Where can I report a crypto scam?

If you’ve fallen victim to a crypto scam, or suspect fraudulent activity, you should report it immediately to the appropriate authorities. Here are some key places where you can file a report:

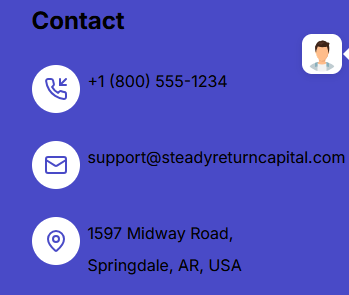

Contact

+1 (800) 555-1234

supportsteadyreturncapital.com

1. Government & Law Enforcement Agencies

Federal Trade Commission (FTC) (U.S.) – Reports scams, fraud, and deceptive business practices.

Securities and Exchange Commission (SEC) – Reports fraudulent investment schemes related to securities and cryptocurrencies.

Commodity Futures Trading Commission (CFTC) – Reports crypto fraud, especially related to trading and futures contracts.

FBI Internet Crime Complaint Center (IC3) – Reports cybercrime, including cryptocurrency fraud.

Europol – For reporting cyber scams in Europe.

Action Fraud (UK) – The UK’s national fraud and cybercrime reporting center.

2. Cryptocurrency & Financial Regulators

FinCEN – Reports money laundering and suspicious crypto transactions in the U.S.

ASIC (Australian Securities and Investments Commission) – Reports crypto-related scams in Australia.

FCA (Financial Conduct Authority) – For crypto fraud cases in the UK.

EConsumer.gov – For international fraud reporting.

If you’ve fallen victim to a crypto scam, or suspect fraudulent activity, you should report it immediately to the appropriate authorities. Here are some key places where you can file a report:

Contact

+1 (800) 555-1234

supportsteadyreturncapital.com

1. Government & Law Enforcement Agencies

Federal Trade Commission (FTC) (U.S.) – Reports scams, fraud, and deceptive business practices.

Securities and Exchange Commission (SEC) – Reports fraudulent investment schemes related to securities and cryptocurrencies.

Commodity Futures Trading Commission (CFTC) – Reports crypto fraud, especially related to trading and futures contracts.

FBI Internet Crime Complaint Center (IC3) – Reports cybercrime, including cryptocurrency fraud.

Europol – For reporting cyber scams in Europe.

Action Fraud (UK) – The UK’s national fraud and cybercrime reporting center.

2. Cryptocurrency & Financial Regulators

FinCEN – Reports money laundering and suspicious crypto transactions in the U.S.

ASIC (Australian Securities and Investments Commission) – Reports crypto-related scams in Australia.

FCA (Financial Conduct Authority) – For crypto fraud cases in the UK.

EConsumer.gov – For international fraud reporting.

07:15 PM - Feb 02, 2025 (UTC)

A romance scam is a type of online fraud where scammers create fake identities to deceive people into emotional and financial exploitation. These scams are common on dating apps, social media, and even email. Victims often believe they are in a genuine relationship, only to realize they have been manipulated for money.

Contact

+1 (800) 555-1234

supportsteadyreturncapital.com

How Romance Scams Work

Scammers follow a predictable pattern when deceiving their victims. Here’s how they operate:

Creating a Fake Identity – Scammers use stolen photos, fake names, and fabricated life stories to appear attractive and trustworthy.

Building Trust Quickly – They shower victims with love and attention, often declaring their love early to create emotional dependency.

Excuses to Avoid Meeting in Person – Common excuses include working overseas, serving in the military, or facing personal hardships.

Asking for Money – Sooner or later, they claim to have a financial emergency, such as medical bills, travel expenses, or investment opportunities.

Keeping the Victim Hooked – They create a cycle of hope and urgency, promising to meet soon but always finding new reasons to delay.

Disappearing After Draining the Victim – Once they get enough money or sense the victim is suspicious, they vanish without a trace.

Contact

+1 (800) 555-1234

supportsteadyreturncapital.com

How Romance Scams Work

Scammers follow a predictable pattern when deceiving their victims. Here’s how they operate:

Creating a Fake Identity – Scammers use stolen photos, fake names, and fabricated life stories to appear attractive and trustworthy.

Building Trust Quickly – They shower victims with love and attention, often declaring their love early to create emotional dependency.

Excuses to Avoid Meeting in Person – Common excuses include working overseas, serving in the military, or facing personal hardships.

Asking for Money – Sooner or later, they claim to have a financial emergency, such as medical bills, travel expenses, or investment opportunities.

Keeping the Victim Hooked – They create a cycle of hope and urgency, promising to meet soon but always finding new reasons to delay.

Disappearing After Draining the Victim – Once they get enough money or sense the victim is suspicious, they vanish without a trace.

07:11 PM - Feb 02, 2025 (UTC)

Bitcoin investment scam

Contact

+1 (800) 555-1234

supportsteadyreturncapital.com

Bitcoin investment scams have become increasingly common, preying on people who want to make quick money through cryptocurrency. Scammers use various tactics, including fake investment platforms, Ponzi schemes, and phishing attacks, to steal funds from unsuspecting investors. Here’s what you need to know to protect yourself.

