Investors sent 300K $BANANA ($5M) to exchanges, taking profits

BANANA expands via #Sonic DEXs, boosting adoption and liquidity

If BANANA breaks $17.57, it may hit $23.24; else, $10.29 looms

https://coinpedia.org/news...

Telegram Bot BANANA Surges 50% Amid Launch Hype, But Can It Hold?

Banana Gun (BANANA), a cryptocurrency linked to a Telegram trading bot, has seen a massive surge of nearly 50%, reaching a high of $20.33. This sudden

https://coinpedia.org/news/telegram-bot-banana-surges-50-amid-launch-hype-but-can-it-hold/Decentralized exchanges (DEXs) offer control and transparency, but they come with risks. Understanding these losses can help you trade smarter!

🔥 Common Losses & How to Avoid Them

✅ Impermanent Loss – Happens when asset prices fluctuate in liquidity pools.

🔹 Use stablecoin pairs

🔹 Diversify liquidity investments

🔹 Choose pools with lower volatility

✅ Slippage – Price changes between order placement and execution.

🔹 Trade in high-liquidity pools

🔹 Set slippage tolerance wisely

🔹 Use limit orders

✅ High Gas Fees – Ethereum congestion leads to expensive transactions.

🔹 Use layer-2 scaling solutions

🔹 Trade on lower-fee blockchains (BSC, Polygon)

💡 Stay cautious, trade smart, and minimize risks for a secure DEX experience! 🚀

Visit: https://justtrytech.com/cr...

Over the past ten years, cryptocurrency trading has seen significant change.Among the most significant advancements is the rise of decentralized exchanges (DEXs), which are transforming the way traders buy, sell, and swap crypto assets. Unlike traditional centralized exchanges, DEXs operate without a middleman, offering a more secure, transparent, and user-empowered trading environment.

In this blog, we’ll explore how decentralized exchanges make crypto trading better by breaking down their key benefits and advantages.

Discover the benefits of decentralized platforms and why they’re reshaping the crypto world

Users can trade straight from their wallets on decentralised exchanges that run on blockchain networks. This peer-to-peer approach eliminates the need to deposit funds into a centralized system, reducing the risk of hacks or theft. Furthermore, by allowing users to always have complete ownership over their assets, DEXs support financial sovereignty.

This shift toward decentralization is reshaping the crypto landscape by fostering trust and democratizing access. Anyone with an internet connection can participate in global crypto markets without relying on traditional intermediaries. As blockchain technology continues to evolve, DEXs will play an increasingly important role in the growth and adoption of digital assets.

Why decentralised exchanges are giving traders more power, security, and transparency

Secu

Dwngo social network website

Dwngo – The Social Media Platform! * Share your thoughts & ideas * Publish blogs & trending stories * Connect, engage & grow your networkJoin now & be part of the future of social networking! #SocialMedia #Blogging #Dwngo --https://dwngo.com/

1. How Decentralized Exchanges Offer Better Security and Control

One of the most significant advantages of decentralized exchanges is enhanced security. Centralized exchanges hold users’ funds in custody, which means users must trust the platform to safeguard their assets. This setup has historically led to high-profile hacks and thefts, where millions of dollars worth of cryptocurrencies were stolen.

In contrast, decentralized exchanges allow users to retain control of their private keys and funds at all times. Trades occur directly from user wallets, eliminating the need to deposit funds into a third-party platform. This significantly reduces the risk of large-scale theft or fraud since there is no central point of failure. For users, this means greater peace of mind and a safer trading environment.

2. Why Users Prefer Decentralized Platforms for Privacy and Trust

Privacy is a core principle in the crypto world, and decentralized exchanges cater to this demand better than centralized pl

