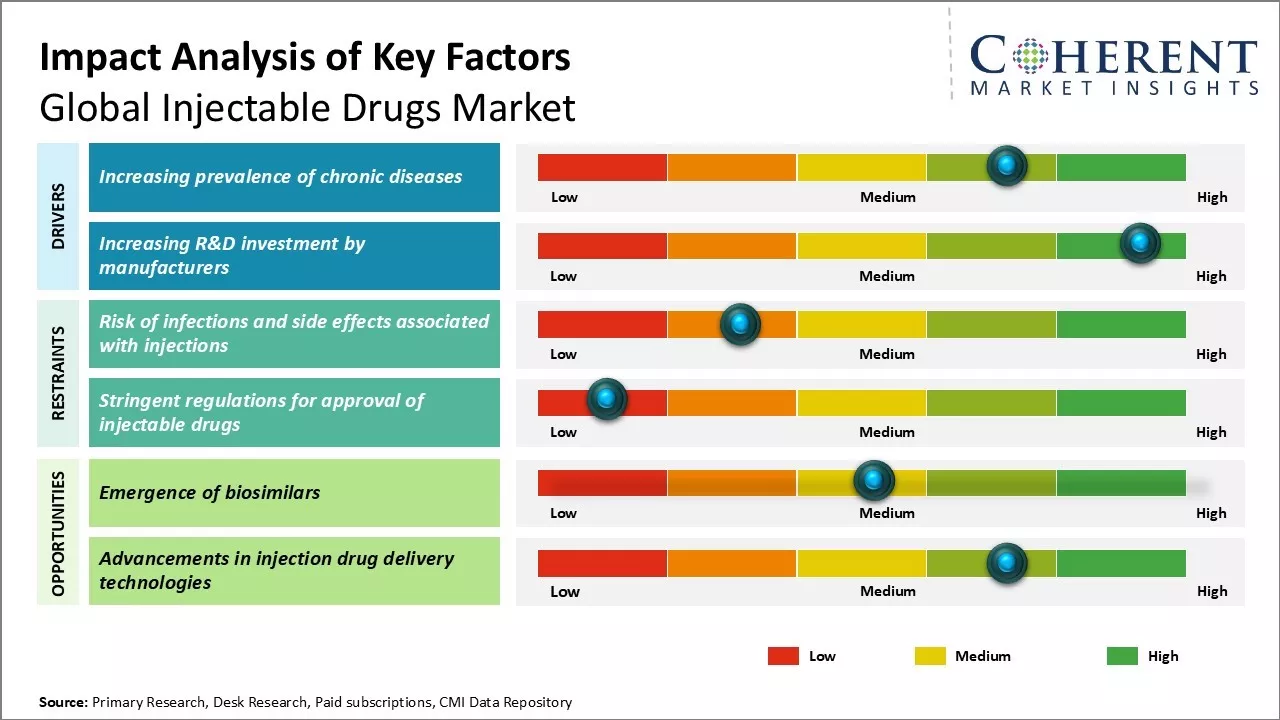

The injectable drugs industry has witnessed substantial evolution driven by advances in drug delivery methods and increasing demand for biologics and specialty pharmaceuticals. This sector's expansion reflects critical shifts in healthcare treatment protocols and rising preference for parenteral applications over oral delivery. Robust innovation and rising incidence of chronic diseases have intensified interest in injectable drugs market growth and development.

Market Size and Overview

Global Injectable Drugs Market is estimated to be valued at USD 614.07 Bn in 2025 and is expected to reach USD 1,032.78 Bn by 2032, exhibiting a compound annual growth rate (CAGR) of 7.7% from 2025 to 2032.

This Injectable Drugs Market Size is fueled by increasing R&D investments and expanding applications across oncology, immunology, and infectious disease segments. The injectable drugs market report highlights rising demands in hospital and outpatient settings, driving overall industry size and market revenue expansion.

Injectable Drugs Market-https://www.coherentmarket...