Common Bitcoin Investment Scams

Fake Investment Platforms – Scammers create websites or apps that promise high returns on Bitcoin investments. They may show fake profit numbers to lure investors.

Ponzi & Pyramid Schemes – Fraudsters promise guaranteed returns by paying early investors with money from new investors instead of real profits.

Celebrity Endorsement Scams – Scammers use fake social media ads featuring celebrities like Elon Musk, claiming they endorse Bitcoin investments.

Phishing Scams – Fraudsters send emails or messages with links to fake websites, tricking users into entering their private keys or login credentials.

Pump-and-Dump Schemes – Scammers artificially inflate the price of a little-known cryptocurrency, convincing people to invest, then sell off their shares, causing the price to crash.

Fake Giveaways & Airdrops – Scammers ask people to send a small amount of Bitcoin to verify their wallets, promising to return a larger amount, which never happens.

Contact

+1 (800) 555-1234

supportsteadyreturncapital.com

Bitcoin investment scams have become increasingly common, preying on people who want to make quick money through cryptocurrency. Scammers use various tactics, including fake investment platforms, Ponzi schemes, and phishing attacks, to steal funds from unsuspecting investors. Here’s what you need to know to protect yourself.

Common Bitcoin Investment Scams

Fake Investment Platforms – Scammers create websites or apps that promise high returns on Bitcoin investments. They may show fake profit numbers to lure investors.

Ponzi & Pyramid Schemes – Fraudsters promise guaranteed returns by paying early investors with money from new investors instead of real profits.

Celebrity Endorsement Scams – Scammers use fake social media ads featuring celebrities like Elon Musk, claiming they endorse Bitcoin investments.

Phishing Scams – Fraudsters send emails or messages with links to fake websites, tricking users into entering their private keys or login credentials.

Pump-and-Dump Schemes – Scammers artificially inflate the price of a little-known cryptocurrency, convincing people to invest, then sell off their shares, causing the price to crash.

Fake Giveaways & Airdrops – Scammers ask people to send a small amount of Bitcoin to verify their wallets, promising to return a larger amount, which never happens.

07:08 PM - Feb 02, 2025 (UTC)

Binary options scam

Binary options trading has been widely criticized as a scam due to the high risks involved and the fraudulent activities of many brokers. Here’s what you need to know:

Contact

+1 (800) 555-1234

supportsteadyreturncapital.com

What Is a Binary Options Scam?

A binary option is a financial instrument where traders predict whether an asset's price will go up or down within a fixed time frame. If they guess correctly, they earn a profit; if they guess wrong, they lose their entire investment.

The problem? Many platforms operate like casinos, rigging results and making it impossible for traders to win consistently.

Common Binary Options Scam Tactics

Unregulated Brokers – Many brokers operate without regulatory oversight, making it easy to manipulate trades and disappear with users' money.

Fake Promises of High Returns – Scammers lure victims with unrealistic profits, such as "Earn $10,000 in a week!"

Withdrawal Restrictions – Some platforms refuse withdrawals, demand high fees, or require impossible conditions to cash out.

Manipulated Trading Software – The broker may control prices, ensuring traders lose most of their bets.

Pressure Sales Tactics – Scammers use aggressive marketing, fake testimonials, and pushy phone calls to pressure victims into depositing more money.

Bonus Traps – Some brokers offer "free" bonuses but attach impossible conditions, making withdrawals nearly impossible.

Binary options trading has been widely criticized as a scam due to the high risks involved and the fraudulent activities of many brokers. Here’s what you need to know:

Contact

+1 (800) 555-1234

supportsteadyreturncapital.com

What Is a Binary Options Scam?

A binary option is a financial instrument where traders predict whether an asset's price will go up or down within a fixed time frame. If they guess correctly, they earn a profit; if they guess wrong, they lose their entire investment.

The problem? Many platforms operate like casinos, rigging results and making it impossible for traders to win consistently.

Common Binary Options Scam Tactics

Unregulated Brokers – Many brokers operate without regulatory oversight, making it easy to manipulate trades and disappear with users' money.

Fake Promises of High Returns – Scammers lure victims with unrealistic profits, such as "Earn $10,000 in a week!"

Withdrawal Restrictions – Some platforms refuse withdrawals, demand high fees, or require impossible conditions to cash out.

Manipulated Trading Software – The broker may control prices, ensuring traders lose most of their bets.

Pressure Sales Tactics – Scammers use aggressive marketing, fake testimonials, and pushy phone calls to pressure victims into depositing more money.

Bonus Traps – Some brokers offer "free" bonuses but attach impossible conditions, making withdrawals nearly impossible.

07:05 PM - Feb 02, 2025 (UTC)

Recovering lost funds from a binary options company can be challenging, but it is possible depending on the circumstances. Here are some steps you can take:

Contact

+1 (800) 555-1234

supportsteadyreturncapital.com

1. Assess the Situation

Determine whether the company is legitimate or a scam.

Check if the company is regulated by a financial authority.

