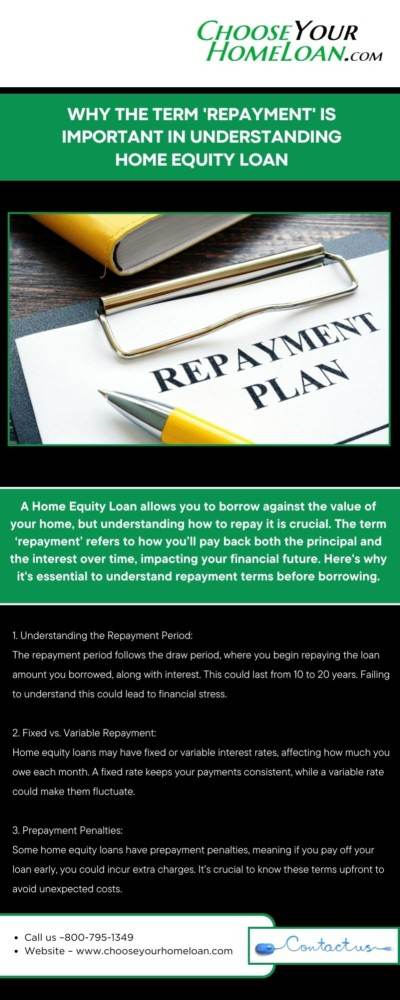

A Home Equity Loan allows you to borrow against the value of your home, but understanding how to repay it is crucial. The term ‘repayment’ refers to how you’ll pay back both the principal and the interest over time, impacting your financial future. Here's why it's essential to understand repayment terms before borrowing. Visit us > https://www.edocr.com/v/nw...

edocr - Why the Term 'Repayment' is Important in Understanding Home Equity Loan

A Home Equity Loan allows you to borrow against the value of your home, but understanding how to repay it is crucial. The term ‘repayment’ refers to how you’ll pay back both the principal and the interest over time, impacting your financial future. Here's why it's essential to understand rep..

https://www.edocr.com/v/nw4pb5zx/chooseyourhomeloan/why-the-term-repayment-is-important-in-understandiIn the chaos of modern life, our homes have become much more than just a physical space to reside in – they are sanctuaries of comfort, reflections of our personalities, and significant contributors to our overall well-being. Therefore, it is no surprise that improving one’s home can lead to an improved life. Visit us > https://chooseyourhomeloan...

On the plus side, home equity loans offer fixed interest rates, ensuring predictable monthly payments throughout the loan term. This can be especially beneficial for budgeting purposes. Additionally, the interest paid on home equity loans may be tax-deductible, providing potential savings during tax season. Furthermore, you can get home equity instant approval through trusted agents. Visit us > https://chooseyourhomeloan...

Choosing the Right Loan for Your Needs Home Equity vs Personal Loans

Get instant approval for your home equity loan and access funds quickly. Streamlined process, competitive rates, and easy online application—unlock your home’s value today!

https://chooseyourhomeloan.com/choosing-the-right-loan-for-your-needs-home-equity-vs-personal-loans/New home purchases can be exhilarating and intimidating, particularly for first-time purchasers and real estate investors. A home equity loan is one financial instrument that can make this procedure easier. This blog will examine how to use your home equity to buy a new home. We’ll go over everything from how to use equity for real estate investing to first-time homebuyer advice and the definition of a home equity loan. Visit us > https://chooseyourhomeloan...

Refinancing your mortgage is a smart way to secure a lower interest rate, and it is one of the most common reasons homeowners choose this option. By opting to refinance for equity at a reduced rate, you can significantly lower your monthly mortgage payments and save thousands of dollars in interest over the life of the loan. This strategic move not only eases your financial burden but also helps you make the most of your home’s equity. Visit us > https://chooseyourhomeloan...

Dwngo social network website

Dwngo – The Social Media Platform! * Share your thoughts & ideas * Publish blogs & trending stories * Connect, engage & grow your networkJoin now & be part of the future of social networking! #SocialMedia #Blogging #Dwngo --https://dwngo.com/