Smart financial decisions begin with effective tax strategies. Tax planning services are designed to help individuals and businesses reduce tax liabilities legally and efficiently.

https://www.slideshare.net...

Maximize Your Returns with Expert Tax Planning Services | PDF

Introduction Smart financial decisions begin with effective tax strategies. Tax planning services are designed to help individuals and businesses reduce tax liabilities legally and efficiently. Whether you're a salaried professional, a freelancer, or a small business owner, planning your taxes..

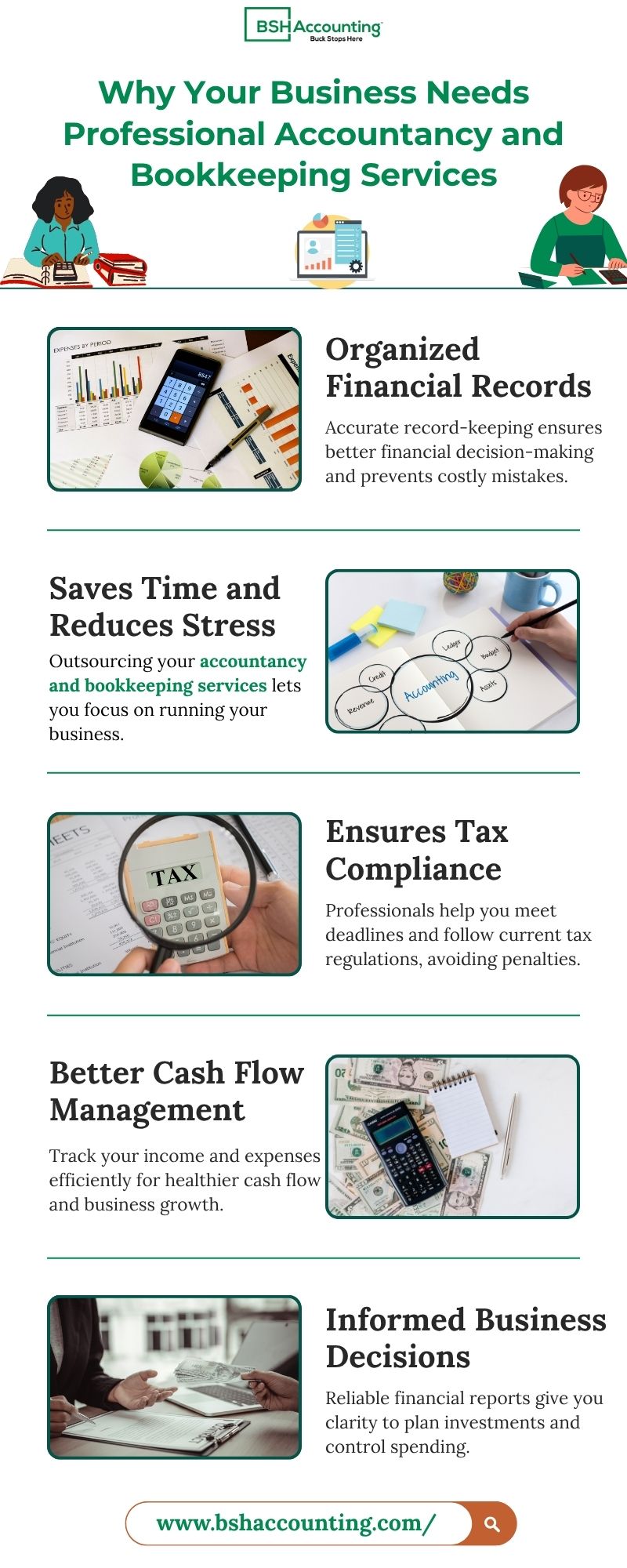

https://www.slideshare.net/slideshow/maximize-your-returns-with-expert-tax-planning-services/281868459Organized Financial Records

Accurate record-keeping ensures better financial decision-making and prevents costly mistakes.

Saves Time and Reduces Stress

Outsourcing your accountancy and bookkeeping services lets you focus on running your business.

https://freeimage.host/i/F...