2. Contact the Company

Reach out to their customer support and request a withdrawal.

Document all communications.

3. Report to Regulatory Authorities

If the company is regulated, file a complaint with the relevant financial authority.

Common regulatory bodies include CySEC (Cyprus), FCA (UK), SEC (USA), and ASIC (Australia).

4. Chargeback Through Your Bank

If you deposited funds using a credit or debit card, contact your bank and request a chargeback.

Provide evidence that the company did not fulfill its obligations.

5. Use a Fund Recovery Service

Some professional services specialize in recovering lost funds from scams.

Be cautious, as some "recovery services" may be scams themselves.

6. Legal Action

Consult a lawyer experienced in financial fraud cases.

File a complaint with law enforcement if you suspect fraud.

7. Warn Others

Report the scam to websites like Better Business Bureau (BBB), Trustpilot, and Forex Peace Army.

This helps prevent others from falling victim.

Would you like help identifying specific recove

Contact

+1 (800) 555-1234

supportsteadyreturncapital.com

1. Assess the Situation

Determine whether the company is legitimate or a scam.

Check if the company is regulated by a financial authority.

2. Contact the Company

Reach out to their customer support and request a withdrawal.

Document all communications.

3. Report to Regulatory Authorities

If the company is regulated, file a complaint with the relevant financial authority.

Common regulatory bodies include CySEC (Cyprus), FCA (UK), SEC (USA), and ASIC (Australia).

4. Chargeback Through Your Bank

If you deposited funds using a credit or debit card, contact your bank and request a chargeback.

Provide evidence that the company did not fulfill its obligations.

5. Use a Fund Recovery Service

Some professional services specialize in recovering lost funds from scams.

Be cautious, as some "recovery services" may be scams themselves.

6. Legal Action

Consult a lawyer experienced in financial fraud cases.

File a complaint with law enforcement if you suspect fraud.

7. Warn Others

Report the scam to websites like Better Business Bureau (BBB), Trustpilot, and Forex Peace Army.

This helps prevent others from falling victim.

Would you like help identifying specific recove

07:03 PM - Feb 02, 2025 (UTC)

Recovering lost Bitcoin depends on how you lost it. Here are a few scenarios and potential solutions:

https://steadyrc.com/

1. Lost Access to Wallet (Forgot Password or Seed Phrase)

If you forgot your password: Try using password recovery tools like BTCRecover, which helps brute-force wallet passwords.

Contact

+1 (800) 555-1234

supportsteadyreturncapital.com

If you lost your seed phrase: Unfortunately, Bitcoin wallets are highly secure, and without your seed phrase, recovery is nearly impossible. However, if you have a partial phrase, tools like Mnemonic Code Converter may help reconstruct it.

2. Sent Bitcoin to the Wrong Address

If you sent it to an incorrect but valid address: Bitcoin transactions are irreversible. The only way to recover funds is if the recipient agrees to send them back.

If you sent it to an address with no private key (burn address): Unfortunately, those funds are permanently lost.

3. Lost Funds Due to Exchange Issues (Hack, Scam, or Locked Account)

Hacked Exchange or Wallet: Contact the platform immediately. If it was a major exchange (like Binance, Coinbase), they may have reimbursement policies.

Scams: If you were scammed, report it to authorities like the FBI’s IC3, local cybercrime units, or blockchain tracing firms like Chainalysis or CipherTrace.

Locked Account: If an exchange locked your account, submit support tickets and provide any verification they need.

https://steadyrc.com/

1. Lost Access to Wallet (Forgot Password or Seed Phrase)

If you forgot your password: Try using password recovery tools like BTCRecover, which helps brute-force wallet passwords.

Contact

+1 (800) 555-1234

supportsteadyreturncapital.com

If you lost your seed phrase: Unfortunately, Bitcoin wallets are highly secure, and without your seed phrase, recovery is nearly impossible. However, if you have a partial phrase, tools like Mnemonic Code Converter may help reconstruct it.

2. Sent Bitcoin to the Wrong Address

If you sent it to an incorrect but valid address: Bitcoin transactions are irreversible. The only way to recover funds is if the recipient agrees to send them back.

If you sent it to an address with no private key (burn address): Unfortunately, those funds are permanently lost.

3. Lost Funds Due to Exchange Issues (Hack, Scam, or Locked Account)

Hacked Exchange or Wallet: Contact the platform immediately. If it was a major exchange (like Binance, Coinbase), they may have reimbursement policies.

Scams: If you were scammed, report it to authorities like the FBI’s IC3, local cybercrime units, or blockchain tracing firms like Chainalysis or CipherTrace.

Locked Account: If an exchange locked your account, submit support tickets and provide any verification they need.

06:58 PM - Feb 02, 2025 (UTC)

Sponsored by

OWT

6 months ago

Dwngo social network website

Dwngo – The Social Media Platform! * Share your thoughts & ideas * Publish blogs & trending stories * Connect, engage & grow your networkJoin now & be part of the future of social networking! #SocialMedia #Blogging #Dwngo --https://dwngo.com/