Injectable Drugs Market Size, Share and Analysis, 2025-2032

Injectable Drugs Market size is estimated to be valued at USD 614.07 Bn in 2025 and is expected to expand at a CAGR of 7.7%, reaching USD 1032.78 Bn by 2032.

https://www.coherentmarketinsights.com/market-insight/injectable-drugs-market-5378The Drone Logistics and Transportation industry is rapidly evolving, driven by technological innovations and growing demand for faster, cost-effective delivery solutions. This sector is transforming traditional supply chains and creating lucrative market opportunities, with numerous companies focusing on developing advanced drone networks and infrastructure.

This significant Drone Logistics and Transportation Market Forecast highlights a sustained growth trajectory fueled by increasing adoption across e-commerce, healthcare, and last-mile delivery services.

The evolving market dynamics reflect rising demand, technological advancements, and expanding regulatory frameworks encouraging sector development. The Drone Logistics and Transportation market size and market report emphasize robust market revenue growth, setting the stage for strategic investments and expansion.

Drone Logistics and Transportation Market-https://www.coherentmarket...

At Ask an Expert, we connect you with seasoned professionals offering clear, actionable advice across various fields. Whether you're navigating property investments, social media marketing, legal challenges, or wellness practices, our consultants provide tailored solutions to help you make informed decisions.

Visit us at https://askanexpert.in/

.

Dubai has always been a symbol of grandeur, innovation, and economic prosperity. In 2025, the city will continue to raise the bar, not just in terms of iconic architecture and infrastructure, but also in real estate investments. Among the many choices investors have, luxury flats in Dubai stand out as a powerful combination of lifestyle and financial value. Whether you are an NRI, global investor, or someone seeking a dream home abroad, the Dubai luxury property market offers unmatched opportunities. In this blog, The SmartKey Realty explores why investing in luxury flats in Dubai is a smart decision in 2025.

.

Read This: https://www.foodfashionand...

The conveyor system industry is undergoing dynamic expansion fueled by advancements in automation and logistics infrastructure worldwide. This market’s strategic relevance is growing steadily across manufacturing, warehousing, and distribution sectors, underpinned by evolving market drivers and technology integration. The Global Conveyor System Market size is estimated to be valued at USD 10.94 billion in 2025 and is expected to reach USD 16.14 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.7% from 2025 to 2032. Conveyor System Market Size reflects expansive industry size driven by rising automation, e-commerce expansion, and demand for optimized supply chain solutions. Market insights highlight increased investments in conveyor system innovations, impacting overall market revenue positively.

Get more insights on, Conveyor System Market- https://prachicmi.liveposi...

#CoherentMarketInsights #ConveyorSystem #ConveyorSystemMarket #ConveyorSystemMarketInsights #RollerConveyorSystems

Global Conveyor System Market Size, Trends, and Growth Forecast 2025-2032

The conveyor system industry is witnessing steady expansion driven by rapid industrial automation and logistics optimization. Recent advancements in technology