Why Your Business Needs Professional Accountancy and Bookkeeping Services — Freeimage.host

Organized Financial Records Accurate record-keeping ensures better financial decision-making and prevents costly mistakes. Saves Time and Reduces Stress Outsourcing your accountancy and bookkeeping services lets you focus on running your business. Ensures Tax Compliance Professionals help you mee..

https://freeimage.host/i/FEXkxm7Expert Financial Management: Professional accountancy services ensure accurate bookkeeping and financial planning tailored to your business needs.

https://infogram.com/top-b...

Top Benefits of Accountancy Services by BSHaccounting - Infogram

Professional accountancy services ensure accurate bookkeeping and financial planning tailored to your business needs. Specialized services help you navigate tax laws efficiently. https://www.bshaccounting.com/services/

https://infogram.com/top-benefits-of-accountancy-services-1hnp27e1808vy4gReduce Overhead Costs Skip the salaries, benefits, and office space. An outsourced bookkeeping company provides expert service at a fraction of the cost of an in-house team.

https://500px.com/photo/11...

Innovation is at the heart of every successful business, but research and development (R&D) can often come with a hefty price tag. Fortunately, the R&D Tax Credit for Small Business offers a powerful way to reduce your tax burden while fueling your company’s growth.

https://bshaccounting.hash...

Navigating ecommerce sales tax is crucial for online sellers to stay compliant and avoid unexpected penalties. As e-commerce continues to grow, so does the complexity of tax laws surrounding online sales.

https://smallpdf.com/file#...

File shared on Smallpdf

Click to open this document on Smallpdf—or use our 30+ free PDF tools to compress, merge, edit, and more!

https://smallpdf.com/file#s=556bf35a-9f82-49ce-bd00-507a26ab5a7cPartnering with outsourced bookkeeping companies is becoming a popular choice for businesses aiming to streamline their financial management.

https://pdf.ac/3iVXB1

BSH Accounting

Tailored e-commerce tax services

Avoid costly mistakes

https://www.behance.net/ga...

Maximize your tax savings with BSH Accounting’s tax planning services. Our experienced professionals develop strategic tax plans to minimize liabilities, maximize deductions, and ensure full compliance. Whether you’re an individual or a business, we help you stay ahead with proactive tax strategies that work in your favor.

https://www.bshaccounting....

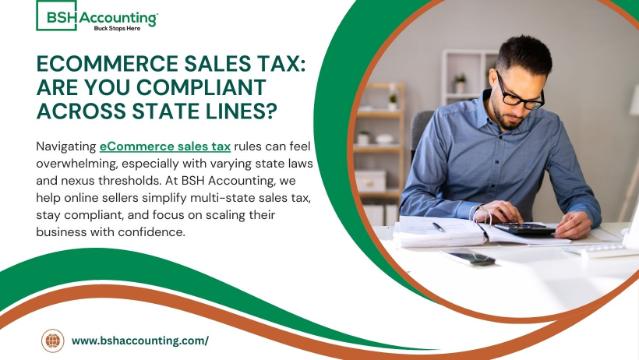

Navigating eCommerce sales tax rules can feel overwhelming, especially with varying state laws and nexus thresholds. At BSH Accounting, we help online sellers simplify multi-state sales tax, stay compliant, and focus on scaling their business with confidence.

https://app.screencast.com...

eCommerce Sales Tax: Are You Compliant Across State Lines? - TechSmith Screencast - TechSmith Screencast

Navigating eCommerce sales tax rules can feel overwhelming, especially with varying state laws and nexus thresholds. At BSH Accounting, we help online sellers simplify multi-state sales tax, stay compliant, and focus on scaling their business with confidence. https://www.bshaccounting.com/

https://app.screencast.com/UqFR9F1ogxT8pDwngo social network website

Dwngo – The Social Media Platform! * Share your thoughts & ideas * Publish blogs & trending stories * Connect, engage & grow your networkJoin now & be part of the future of social networking! #SocialMedia #Blogging #Dwngo --https://dwngo.com/