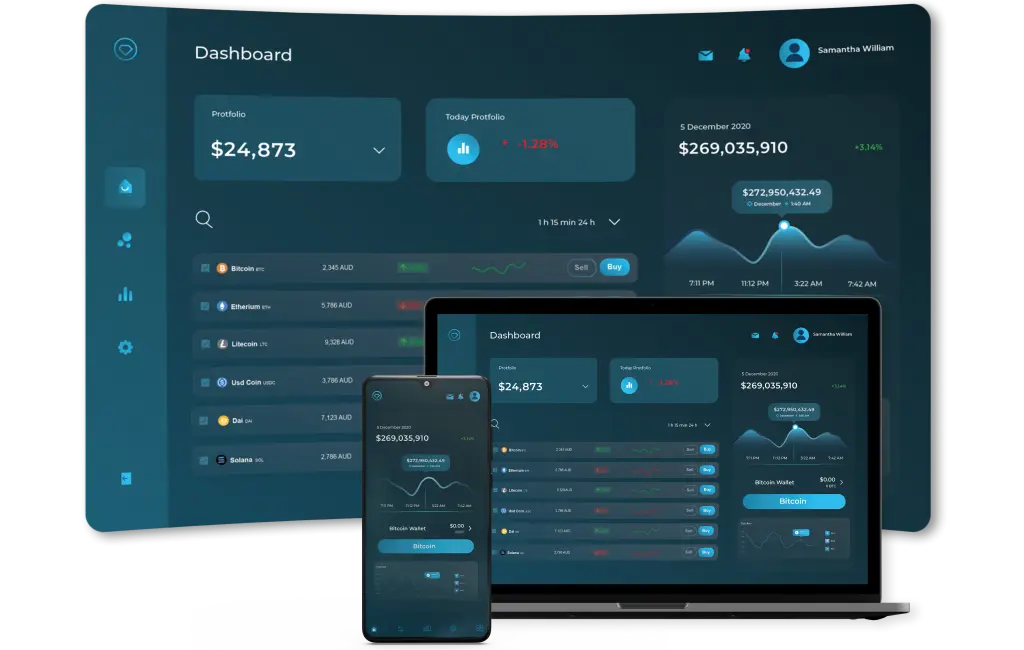

In the evolving world of blockchain and cryptocurrencies, decentralized exchanges (DEXs) are gaining momentum for all the right reasons.DEXs give consumers more autonomy, privacy, and security than traditional centralised systems. As more businesses and developers dive into decentralized exchange development, it's crucial to understand what makes these platforms unique, how they work, and what lies ahead.

What Is a Decentralized Exchange (DEX)?

A Decentralized Exchange (DEX) is a platform that allows users to trade cryptocurrencies directly with one another without the need for a centralized intermediary. Unlike centralized exchanges (CEXs), where a third party controls the funds and facilitates trades, DEXs operate through smart contracts and blockchain technology.

On a DEX, users retain control of their private keys and funds, making it a non-custodial environment. This model not only reduces the risk of hacks and data breaches but also supports the foundational principles of blockchain decentralization, transparency, and trustlessness.

Core Features of a Decentralized Exchange

Decentralized exchanges are equipped with several innovative features that distinguish them from their centralized counterparts. Some of the key functionalities include:

Smart Contracts: These are self-executing contracts that facilitate trades automatically based on predefined rules.

Automated Market Makers (AMMs): AMMs replace traditional or

Decentralized exchanges (DEXs) are transforming crypto trading by offering security, transparency, and asset control. But high fees remain a concern for traders. In 2025, several DEXs are emerging with the lowest fees, making trading more accessible and cost-effective.

Top Low-Fee DEXs to Watch in 2025 🔍

✅ Uniswap v4 – Enhanced gas efficiency & dynamic fee tiers.

✅ PancakeSwap – 0.25% trading fees & lower gas costs on BSC.

✅ dYdX – Zero gas fees & ultra-low maker/taker fees.

✅ Sushiswap – Multi-chain support with staking rewards.

✅ Curve Finance – Optimized for stablecoins with minimal slippage.

🔹 Why Low Fees Matter?

🔸 More profits & frequent trading 🔄

🔸 Higher user adoption 🌎

🔸 Better liquidity incentives 💰

💡 Ready to build your own DEX? Let’s revolutionize crypto trading! 🚀

Visit: https://justtrytech.com/cr...

✅ Decentralized Exchanges (DEXs) & Security

DEXs remove intermediaries, giving users full control over their assets.

Non-custodial trading ensures users hold private keys.

Smart contracts automate transactions securely.

⚠️ Security Risks in DEXs

🚨 Smart Contract Vulnerabilities – Poorly coded contracts can be exploited.

💧 Liquidity Issues – Low liquidity may cause price slippage.

🔒 User Experience & Security – Secure platforms should also be user-friendly.

🔍 Top Secure DEXs in 2025

Uniswap – High liquidity & strong security.

PancakeSwap – Low fees & audited smart contracts.

dYdX – Professional security & advanced features.

💡 Future Trends

🌉 Cross-Chain Trading – Seamless transactions between blockchains.

🤖 AI-Powered Security – Fraud detection & risk prevention.

Trade smart, stay secure, and embrace the future of decentralized finance! 🚀

Visit: https://justtrytech.com/cr...

The best-decentralized exchange on Ethereum depends on your needs:

1. Uniswap: General ERC-20 token swaps, deep liquidity

2. SushiSwap: Yield farming, staking, and community rewards

3. Curve Finance: Stablecoin trading with low slippage

4. Balancer: Custom liquidity pools and advanced trading

5. 1inch Exchange: Aggregating the best prices from multiple DEXs

Ethereum remains the hub of DeFi, and with Layer 2 scaling solutions, trading on DEXs is becoming faster and cheaper. Whether you're a trader, yield farmer, or liquidity provider, there’s a DEX tailored for your needs.

Which Ethereum DEX do you use the most? Share your thoughts in the comments!

Contact:

Ready to bring your DeFi to life? Reach out to the team at

WhatsApp - +91 9500575285

Email - hellocoinsclone.com

When entering the world of Cryptocurrency Exchange Development, choosing the right business model is crucial for long-term profitability and sustainability. From centralized exchanges (CEXs) that offer high liquidity and user control to decentralized platforms (DEXs) that prioritize privacy and security, each model has its unique strengths. Hybrid models are also gaining traction by combining the best of both worlds. Additionally, P2P exchanges and white-label solutions offer cost-effective entry points for startups. This article explores the most effective and trending business models in cryptocurrency exchange development, helping entrepreneurs and investors understand which approach aligns best with their goals, technical capacity, and market demands. Whether you’re aiming to build a niche trading platform or a full-scale global exchange, understanding these models is essential to making informed decisions in the rapidly evolving crypto industry.

