Ensuring Payroll Statutory Compliance Through Outsourced Accounting Services

Today’s business scenario demands candidates to be aware of the statutory requirements in the field of payroll. Adherence to the payroll regulations is not only useful in an aspect of reducing legal repercussions but also beneficial in gaining the employee’s confidence. This is where outsourced accounting services step in since they provide a sound solution for the proper handling of the payroll and statutory compliance. This paper aims to discuss the importance of outsourcing these services as they justify compliance with statutory requirement in payroll services.

https://paysquare.com/stat...

Today’s business scenario demands candidates to be aware of the statutory requirements in the field of payroll. Adherence to the payroll regulations is not only useful in an aspect of reducing legal repercussions but also beneficial in gaining the employee’s confidence. This is where outsourced accounting services step in since they provide a sound solution for the proper handling of the payroll and statutory compliance. This paper aims to discuss the importance of outsourcing these services as they justify compliance with statutory requirement in payroll services.

https://paysquare.com/stat...

07:27 AM - Jul 08, 2024 (UTC)

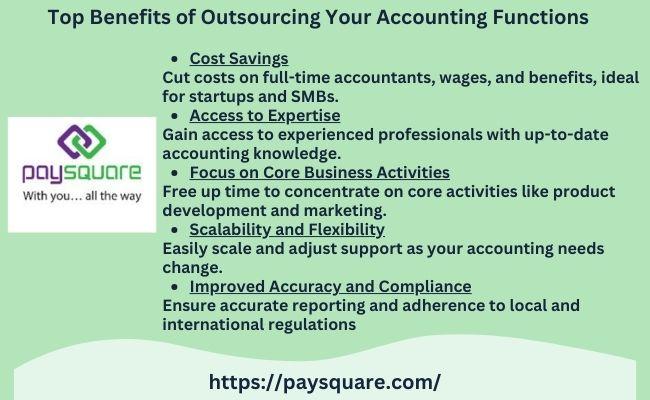

Top Benefits of Outsourcing Your Accounting Functions

outsourcing the responsibilities of accounting has numerous advantages that can affect your business both in terms of cost and efficiency. With accounting bookkeeping services and incorporating accounting outsourcing companies, your financial processes will be managed, which will relieve the time for you to focus on your business. In the finance and account department no matter if the firms are searching for accounting companies in Chennai or outsourced accounting services in Mumbai the benefits of outsourcing gives a clear image.

https://paysquare.com/acco...

outsourcing the responsibilities of accounting has numerous advantages that can affect your business both in terms of cost and efficiency. With accounting bookkeeping services and incorporating accounting outsourcing companies, your financial processes will be managed, which will relieve the time for you to focus on your business. In the finance and account department no matter if the firms are searching for accounting companies in Chennai or outsourced accounting services in Mumbai the benefits of outsourcing gives a clear image.

https://paysquare.com/acco...

11:12 PM - Jul 03, 2024 (UTC)

Top Benefits of Outsourcing Your Accounting Functions

As the fraction of the company depending on outsourcing of accounting functions by the business increases, especially for small and medium enterprises, it has a notable impact. Accounting bookkeeping services and accounting outsourcing companies also provide an opportunity for the companies to concentrate on their central functions while the company’s accounts are managed. Allow me in this Infographic to present and explain to you the seven good reasons why you should outsource your accounting operations.

https://paysquare.com/acco...

As the fraction of the company depending on outsourcing of accounting functions by the business increases, especially for small and medium enterprises, it has a notable impact. Accounting bookkeeping services and accounting outsourcing companies also provide an opportunity for the companies to concentrate on their central functions while the company’s accounts are managed. Allow me in this Infographic to present and explain to you the seven good reasons why you should outsource your accounting operations.

https://paysquare.com/acco...