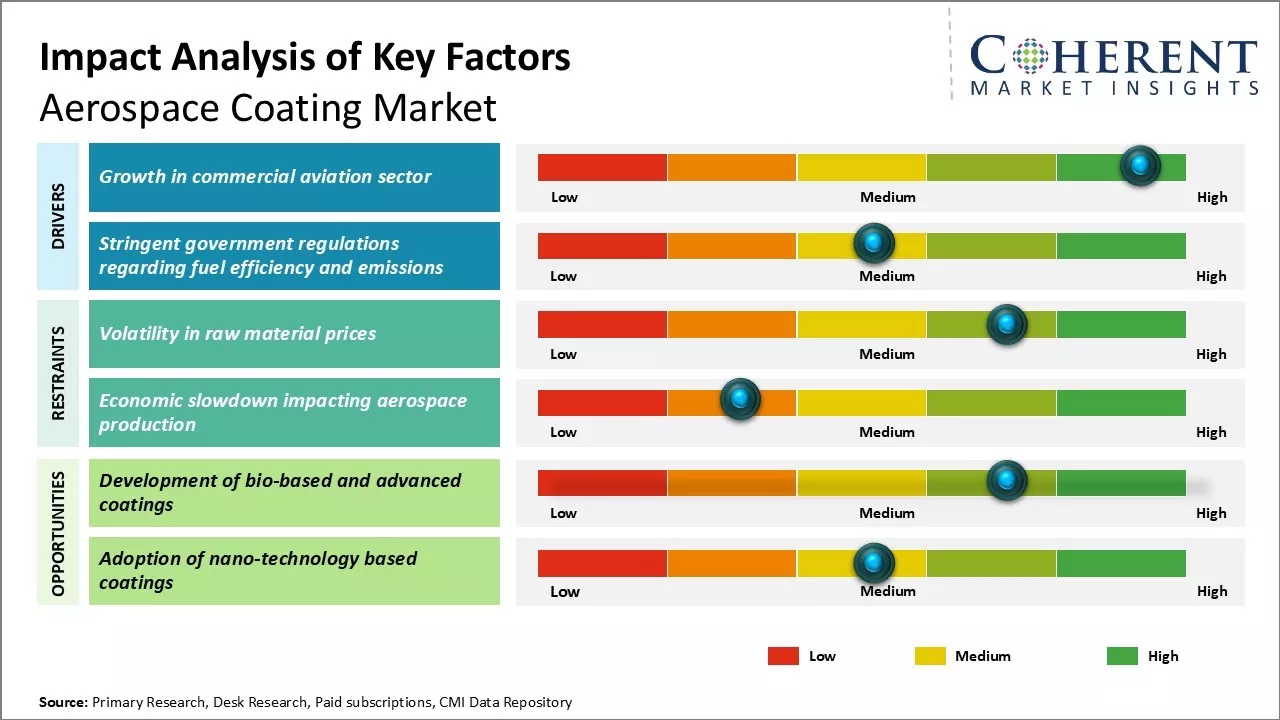

https://prachicmi.livepositively.com/global-conveyor-system-market-size-trends-and-growth-forecast-2025-2032/new=1The aerospace coating market is witnessing robust evolution, driven by increasing demand for advanced protective and functional coatings in commercial and defense aviation sectors. The integration of innovative materials and strict regulatory norms for environmental compliance are shaping the industry's expansion. An in-depth market analysis reveals significant opportunities aligned with technological advancements and rising aerospace production globally.

Global aerospace coating market is estimated to be valued at USD 3.62 Bn in 2025 and is expected to reach USD 6.04 Bn by 2032, exhibiting a compound annual growth rate (CAGR) of 7.6% from 2025 to 2032.

This Aerospace Coating Market Forecast reflects strong market growth driven by increased aerospace manufacturing and refurbishment activities. The aerospace coating market report indicates rising investments in durable, lightweight coatings that improve fuel efficiency and meet environmental standards, enhancing overall market revenue and industry size.

Aerospace Coating Market-https://www.coherentmarket...

Aerospace Coating Market Size, Share and Analysis, 2025-2032

Aerospace Coating Market valuation is estimated to reach USD 3.62 Bn in 2025 and is anticipated to grow to USD 6.04 Bn by 2032 with steady CAGR of 7.6%.

https://www.coherentmarketinsights.com/industry-reports/aerospace-coating-marketThe aerospace foams market is witnessing robust expansion driven by rising demand for lightweight and high-performance materials in aviation and defense sectors. Industry players are capitalizing on technological advancements and shifting market dynamics to address evolving market challenges and leverage emerging opportunities. Strategic investments and regional growth prospects continue to reshape the aerospace foams market landscape globally.

This Aerospace Foams Market Size reflects strong market revenue growth fueled by increasing aerospace production and demand for materials with superior insulation, impact absorption, and weight reduction properties. The aerospace foams market report highlights key market segments emphasizing sustainable material adoption and advanced manufacturing techniques as major market drivers influencing industry size and market scope.