Visit- https://wisewaytec.com/cry...

Cryptocurrency Exchange Development Company | Wisewaytec

Make your move in decentralized world with the best cryptocurrency exchange development company. WisewayTec is here to take your business to the next level!

https://wisewaytec.com/cryptocurrency-exchange-development-company/Decentralised exchanges (DEXs) are becoming increasingly popular venues for international bitcoin trading. Unlike traditional, centralized exchanges, DEXs allow users to trade cryptocurrencies directly with one another no middleman, no delays, and no need to give up control of your funds. In this blog, we’ll explore the real value of decentralized exchanges and why they’re gaining massive popularity, especially among those who care about privacy, security, and freedom in the crypto space.

1. Why more individuals are trading cryptocurrencies on DEXs

In recent years, we’ve seen a significant shift in the way people trade cryptocurrencies. Centralized exchanges, while popular and easy to use, come with major drawbacks: they require you to trust a third party with your funds, they’re often targeted by hackers, and they may suffer from outages or restrictions.

On the other hand, decentralized exchanges offer a safer and more flexible alternative. Since users retain full control of their crypto wallets and private keys, there’s no need to rely on a centralized platform to hold or protect your funds. Peer-to-peer communication is quick, effective, and transparent.

2. How DEXs give you more control and safety

Control is one of the main benefits of utilising a decentralised exchange. Your bitcoin stays in your wallet until you trade on a DEX.This removes a major point of failure common in centralized platforms, where funds are stored

In the world of cryptocurrency and blockchain technology, decentralized exchanges (DEXs) are gaining rapid popularity. These platforms allow users to trade digital assets without relying on a centralized authority. If you're a developer, entrepreneur, or crypto enthusiast, now is the perfect time to build your own DEX. This guide walks you through the essential aspects of decentralized exchange development and how you can get started.

Plurance offers cutting-edge Flash Loan Arbitrage Bot Development, empowering entrepreneurs and traders to capitalize on market inefficiencies instantly. Our AI-driven arbitrage bots execute lightning-fast trades across multiple DEXs, leveraging zero-collateral flash loans for risk-free profits. Designed with high-frequency trading algorithms, MEV protection, real-time analytics, and gas optimization, our bots ensure maximum returns with minimal risk. Whether you seek custom strategies, multi-chain compatibility, or automated yield farming, our expert team delivers scalable, high-performance solutions. Take advantage of the fastest arbitrage execution in DeFi.

For more info: Book A Free Demo

Call/Whatsapp - +91 8807211181 (Or) +971 504211864

Mail - salesplurance.com

Telegram - Pluranceteck

Skype - live:.cid.ff15f76b3b430ccc

Website - https://www.plurance.com/f...

Flash Loan Arbitrage Bot Development Company

Flash loan arbitrage bot development by Plurance helps you create flash loan arbitrage bots that make profits by exploiting market differences.

https://www.plurance.com/flash-loan-arbitrage-bot-developmentDecentralized exchanges (DEXs) have emerged as one of the cornerstones of the decentralized finance (DeFi) revolution. Unlike centralized exchanges that rely on intermediaries to facilitate transactions, DEXs enable peer-to-peer trading through smart contracts. As the crypto market matures, the development of decentralized exchanges is rapidly evolving, setting the stage for a more secure, transparent, and user-empowered financial system.

In this blog, we explore where DEX development is headed, the innovations driving change, and the challenges developers must overcome to build the next generation of trading platforms.

1. Exploring Innovations, Trends, and the Road Ahead for DEX Platforms

Over the past few years, decentralized exchanges have shifted from being experimental projects to becoming full-fledged trading ecosystems. Early platforms like EtherDelta paved the way, but today’s leading DEXs Uniswap, SushiSwap, PancakeSwap have introduced innovations like automated market makers (AMMs), liquidity mining, and governance tokens.

The trend is clear: DEXs are evolving beyond basic trading functionalities. Layer 2 scaling solutions such as Optimism and zkSync are improving speed and reducing transaction costs. Multi-chain interoperability is becoming more seamless, allowing DEXs to operate across Ethereum, Binance Smart Chain, Avalanche, and more. Developers are also experimenting with hybrid models that combine decentr

🔒 Decentralized Exchanges (DEXs):

DEXs are gaining popularity, offering users more control, stronger security, and lower fees by eliminating intermediaries.

🤖 AI-Powered Tools:

AI enhances trading through predictive analytics, automated bots, and advanced security measures.

🔗 Multi-Asset Support & Interoperability:

Future exchanges will support crypto, tokenized stocks, and NFTs, with seamless cross-chain transactions.

✅ Regulatory Compliance & Security:

KYC, AML, and smart contract audits will build trust and platform stability.

The future of crypto exchanges is bright — businesses that embrace innovation will lead the next era of digital trading!

https://justtrytech.com/cr...