09:51 PM - Jul 03, 2024 (UTC)

Understanding and Adhering to Payroll Outsourcing Regulatory Frameworks

In the course of their quest for efficiency and compliance in payroll processes, they the majority of enterprises turn to outsourcing as a most expedient and profitable option. The possibility to delegate payroll activities to outsourced providers with high expertise is an interesting option for the company because it allows to decrease operational costs, increase the accuracy of the calculations and to adjust the staffing to the changing tasks require. Nonetheless, the benefits are interrelated with difficult regulatory council that control payroll outsourcing. This blog dives deeper into the extent to which the failure to comply with these sophisticated regulatory measures will have severe implications on businesses, and it highlights some vital considerations. Furthermore, we will go through the soundscaping of payroll processing companies and accounting outsourcing companies in India, particularly to Mumbai, the cocobby financial pond in the country.

The Essence of the Regulatory Rules about Outsourcing of Payroll

Compliant and transparent payroll outsourcing regulatory frameworks are the foundation that facilitates the payroll operation's compliance while accounting for it. These frameworks encompass a wide range of regulations and guidelines, including:These frameworks encompass a wide range of regulations and guidelines, including:

Labor Laws: One of the issues here is that wages and overtime pay actually influenced payroll processing and employee salary packages.

Tax Laws: According to tax regulations paying agents are those who determine and deduct income tax, social security contributions and other statutory contributions.

Data Protection Laws: Limitation of data security and privacy regulations protect payroll information, specifying on the treatment of data and storing of it in firm way.

Contractual Agreements: Agreements between the organization and payroll outsourcing firm are reverse-engineered and enumerated in contracts with defined roles, duties, and service agreements for both parties to maintain transparency and accountability.

Regulatory compliance in Payroll outsourcing is an integral part of a well-functioning payroll service, and practitioners must stay abreast of the constantly evolving rules and requirements to meet all necessary standards.

Managing the regulatory structure within the framework of the payroll outsourcing act is

In the course of their quest for efficiency and compliance in payroll processes, they the majority of enterprises turn to outsourcing as a most expedient and profitable option. The possibility to delegate payroll activities to outsourced providers with high expertise is an interesting option for the company because it allows to decrease operational costs, increase the accuracy of the calculations and to adjust the staffing to the changing tasks require. Nonetheless, the benefits are interrelated with difficult regulatory council that control payroll outsourcing. This blog dives deeper into the extent to which the failure to comply with these sophisticated regulatory measures will have severe implications on businesses, and it highlights some vital considerations. Furthermore, we will go through the soundscaping of payroll processing companies and accounting outsourcing companies in India, particularly to Mumbai, the cocobby financial pond in the country.

The Essence of the Regulatory Rules about Outsourcing of Payroll

Compliant and transparent payroll outsourcing regulatory frameworks are the foundation that facilitates the payroll operation's compliance while accounting for it. These frameworks encompass a wide range of regulations and guidelines, including:These frameworks encompass a wide range of regulations and guidelines, including:

Labor Laws: One of the issues here is that wages and overtime pay actually influenced payroll processing and employee salary packages.

Tax Laws: According to tax regulations paying agents are those who determine and deduct income tax, social security contributions and other statutory contributions.

Data Protection Laws: Limitation of data security and privacy regulations protect payroll information, specifying on the treatment of data and storing of it in firm way.

Contractual Agreements: Agreements between the organization and payroll outsourcing firm are reverse-engineered and enumerated in contracts with defined roles, duties, and service agreements for both parties to maintain transparency and accountability.

Regulatory compliance in Payroll outsourcing is an integral part of a well-functioning payroll service, and practitioners must stay abreast of the constantly evolving rules and requirements to meet all necessary standards.

Managing the regulatory structure within the framework of the payroll outsourcing act is

10:23 AM - May 13, 2024 (UTC)

Sponsored by

OWT

6 months ago

Dwngo social network website

Dwngo – The Social Media Platform! * Share your thoughts & ideas * Publish blogs & trending stories * Connect, engage & grow your networkJoin now & be part of the future of social networking! #SocialMedia #Blogging #Dwngo --https://dwngo.com/