Aerospace Foams Market-https://www.coherentmarket...

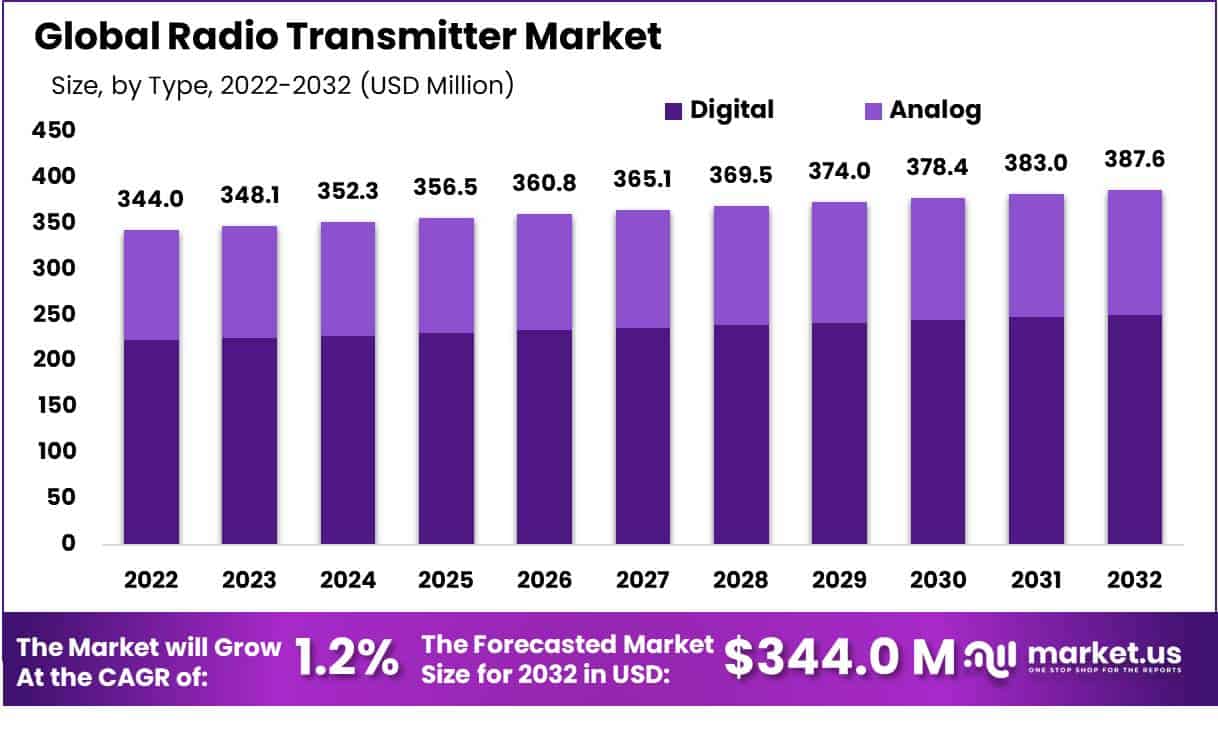

The global Radio Transmitter market was valued at USD 344.0 million in 2022 and is projected to reach USD 387.6 million by 2032, growing at a CAGR of 1.2% over the forecast period. This growth reflects sustained demand from public broadcasters, defense, and emergency systems, especially in developing and rural regions where radio remains a primary communication tool. The market experiences steady replacement cycles and infrastructure upgrades, bolstered by continued investments in digital and hybrid broadcasting solutions. Despite competition from streaming services, the reliability and cost-effectiveness of radio transmission technology sustain market demand across various sectors.

Read More : https://market.us/report/r...

Radio Transmitter Market Size, Share | CAGR of 1.2%

Radio Transmitter Market is predicted to be valued at USD 344.0 Mn in 2022 and USD 387.6 Mn by 2032; expected to increase at a CAGR of 1.2%.

https://market.us/report/radio-transmitter-market/